- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: HSA distribution not accurate, due to reversing an overfunded deposit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution not accurate, due to reversing an overfunded deposit

Toward the end of 2018, I added money to my husband's HSA. We later learned we overfunded, but not until 2019. So I did what I thought was right and transferred money out of the fund. But now, my distribution for 2019 includes the amount I reversed out for overfunding. So it's impacting my medical deduction allowed. How do I fix that? If I correct the distribution amount on my return, it won't match the amount on the 1099-SA.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution not accurate, due to reversing an overfunded deposit

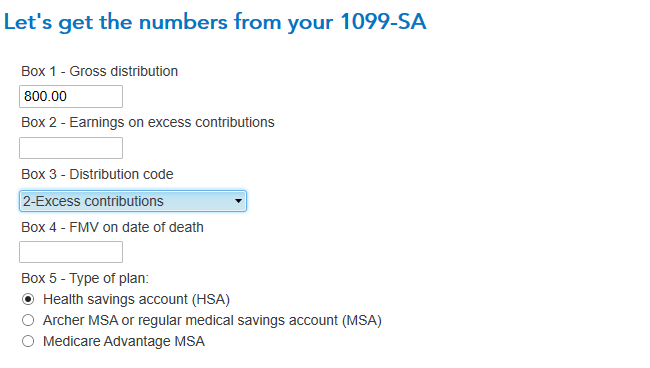

If you enter code 2 "Excess contributions" in the box 3 entry for your 1099-SA form, the amount will be designated as "excess contributions" and as such should not affect your medical expense deduction on your schedule A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution not accurate, due to reversing an overfunded deposit

Thanks for the answer, Thomas, but only PART of it was excess. Part was actual distribution. So how to I show what was what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distribution not accurate, due to reversing an overfunded deposit

You need to make two form 1099-SA entries, the total of which will equal the amount reported on your 1099-SA form. That way you can show the excess contribution on one form entry and the rest on the other entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cbrough1

New Member

MojoMom777

Level 3

in Education

gonglien

Level 2

jimmy56

New Member

KBSC

Level 1

in Education