- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How to do you link the foreign tax credit section (that generates Form 1116s) to an investmen...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do you link the foreign tax credit section (that generates Form 1116s) to an investment sale that does not have a 1099 (sale of a 2nd home in foreign country)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do you link the foreign tax credit section (that generates Form 1116s) to an investment sale that does not have a 1099 (sale of a 2nd home in foreign country)?

You would just need to enter the information manually in the section. Be sure to answer the interview questions carefully. Here are the steps:

To enter this information in the TurboTax program, here are the steps:

- Open up your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

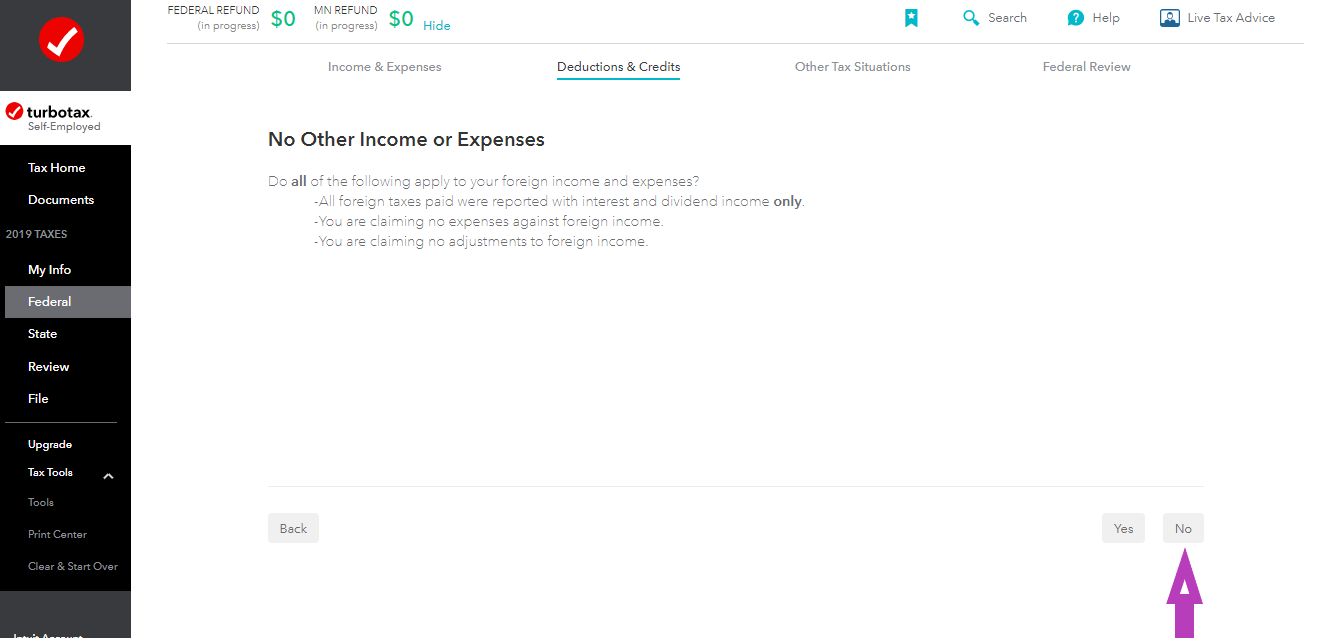

- On-screen, "No Other Income or Expenses", select No ( See the image below)

- Follow prompts

- On-screen, "Choose the Income Type" select General category income ( or check with instructions (https://www.irs.gov/pub/irs-pdf/i1116.pdf, page 4 under Categories)

- Follow prompts

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do you link the foreign tax credit section (that generates Form 1116s) to an investment sale that does not have a 1099 (sale of a 2nd home in foreign country)?

Hi @LinaJ2020

I also had a sale of a 2nd home in another country.

But I was advised to use "Passive Category Income" for FTC purposes (see In entering foreign tax credit for sale of 2nd home in another country - what type of income do I us...) instead of "General category income" as you stated in this discussion.

Now I am confused... 🙂

Which is correct?

Thanks to any and all replies!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to do you link the foreign tax credit section (that generates Form 1116s) to an investment sale that does not have a 1099 (sale of a 2nd home in foreign country)?

Passive income broadly refers to money you don't earn from actively engaging in a trade or business. By its broadest definition, passive income would include nearly all investment income, including interest, dividends, and capital gains.

The income derived from the sale of your investment property would be considered Passive Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vol2Smile

Level 1

RehbergW

New Member

poncho_mike

Level 4

1891gigi

Level 3

MainiacGus

Returning Member