- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How do I report qualified charitable donations paid from IRA

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

if you are using online you have to use interview but you can skip over parts. a direct entry that is an override would prevent e-filing

choose this tab

wages and income

retirement plans - ira link

add the 1099-R

then go through the steps to enter the required info.

in the desktop versions, you can go into forms mode to get to the 1099-R and scroll down and be sure to answer all the QCD questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

My 2022 Turbo Tax Deluxe does not ask me if I made a qualified charitable donation from my IRA. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

Taxpayers age 70 ½ or older can make a qualified charitable distribution, up to $100,000, directly from their IRA, other than a SEP or SIMPLE IRA, to a qualified charitable organization. It's generally a nontaxable distribution made by the IRA trustee directly to a charitable organization.

The question about a QCD (Qualified Charitable Distribution) is asked as part of the 1099-R interview, that is, after you enter your 1099-R AND if your distribution is from an IRA, then you may be asked the question about QCD.

Unless you are at least 70 1/2 (and therefore eligible to make a QCD), TurboTax won't even ask you the question, because you couldn't answer YES anyway.

To report a QCD in TurboTax:

1. Enter the Form 1099-R under Wages & Income -> Retirement Plans and Social Security -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

2. In the follow-up indicate that some or all of the distribution was transferred to charity. TurboTax will include the entire amount on Form 1040. TurboTax will include the notation "QCD" next to the line.

This is what the IRS guidance says for 2022 tax returns:

A 2022 QCD must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season.

In early 2023, the IRA owner will receive Form 1099-R from their IRA trustee that shows any IRA distributions made during calendar year 2022, including both regular distributions and QCDs.

The total distribution is in Box 1 on that form.

There is no special code for a QCD.

Like other IRA distributions, QCDs are shown on Line 4 of Form 1040 or Form 1040-SR. If part or all of an IRA distribution is a QCD, enter the total amount of the IRA distribution on Line 4a. This is the amount shown in Box 1 on Form 1099-R.

Then, if the full amount of the distribution is a QCD, enter 0 on Line 4b. If only part of it is a QCD, the remaining taxable portion is normally entered on Line 4b.

Either way, be sure to enter "QCD" next to Line 4b. Further details will be in the final instructions to the 2022 Form 1040.

Click here for IRS guidance on QCD's.

Click here for TurboTax guidance on QCD's.

If you have issues with this entry you can contact TurboTax. Click here for information on Turbo Tax Support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

Please see this response from Coleen D.

First, be sure that the distribution is from and IRA and that the IRA box is checked in the program. As you continue in the interview section, you will encounter the screen.

As you continue with the interview screens, you will be asked if you donated a portion or all of the distribution to charity. There are eligibility requirements. TurboTax will exclude this amount and will show the notation QCD.

You have to continue through the interview screen by screen. The screen that asks whether you transferred any of the distribution to charity doesn't say "QCD," but that's what it's about. If you answer that you transferred part of the distribution to charity, the next screen will ask you how much was transferred to charity. The next screen after that will tell you that the amount you specified is designated as a QCD. That last confirmation screen is the only place that you will actually see the term QCD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

My problem is not that I don't understand the process of reporting an QCD (which I have made), but that my Turbo Tax does not ask me if I've made a charitable contribution from my IRA. How can I report that a portion of my RMD is a QCD if the question does not appear in any of the pages/boxes, etc.?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

The question about charity contributions will only show up if you are 70 1/2 or older and marked the IRA/Simple/SEP box. To check this in TurboTax, follow these instructions:

- Click Wage & Income

- Click Edit/Add next to IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Click Review next to 1099-R

- Continue to the Enter your 1099-R screen, and verify if box IRS/Simple/SEP box is checked

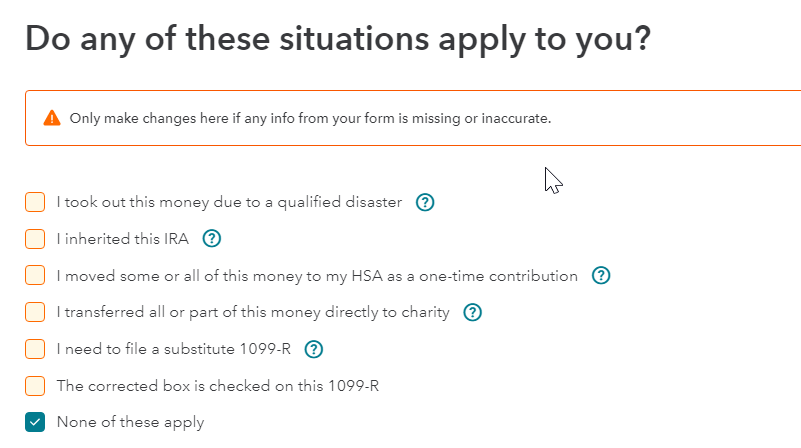

- The "I transferred all or part of this money directly to charity" will be available under the "Do any of these situations apply to you?" section.

Here is a screenshot of what the screen will look like:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

One of the follow up screens allows me to input the total amount of my QCD but cannot find where the breakdown of the 7 charity names and amounts are input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report qualified charitable donations paid from IRA

A qualified charitable distribution (QCD) allows individuals who are 70½ years old or older to donate up to $108,000 total to one or more charities directly from a taxable IRA instead of taking their required minimum distributions.

You don't need to report the charities names when claiming a Qualified Charitable Distribution (QCD) on your tax return;

To report a qualified charitable distribution on your Form 1040 tax return, you'll use the 1099-R (even though there's no indication that it was a QCD).

Enter the info as a 1099-R and you'll be asked in one of the follow-up questions if it was a Qualified Charitable Distribution.

TurboTax includes the full amount of the distribution reported on your Form 1099-R on line 4a (IRA Distributions) of your Form 1040 or 1040-SR. The taxable amount reported on Line 4b will be the total distribution less the QCD amount and will have "QCD" entered next to it.

For more information, check Here .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17571041717

New Member

e024486

Level 3

andrewrich

New Member

stefaniestiegel

New Member

intuit

New Member