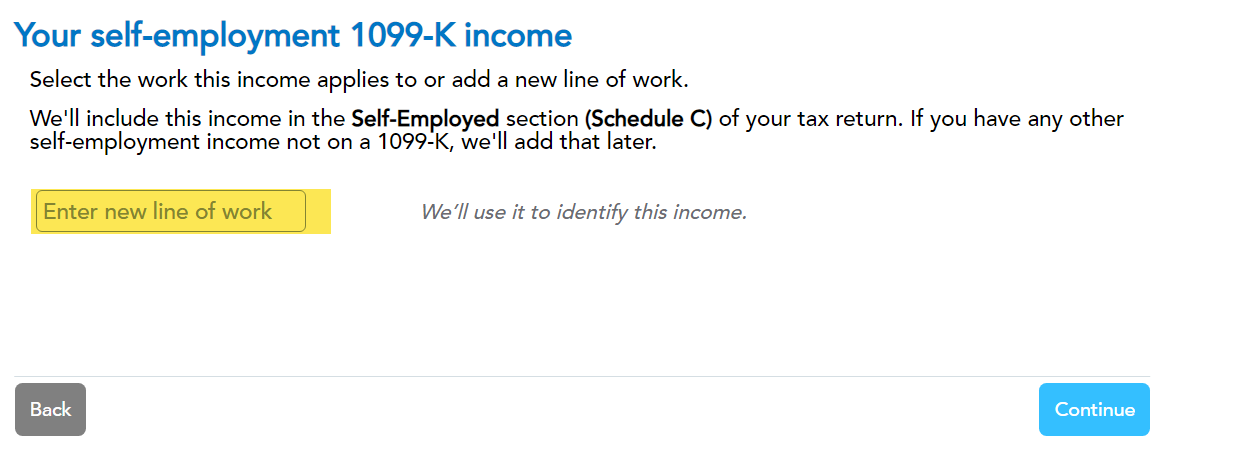

When you enter the Form1099-K, you will indicate that it is for self-employment income. Then you will see a screen that says Your self-employment 1099-K income on which you can use the Enter new line of work box to name the business you are in:

Then you can got to the self-employment section and find the business you named and add expenses to reduce the gross income reported on the Form 1099-K down to the net income you received.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"