- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added togethe...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

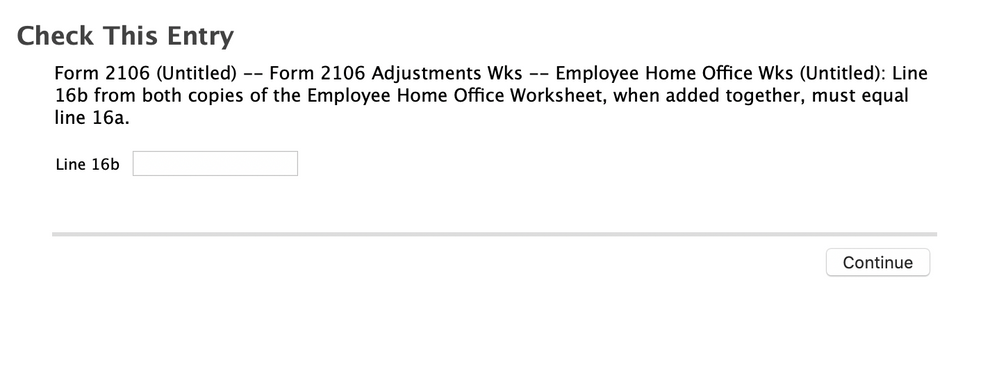

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

When you have two employee home offices, the total employee expenses from the Home Office Wks line 16a must be divvied up between the two offices: how much of the total belongs to Office #1 line 16b? How much to Office #2 line 16b? Only you have the information to allocate the total expenses between the two.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

I only have one home office, (well I deleted once and added again), how do I solve this?

I tried to print all the forms, I found out the value 16b will never changed even if I modify some values of my cost.

the error appears when I tried to file CA state tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

Where are you entering the expenses for the home office?

California allows adjustments for Federal Form 2106, (employee expenses) but home office is no longer on that form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

I entered home office Federal Deductions & Credits, it doesn't affect federal refund, it changed CA refund, but when I tried to file, I got error on Form 2106. and the error didn't go away even if I delete the homeoffice entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

I guess I probably tried to fix the problem by entering some number, and the number stays there somehow even if I modified home office or delete home office

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

Try deleting the form 2106.

If using an online version:

1. Click "Tax Tools" in the left hand menu

2. Click "Tools" in the left hand menu

3. Click "Delete a form" in the center screen

4. Find the form 2106 and "Delete"

5. There will also be a CA form 2106 as well to delete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

Left Hand menu is empty (all white), I'm using mac version FPS 4.2.7.8

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

I saw different values on Form 2106 by following different ways:

1) click "Form" Icon on the menu

2) Print -> PDF file and go to Form 2106

Did I hit a rare bug caused by rare combination of actions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

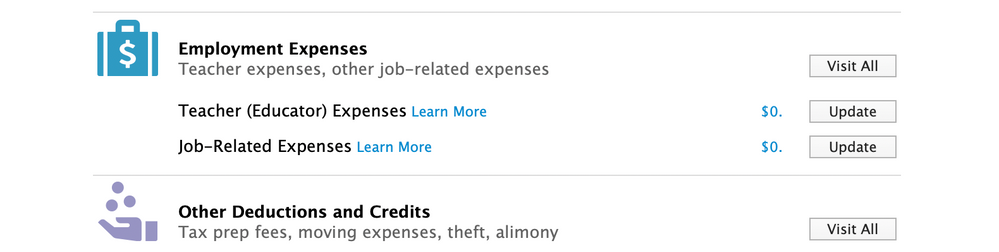

In general, this deduction is no longer available for W-2 employees. Therefore, you will not see a change to your Federal refund.

The business deductions on Form 2106 are allowed for Armed Forces reservist, a qualified performing artist, a fee-basis state or local government official, or an individual with a disability claiming impairment-related work expenses. All other taxpayers can no longer deduct these expenses beginning in tax year 2018. However, some states still allow the deduction. You would enter these expenses on your Federal return to carry to the state.

To try to delete, follow these steps:

- Under the Federal menu, choose Deductions & Credits

- Expand the menu for Employment Expenses

- Click Start/Revisit next to Job Expenses for W-2 Income

- You should be able to delete any information entered and then return to this area to re-enter the deductions that will apply to your state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

You said the error is in your TT Calif return - TT Calif has its own copies of the Employee Home Office Wks. If two of those exist then you will get that "line 16a" must be allocated error. The presence of a federal Emp. Home Office Wks will cause TT Calif to generate a corresponding copy.

Look in your TT Calif return and if there are two copies of that Wks then delete the extra copy, making sure your federal return doesn't have an extra copy first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

no, it doesn't work.

even if I deleted all entries in employee expenses, smart check still failed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

That error cannot happen unless there are two copies of the Employee Home Office Wks. The program counts the number of copies of it. If more than one copy exists for that Form 2106 (the program doesn't know how to count the number of copies of a form wrong), and there has been no allocation between the two copies, then show that error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

Well, I don't know what to do.

I was able to file Federal tax without issues, doesn't let me to file state (CA)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2106 Line 16b from both copies of the Employee Home Office Worksheet, when added together, must equal line 16a. what has to add up to line 16A

TT Calif has an extra copy of the form that needs to be deleted.

The post at this link will tell you how to delete a form in TurboTax Online:

https://ttlc.intuit.com/questions/1894474-how-do-i-delete-a-tax-form-in-turbotax-online

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Waylon182

New Member

j-byrd

New Member

templeone05

Returning Member

rsblackbird

New Member

kwsucher

New Member