- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

I refinanced my 15-year mortgage (main home) in Apr 2020. I received two Form1098. The Settlement Statement showed “Loan Amt (Points)” = $5,400 but box 6 of Form 1098 = $0.

I entered the original 1098 first, I selected ‘yes, this is the original loan I used to buy or build my home’

- 2nd 1098, I selected ‘this is a refinance’. Can I deduct and amortize this Discount Points? Ex: $5,400 / 180 months = $30/month. First Payment = June so $30 x 7months = $210. Is this correct?

- I selected ‘I am spreading the points over the life of my loan(amortizing)’ but TT did not ask about my points

- 2nd 1098 only showed Real Estate Tax form June-Dec. The Settlement Statement listed RE from Jan-June, paid to County. Can I include RE tax from the Settlement ?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Yes, if the new Settlement Statement showed “Loan Amt (Points)” = $5,400 but box 6 of Form 1098 = $0, you can enter that in Box 6 as "Points".

You correctly entered the original 1098 first, and said yes, this is the original loan I used to buy or build my home’

You correctly entered the 2nd 1098, and selected ‘this is a refinance’.

Yes, you can deduct and amortize this $5,400 Discount Points over the life of the mortgage. You should selected "I am spreading the points over the life of my loan(amortizing)".

You should record the combined total of the Real Estate Taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Yes, if the new Settlement Statement showed “Loan Amt (Points)” = $5,400 but box 6 of Form 1098 = $0, you can enter that in Box 6 as "Points".

You correctly entered the original 1098 first, and said yes, this is the original loan I used to buy or build my home’

You correctly entered the 2nd 1098, and selected ‘this is a refinance’.

Yes, you can deduct and amortize this $5,400 Discount Points over the life of the mortgage. You should selected "I am spreading the points over the life of my loan(amortizing)".

You should record the combined total of the Real Estate Taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Hi JohnB5677,

Sorry to bother you! Where do I enter the Discount Points. Form 1098 in TT only showed:

- Box 1 Mortgage Interest; Box 2 Outstanding mortgage principal; Box 3 Mortgage origination date

- Box 5 Mortgage insurance premiums; Property (real estate) taxes paid

Below are my answers to the below questions:

- 'I am spreading the points over the life of my loan' 'no, this is a home equity line of cr or a loan that's been refinanced' selected 'a mortgage loan that I've refinanced' 'no' to 'have you ever pulled cash out from this loan when you refinanced'

TT didn't ask me where to enter my Discount Points.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

On the entry screen for the 1098 there is space for entering box 6.

Scroll down on the entry screen.

If the screen ends with box 5, select "My 1098 has additional boxes"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Hi KrisD15,

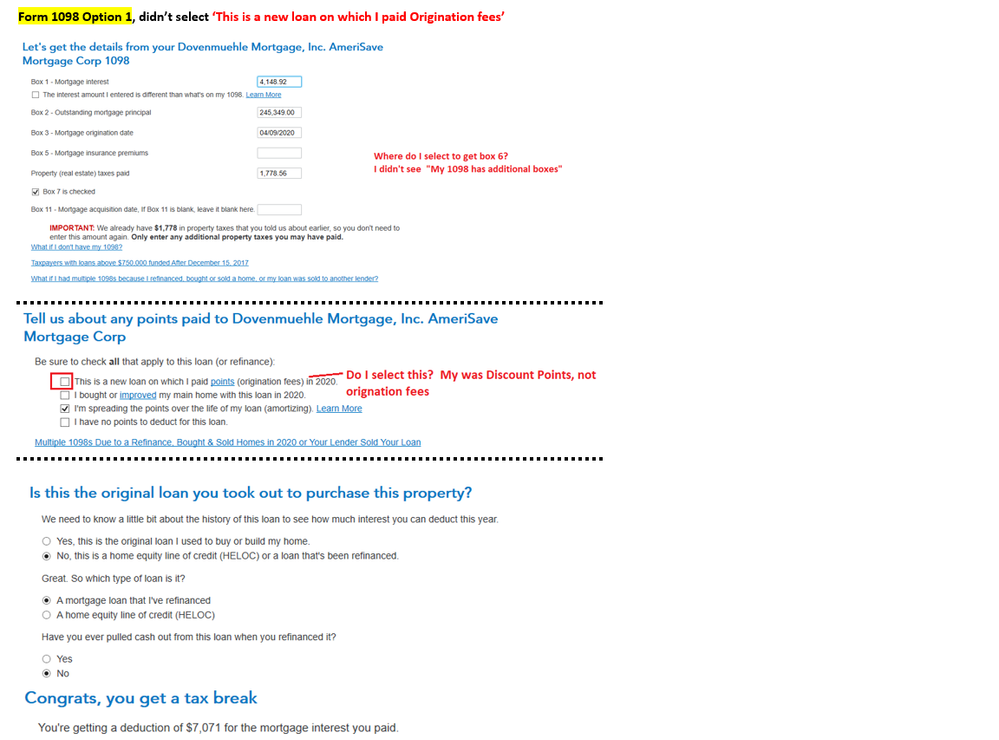

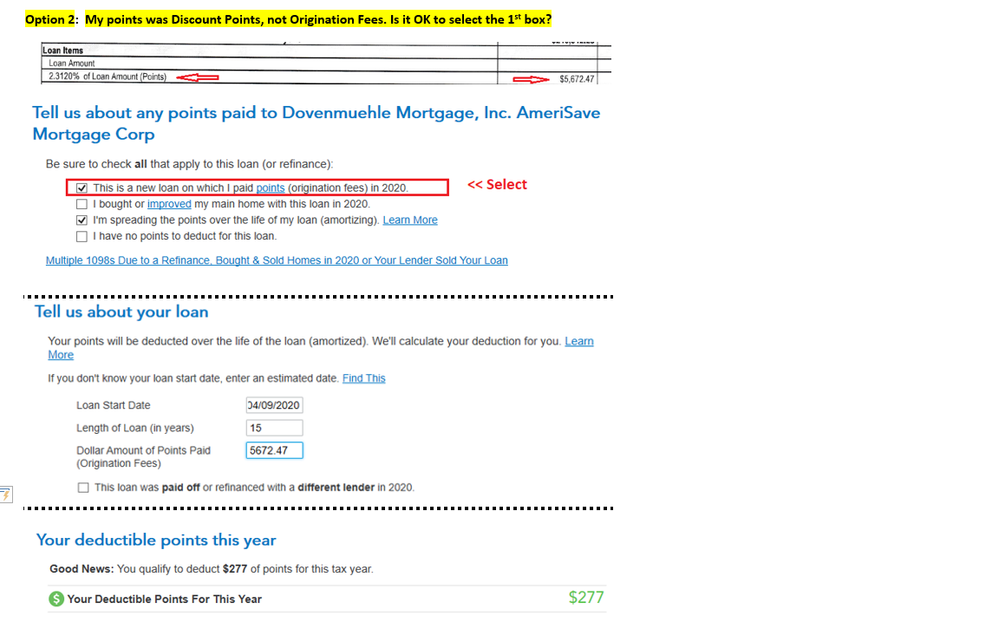

Option 1: I didn’t select ‘This is a new loan on which I paid points (origination fees)’ because my points was Prepaid Interest, not Origination Fees. I couldn't find a place to enter my Discount Points.

Option 2: I selected 'This is a new loan.....origination fees' and was able to deduct $277 of points

Would you please let me know which option is correct to amortizing my Discount Points?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Points on Loans on New Loans: You will want to enter a separate 1098 to cover these points paid. When prompted, enter 0.00 for Boxes 1, 2, 5, and the Property (real estate) taxes box, and checkbox 7, as you’ve already entered the details on your first 1098. For Box 3, add the date in 2020 when the loan originated.

Here is a TurboTax article with a section at the bottom that explains how to enter points for a refinance.

@prettyspring

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Hi MaryM428,

I received two 1098 forms: 1) First-1098: from the previous loan 2) Second-1098: from the Refinance which ONLY listed ½ of the Real Estate tax and NO points.

Q1: I entered the First-1098 OK. Do I enter two more 1098 for the Refinance, total of three 1098?

Q2: The Third-1098 with box 1, 2, 5, Property Tax = 0.00; and checkbox 7?

Q3: “For Box 3, add the date in 2020 when the loan originated.”

My Settlement Date = 4/4/2020

Mortgage Origination Date = 4/9/2020, also on the Second-1098.

Do I enter 4/9/2020?

Thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

No, combine the three 1098's into one entry.

In order to keep TurboTax from adding the amount of debt together and limiting the mortgage deduction allowed, you will combine the three 1098's.

Here is what to put in each box of your entry.\:

- Add together the amounts in Box 1 and enter the total as mortgage interest

- Add Together the amounts in Box 5 and enter the total as Mortgage Insurance Premiums

- Add the property tax paid from each form and enter it in the Property (real estate) taxes box

- Use the loan's original 1098 form to add the amounts in Boxes 2, 3, 7, and 11

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Hi MaryM428,

I’m confused! JohnB5677 advised that I enter two 1098: Original 1098 first, then Refinance 1098. You advised that I enter one entry.

You wrote “Use the loan's original 1098 form to add the amounts in Boxes 2, 3, 7, and 11”

Q1: Does ‘add’ mean to enter? Box 2 (Outstanding Mortgage Principle) of the Refinance 1098 is more accurate because it was less than the Original 1098.

Q2: Box 3 (Origination Date) Original 1098 = 4/2/2018 Refinance 1098: 4/9/2020. When I enter 4/2/2018, TT calculated the Discount Points from 2018 which was not correct because the Discount Points was from the Refinance

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Q1: I did mean "add it to the form" which is to enter it into the form.

Q2: When you refinance the origination date becomes the date of the refinance. So enter 4/2/2020

While it is not wrong to have two entries, TurboTax sometimes combines the outstanding principle and then can make the amount incorrectly not eligible for full tax credits. That is why I advised to combine the two forms for one entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1098 Box 6 = $0 but paid Discount Points; RE Tax is incorrect

Hi MaryM428,

I checked Schedule A to make sure that all deductions (mortgage interest, points, and real estate tax)

Thank you so much for your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LiLiu

Returning Member

carolrubin45

New Member

CharlieRP

Returning Member

yanks772

Returning Member

FoundlingsAreOurFuture

Level 3