- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Foreign Earned Income Exclusion Consecutive Months to Calendar Year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Consecutive Months to Calendar Year

Hi everyone!

In February I amended my 2019 tax return to gain the FIE for the time I lived in the Netherlands (08/2019-08/2020). I moved to Italy 08/2020, am still here, and am reasonably expecting to remain here/in Europe for the next few years, so I'm expecting to continue claiming the FIE. I was wondering though, how can I move back to a calendar year? Can I wait to file my 2020 tax return so that it covers from 08/2020 to 12/2021? Am I stuck doing my taxes August to August forever now?

I know I can file normally now and do another amended one later or request an extension until August, but I'm just wondering if it's possible to include the few extra months needed so I can go back to the normal January-December schedule?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Consecutive Months to Calendar Year

For you 2020 tax return you can enter 01/01/2020 till 31/12/2020 for the qualifying 12 month period.

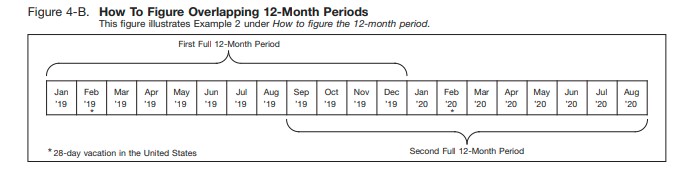

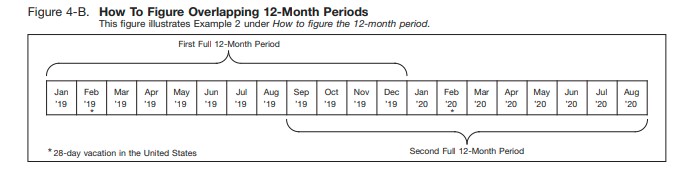

Please see IRS Pub 54 Physical Presence Test pages 15-16 for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Consecutive Months to Calendar Year

For you 2020 tax return you can enter 01/01/2020 till 31/12/2020 for the qualifying 12 month period.

Please see IRS Pub 54 Physical Presence Test pages 15-16 for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Earned Income Exclusion Consecutive Months to Calendar Year

Thank you!! I didn't see this before, your answer is much appreciated.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JackJi0723

Level 1

susq120

Returning Member

memorris7

Level 3

Kat2526

New Member

Romper

Level 6