- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Filing Retroactive Gift Tax Return Form 709

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

Hi,

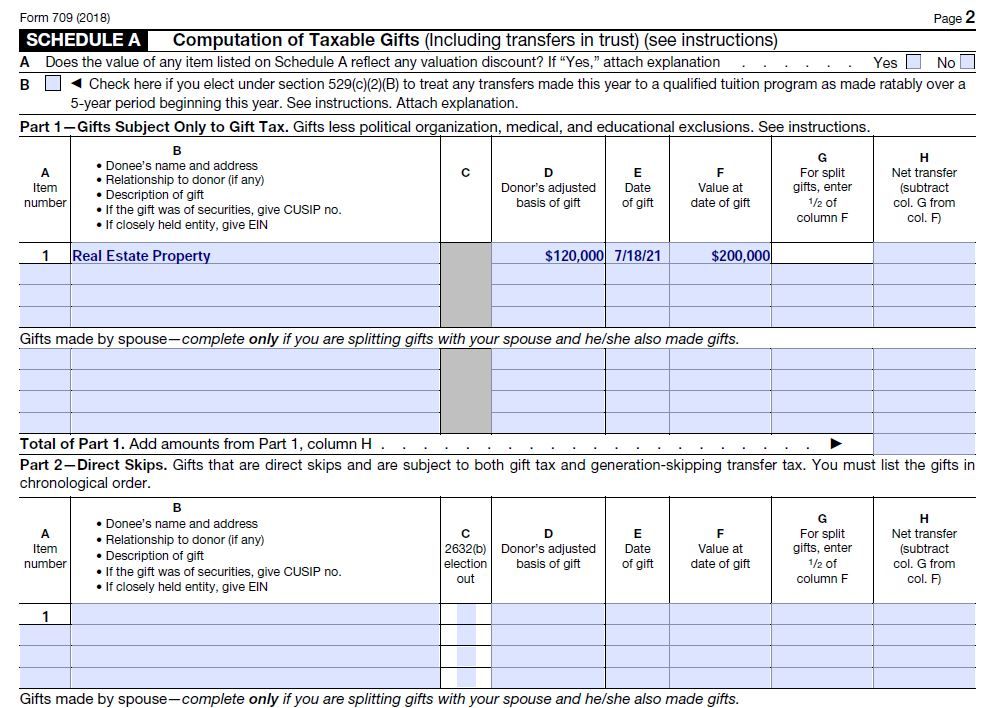

My dad purchased a property in 1999 for $120,000 and he gifted it to my brother in 2018. He did not file a gift tax return. How would he file a retroactive gift tax return form 709 for 2018?

Thanks,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

@hcjontax wrote:

How would he file a retroactive gift tax return form 709 for 2018?

Download a 2018 Form 709 from the IRS web site below, prepare the form, print it and mail it in.

He could also investigate having the return professionally prepared.

See https://taxexperts.naea.org/listing/service/estates-gifts-trusts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

@hcjontax wrote:

How would he file a retroactive gift tax return form 709 for 2018?

Download a 2018 Form 709 from the IRS web site below, prepare the form, print it and mail it in.

He could also investigate having the return professionally prepared.

See https://taxexperts.naea.org/listing/service/estates-gifts-trusts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

Thank you. On the from 709 - I know the cost basis is $120,000 but this was the 1999 purchase price. I don't have any info on the improvement costs or depreciation since then. Can I just estimate it to be $20,000 for the 18 years and have the cost basis be $140,000?

Lastly, what if its difficult to estimate the value at date of gift, can I just use the same amount as the basis? If the value at date of gift is much higher, what cost basis does the recipient use if he sells the gift at a profit a few years from the transfer?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

@hcjontax You should really get an appraisal for the fair market value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

What would happen if I just estimated the value at date of gift as a couple thousand above the cost basis? What does the IRS even do with the value at date of gift number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

You should try to be as accurate as possible. The gift is applied to the Unified Credit.

The U.S. has a unified gift and estate tax system at the federal level. Everyone has a lifetime exemption from gift and estate tax -- $11.4 million for 2019 -- and even after you use up your $15,000 annual exclusion, any remaining gift amount applies against your lifetime exemption amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Retroactive Gift Tax Return Form 709

@hcjontax wrote:

What does the IRS even do with the value at date of gift number?

In addition to what @ColeenD3 wrote, the IRS retains these returns just about forever (unlike income tax returns).

If, eventually, your estate winds up being large enough to the point where an estate tax return is due (Form706), then someone had better have saved the 709s that were filed because the IRS will have them to ensure your estate is not taking the full unified credit at that time.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

henkelcameron8

New Member

elizdara

New Member

abuzooz-zee87

New Member

davemoser22

New Member

lilpahenry

New Member