- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

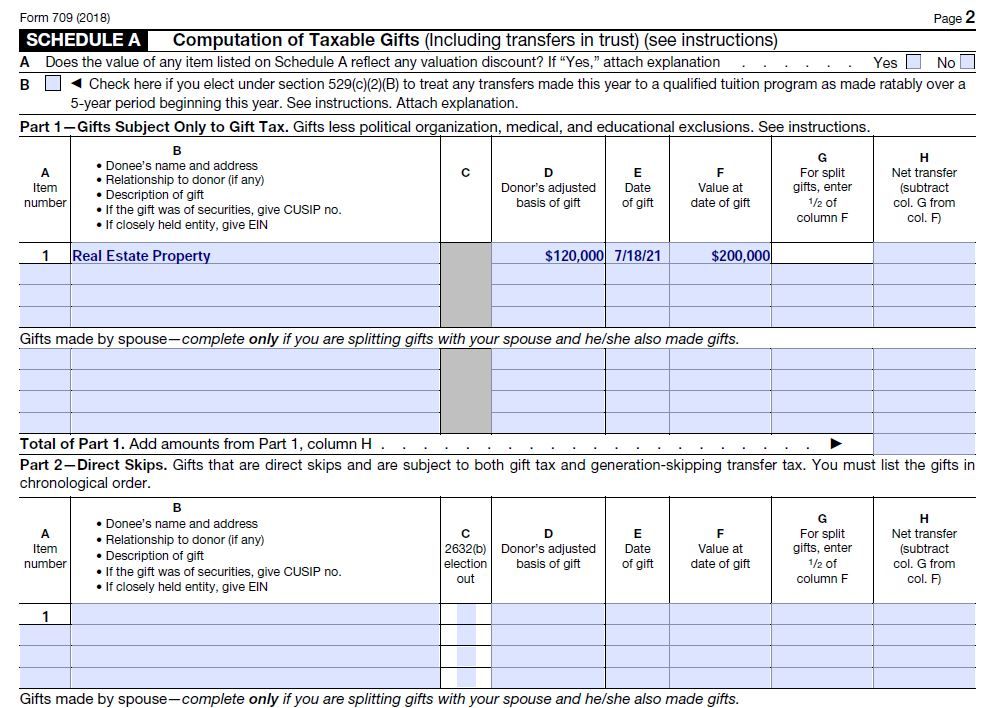

Thank you. On the from 709 - I know the cost basis is $120,000 but this was the 1999 purchase price. I don't have any info on the improvement costs or depreciation since then. Can I just estimate it to be $20,000 for the 18 years and have the cost basis be $140,000?

Lastly, what if its difficult to estimate the value at date of gift, can I just use the same amount as the basis? If the value at date of gift is much higher, what cost basis does the recipient use if he sells the gift at a profit a few years from the transfer?

May 11, 2021

9:06 AM