- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Filing DOT worker M&IE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing DOT worker M&IE

I have an LLC that is taxed as a partnership so I use a schedule K-1 for my income documentation. My LLC is a trucking company and I am a long haul driver which puts me under the DOT rules. Under which section in Turbo Tax Home and Business would I put my M&IE for my time on the road? Would it go in the "Business" or the "Personal" tab? Both allow the deduction but there is a big difference in the impact of taxes owed. I want to make sure I enter the expenses in the correct tab.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing DOT worker M&IE

If you do not have a separate business from the partnership then you will NOT make any entries in the Business tab of the program you are using ... in fact you really only need the Deluxe downloaded version.

Why did the partnership not deduct all the expenses ? Does your partnership agreement require you to pay for your own business expenses ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing DOT worker M&IE

Did you enter the K-1 from the partnership yet ?

To enter a K-1 go to

Federal Taxes Tab ( Personal in the H & B or SE versions )

Income & expenses

Choose Explore on my own or I'll choose what to work on (if it comes up)

Then scroll way down to Business Items

Schedules K-1, Q - Click the Start or Update button

Be sure to pick the right kind of K-1. There are 3 kinds, 1041, 1065 & 1120S

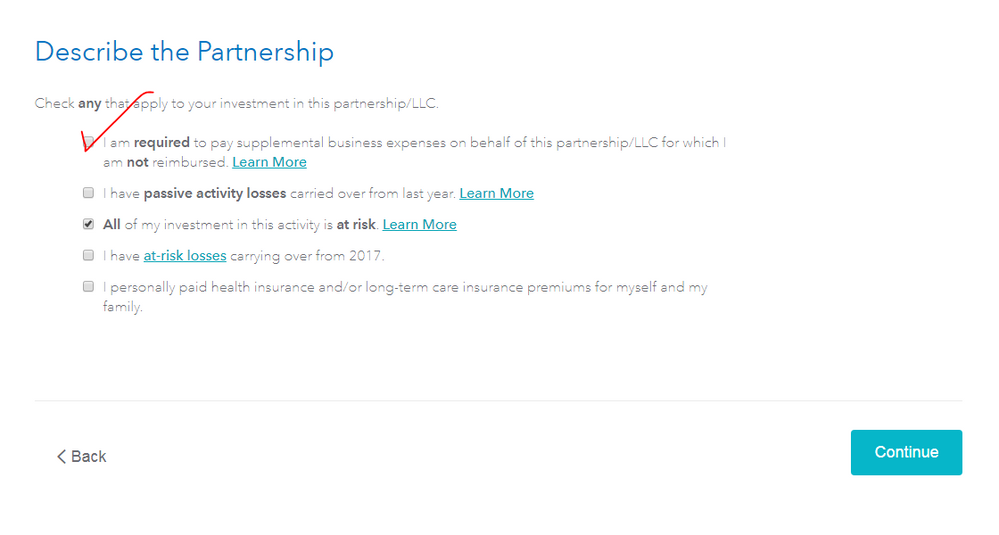

Did you see this screen ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing DOT worker M&IE

No, the LLC does not require the partners to pay out of their own pocket, it's a blanket deduction allowed at 75% and 100% for all days a long haul truck driver is away from home (percentage based on partial or whole day gone). This way drivers don't have to track all of their meals and incidentals for the 250 or so days away from home. Thanks for the guidance, I thought that was the answer.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

april.supple

New Member

reza_mr29

New Member

porterhughes2002

New Member

tomdavey

New Member

tomdavey

New Member