- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal l...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

There are currently several major bugs in how TurboTax handles scenarios where more than one 1098 is received for the same property due to loan sale or refinance.

1) TurboTax is not prompting when entering the 1098 to indicate if the loan the form is for was paid off before the end of the year. I have switched over to the forms view and manually checked off box 9 (Check this box if you refinanced your load with a different lender, paid off this loan or sold the property) myself and it does not appear to actually fix the problem but it would seem like fixing this is needed for TurboTax to even have enough information to correctly handle the scenario.

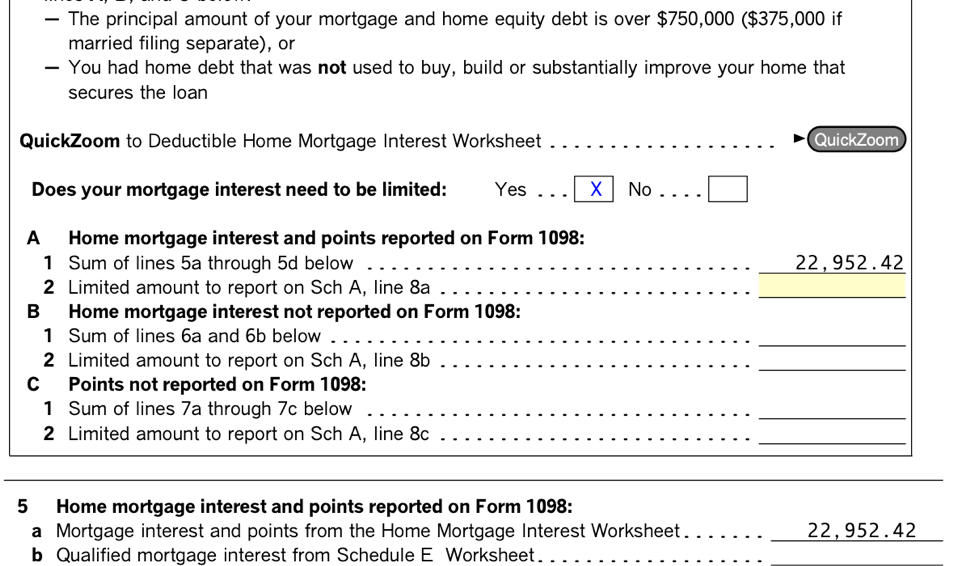

2) Regardless of if box 9 is checked on the worksheets for the individual loans TurboTax appears to be adding up the amounts in box 2 of all the 1098s and if they go over the applicable limit (750k or 1 million both of which we would hit here) it is kicking in the restriction on mortgage interest.

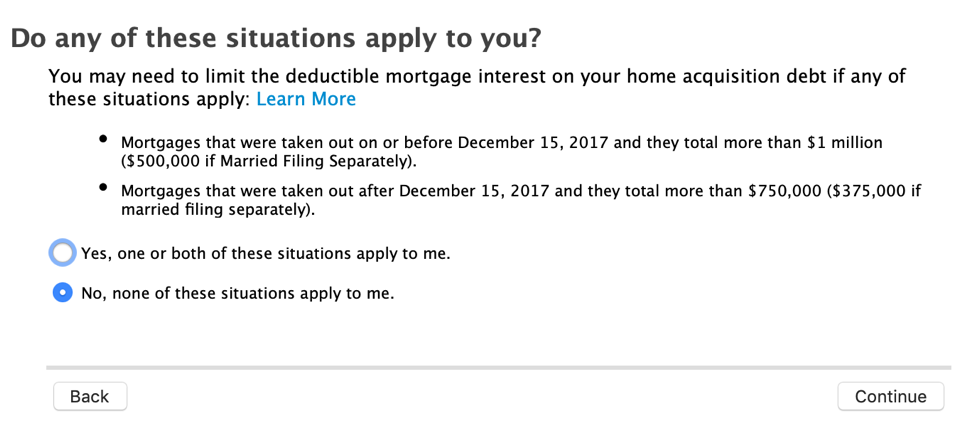

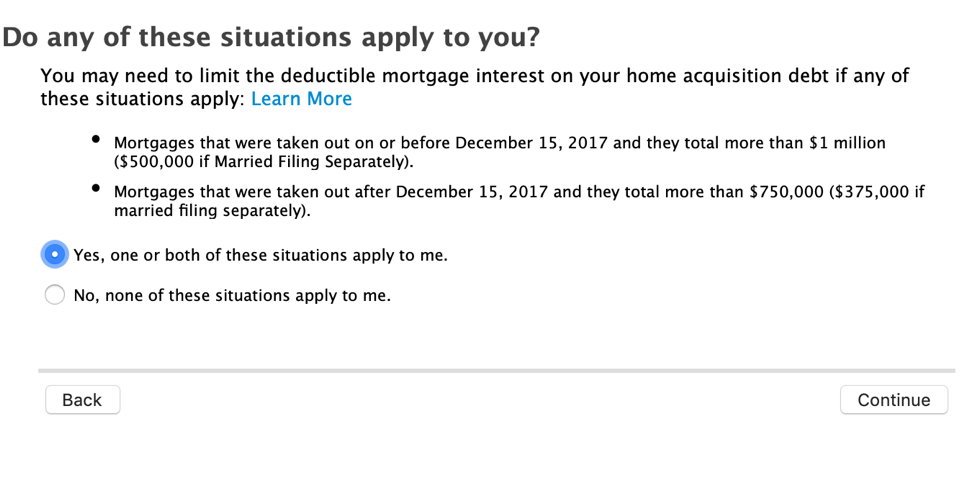

3) In this scenario TurboTax does actually prompt you and asks if you meet either of the exclusion scenarios but then it totally ignores how you answer that question and puts yes onto the worksheet regardless, so I am not sure why it even bothers.

4) What makes this especially confusing is that TurboTax does not immediately take away the mortgage deduction instead it leaves it alone until the smart check when it pops up that you have not filled in the box on the Tax and interest worksheet which would indicate the amount of the interest restriction. Once this value is filled in it takes the deduction away and instantly reduces your refund by a giant amount.

In talking with support, I was told the "fix" is to falsely report the value in Box 2 of one of the 1098s as $1 when entering the form into TurboTax. I am going to pass on any fix that has me fudging the numbers I report to the IRS. And that fact that this is actually being suggested as a fix to what is obviously a software bug has me super concerned about my past tax returns.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

Issue: Regardless of if I answer Yes or No here it fills the worksheet with a Yes

No here

Should translate to no here but it doesn’t. Instead regardless of the answer to the question it fills in Yes.

You can tell this is a bug because if you ACTUALLY answer Yes:

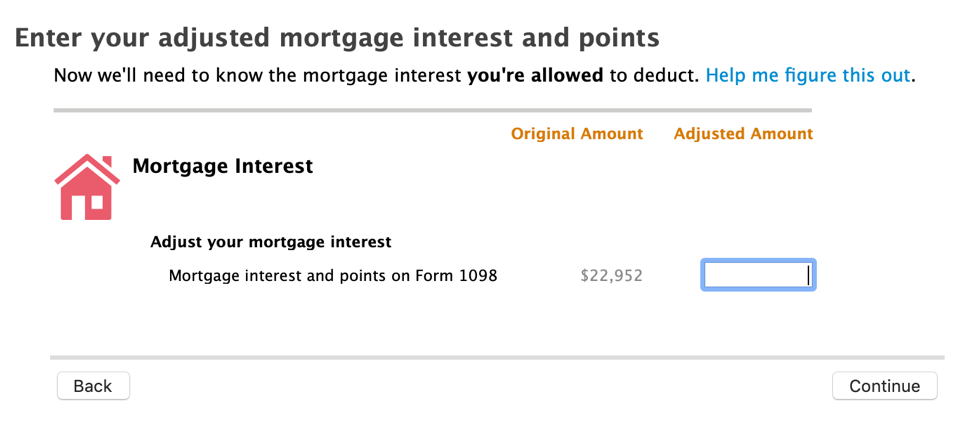

It takes you to a form to help you fill in how much you interest should actually be applied

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

For the refinanced loan the amount in Box 2 should be $0. Box 2 if asking for the balance of the loan on 01/01/2019 for the refinanced loan there was no balance at the beginning of the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

This is not correct per the guidance from the IRS on what belongs in Box 2 of the 1098. It should be the balance 1/1/2019 for all loans originated prior to the current year and should be the starting balance of the loan for any loan originated in the current year.

Quoted from their guidance document:

Box 2. Outstanding Mortgage Principal

Enter the amount of outstanding principal on the mortgage

as of January 1, 2019. If you originated the mortgage in

2019, enter the mortgage principal as of the date of

origination. If you acquired the mortgage in 2019, enter

the outstanding mortgage principal as of the date of

acquisition.

https://www.irs.gov/pub/irs-prior/i1098--2019.pdf

Also all incorrectly filling in this field does is bypass the software bug. Unless you are claiming that TurboTax is by design filling in the Tax form with a Yes when I answer No to the question in the wizard?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

I agree with your findings Andrew. I hope TurboTax addresses this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

I heard it’s still an issue for 2020 tax returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

It is absolutely still an issue for 2020 returns. We refinanced in 2020 a loan which was originally taken out in 2016 (pre-TCJA). TurboTax is unable to handle the fact that all the mortgage interest paid (to both lenders) in 2020 is fully deductible per IRS rules (https://www.irs.gov/pub/irs-pdf/p936.pdf). Instead, the only way to get it to correctly add up the total deductible mortgage interest seems to be to put "$0" for Box 2 of the new loan.

I am also concerned this is going to be a problem going forward in future years as there does not appear to be a way to tell TT that a loan originated in 2020 is nonetheless subject to the pre-2017 deduction rules as it was a refinance of acquisition debt. Certainly possible I am missing something, but have been trying various strategies for a while now without a good solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

@Bostondoc84@DianeC958 @reevesjeremy

I'm running into the same issue right now. If I type everything in correctly (box 2 figures), Turbo Tax eliminates the interest paid on the mortgages all together and pushes me into the 'standard deduction' category. I put $0 in the box 2 question for the newer loan on my refinance, and the issue is gone.

For a program I'm paying for... TurboTax really needs to fix this issue. Someone who doesn't understand the tax system may accidentally go for the standard deduction route when they are entitled to itemize all of their deductions.

For people who did this workaround last year, did any problems come up?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

Yes, we are aware of this experience and are looking into it further.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

@WendyN2 Do you think TurboTax is working to get this resolved? Do you actually work for TurboTax?

I am having the same issue as well. I notice that the issue is that TurboTax is ADDING the refi mortgage balances together instead of taking an average. This is causing the mortgage interest to be phased out for me, when it shouldn't be.

I re-fi'd a 370k mortgage twice (married filing separately). It registers my mortgage debt as over 1mil, when it was in fact never over 370k. I notice on the Home Deduction Worksheet, it adds the 3 mortgages together. The same issue is true for BOTH the federal and the California worksheets. Thus, I am only getting credit for roughly 1/3 of my mortgage interest deduction, whereas I should be getting the entire credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

I have the same exact problem. TurboTax adds up the outstanding principal from the original mortgage and the refinanced mortgage when it should be averaging. The only work around seems to be entering $0 in box 2 on the 1098 of the refinanced mortgage, even though the 1098 form issued by the lender has the amount on origination date filled in. This could cause TurboTax users to lose thousands of dollars in tax refund. Please address this ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

@Anonymous That is one workaround, but unfortunately, that still leads to a very inaccurate "average balance" if you look at the worksheet.

Desktop users are able to override the form and enter their own average debt, which seems like a solid workaround since that is the root of the problem, but online users don't have that ability currently.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

@WendyN2 also want to know if this issue will be fixed. At this point I am holding off on buying TurboTax for 2020 until I see if they will actually bother to fix a bug that has been out there for more than a year. It does seem like some sort of affiliated people are actually ackbowledging the bug this year instead of just going with the see nothing/hear nothing mode they did for 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

I will hold off buying TurboTax for 2020 as well until this is fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Entering multiple 1098s due to a refinance is incorrectly triggering the $750,000 principal limit on home loan interest deductions.

So this is a suggested fix for that issue.

Don't see line 8a on 1098

If there is a refi and there was an outstanding mortgage principal listed in both of them on Line 2 on the 1098. When you do put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest". To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal". Once you change one of them to zero (the one that was paid off by the refinance) then it should no longer pop up with that error at the end when you go to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waldo00

Returning Member

RGB15

Level 2

Bruce05

Level 2

dbergman

Returning Member

kotap004

Level 1