- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Closing Disclosure vs. HUD-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

I have a Closing Disclosure instead of a HUD-1 Settlement Statement. How how do I figure out which fees count as escrow fees? Both my closing disclosure and my master settlement statement itemize the money both the buyer and the seller paid, but the names do not cross over with the categories for the HUD-1. The HUD-1 is for loans before 2015 or reverse mortgages. I bought the house in 2020. Is there a guide I can use to make sure I'm itemizing correctly?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

Yes. Almost no closing costs incurred on the sale or purchase of a residence are deductible. Instead they are added to the cost or purchase price for a future sale to help reduce any gain on the sale for tax purposes.

- Exceptions:

- Mortgage Interest if not included in the Form 1098 total for the year. This may occur if the mortgage was sold to a different lender after a purchase. (Buyer)

- Prorated portion of real estate taxes (both buyer and seller will have their portions in the year of sale/purchase)

- Points, if applicable

All other closing costs such as Title fees, real estate commissions, document recording fees, and legal fees, will be added to the purchase price of the residence for the buyer.

There are articles you may find helpful:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

So are you saying that for the escrow fees page, we put $0 into every single section? Even if the closing disclosure specifically says that there were things like recording fees? The three examples of exceptions you gave aren't listed at all on the escrow fees page.

This is all extremely confusing, as the instructions and tips are only based on a HUD-1. As @Jessi A said, HUD-1 docs are for loans before Oct. 2015. We need better guidance for people with loans made in the last 6 years. I have absolutely no idea what to do for this page, and I don't want to put anything in incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

@macquelm Since virtually none of these closing costs are deductible (except for business property), you could leave all these fields blank (don't enter $0), except for :

- Mortgage interest (including points)

- Property (real estate) tax

- Mortgage insurance (PMI or MIP)

Add up the costs you can't deduct and add that amount to the 'Basis' of your home, in the event you later convert it to Rental Property or sell it for more than the Exclusion Amount.

Click this link for more info on Purchase of a Home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

I refinanced my primary home on 12/23/20, and paid less than $600 in interest for 2020 based on the timing - so I never received a 1098. I do have the Settlement Statement form the title company, as well as the Closing Disclosures - but I don't know where to enter any information related to fees, points, or interest paid.

Where do I find the correct form in Turbo Tax as I'm only asked for 1098s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

It depends. The amounts of deductible closing costs such as mortgage interests, real estate taxes, and points were usually included on the1098 Mortgage Interest statement. You may check the 1098 mortgage statement if the points or prepaid taxes and interst were added If not, you may contact the new lender for a copy of 1098 form. It will be entered where you input morrgage interest and property taxes..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

Colorado doesn't require a 1098 to be issued if the interest collected is less than $600. I paid less than $100 for the six days in 2020 after I closed on the refinance. I asked my lender if I would get a 1098, and was told no (because of the threshold) but that I could find the correct information on my Settlement Statement.

I'm just looking for where I should enter the applicable information into Turbo Tax (or what long form I should use in the form editor) so I can get the data entered since I don't have, and can't get a 1098.

Thanks for the insight.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

Even though you do not have a 1098 mortgage statement, you can enter the information into TurboTax as if you had a form and it will include the mortgage deduction that you are entitled to.

You do want to keep a record of your attempt to get a statement from your lender. That is just for your own records, in case you are ever asked about why you do not have a 1098.

@JoannaB2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

I just came across the same issue. I don't have any HUD form since I bought a property in 2020. The HUD form was replaced in 2015, but TurboTax still didn't update the interface. This is very confusing and frustrating. I'm still not sure how I should translate the Closing Disclosure to HUD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

Actually, the new form is easier to understand that the old HUD-1 - pretty much everything you need is one page Page 2).

See sample at: Closing Disclosure Form

What can you deduct:

A. Origination charges (commonly referred to as "Points")

F. Prepaids, but only Mortgage Insurance Premiums, Prepaid Interest and Prepaid Property Taxes

What is added to the cost basis of your property:

B. Services Borrower Did Not Shop For

C. Services Borrower Did Shop For

E. Taxes and Other Government Fees

H. Other (will depend on the item. For example, an Inspection Fee paid by the purchaser can be added to cost basis)

H. "Other" can include almost anything. In many cases, these costs can be added to the cost basis of the property, but there aren't likely to be any deductible costs reported here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

Thanks for the detailed answer, but unfortunately it didn't help me to understand how to fill what TurboTax is asking me.

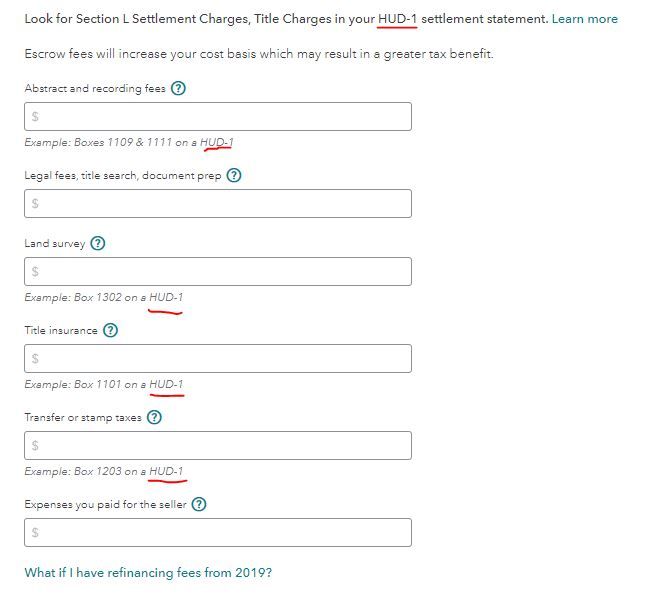

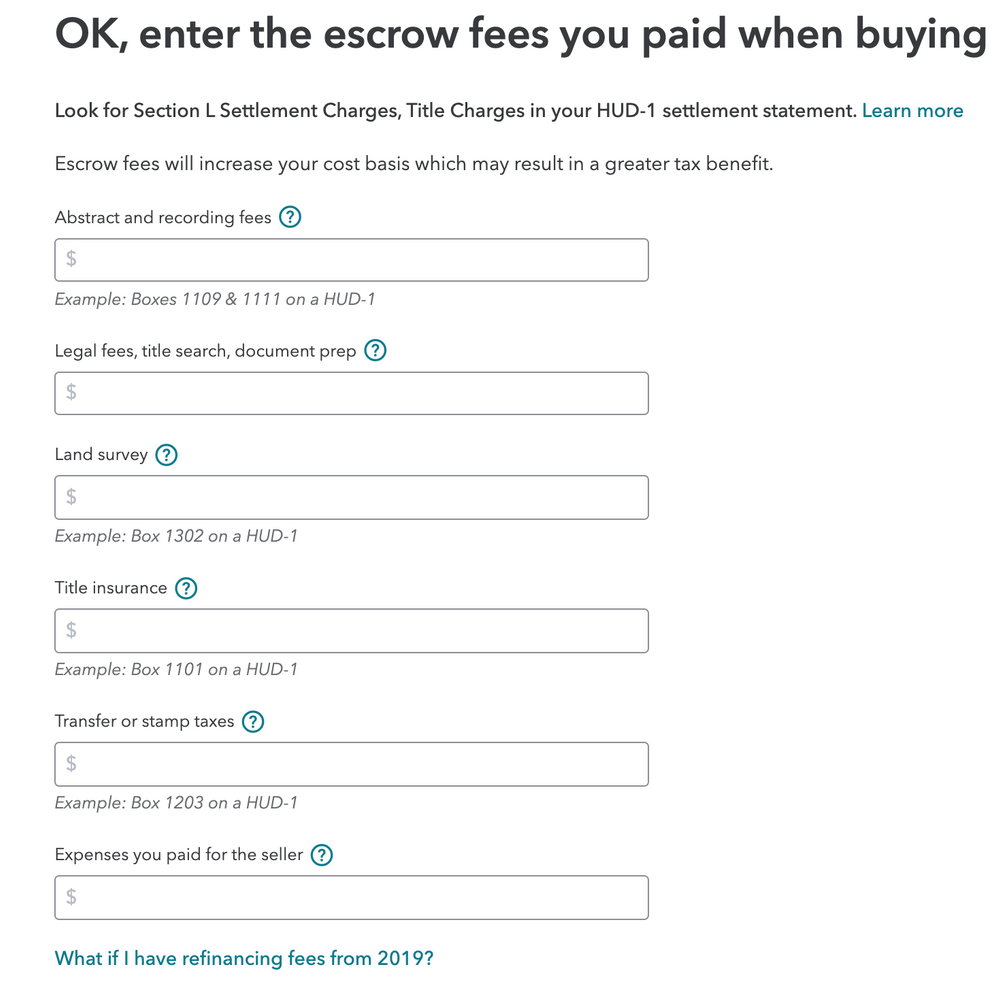

This is what I see on the screen:

I'm still having difficulties to translate what I have in the Closing Disclosure to these fields, for example I don't have a field "Abstract and recording fees", etc. Also, I have no idea where to put points I payed.

Could anyone please help to translate Closing Disclosure to the fields in this picture?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

The HUD-1 statement is rarely used these days, with the exception of reverse mortgages. Each state, and sometimes closing agent, will have their own version of the closing statement. So we can't tell you with certainty what line of the statement applied to each category.

Most of the settlement charges for buying and selling a home are not deductible. They are either added to the basis of the property or deducted from the sales price for calculating capital gain.

Some items on the closing statement that you can deduct on your return are:

- real estate taxes;

- private mortgage insurance;

- mortgage interest; and

- loan origination fees (“points”) that you paid.*

*Check with your lender, though. Many lenders include the interest and points paid at closing in the 1098 they issue for the year.

Points are entered in the Mortgage Interest section of TurboTax. After entering mortgage interest from your 1098, you will see a screen, Did you pay points in 2020 when you took out the loan? Enter the points there if they were not included in the interest reported on the 1098.

In the sample closing statement posted in the screenshot below:

- Abstract & recording fees - line E1

- Legal fees, title search, document prep - C5

- Land Survey - C2

- Title Insurance - C3 + C4 + C6 + H7

- Transfer or stamp tax - E2

The reason you are entering these costs is so they can be added to the basis of your house when you sell in the future to reduce any capital gain. Except for the points, they won't affect your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

It's unbelievable that a product you pay so much money for does not have accurate instructions on how to translate the itemized values in a closing disclosure to this form. The closest thing we got in this thread is the answer above, but each closing disclosure will look different (as does mine) and so it's virtually impossible to figure out what to put in each form fill. So frustrating and disappointing!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

This is exactly what I am looking for! Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing Disclosure vs. HUD-1

Thanks for the replies and clarifications. However, this is the last year I'll be using TurboTax. It was good and easy when I had only W2, but when I started investing to the real estate I see that TurboTax clearly doesn't care about me as a customer anymore.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dreapotter

New Member

jordan-geonna

New Member

Priscilla1985

Returning Member

mernyll

Level 1

fredaratliffe

New Member