- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Charitable donations

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

I have a total of $5,285.00 in charitable donations. When I get to the comparison of 2018 and 2019 deductions and credits, the amount shown for charitable donations is $0. How do I correct this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Unless you have enough itemized deductions --including charity donations_-- to exceed your standard deduction, the donations have no effect on your tax due or refund.

STANDARD DEDUCTION

Many taxpayers are surprised because their itemized deductions are not having the same effect as they did on past tax returns. The new higher standard deduction and the elimination of certain deductions, as well as the cap on state and local taxes have had a major impact since the new tax laws went into effect beginning with 2018 returns.

Your itemized deductions have to be more than your standard deduction before you will see a change in your tax owed or tax refund. The deductions you enter do not necessarily count “dollar for dollar;” many of them are subject to meeting tough thresholds—medical expenses, for example, must meet a threshold that is pretty hard to reach. The software program uses all the IRS rules that apply to the expenses you enter, and it tells you if you have enough to use your itemized deductions or if using the standard deduction is more advantageous for you. Under the new tax laws, some deductions have been capped—there is a $10,000 limit to the itemized deductions for state, local, property and sales taxes.

Your standard deduction lowers your taxable income. It is not a refund.

2019 Standard Deduction Amounts

Single $12,200 (+ $1650 65 or older)

Married Filing Separate $12,200 (+ $1300 if 65 or older)

Married Filing Jointly $24,400 (+ $1300 for each spouse 65 or older)

Head of Household $18,350 (+ $1650 for 65 or older)

Look on line 9 of your 2019 Form 1040 to see your itemized/standard deduction amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

You can only deduct the amount of unreimbursed Medical Expenses you actually paid OVER 7.5% of your AGI. So it might take a lot to deduct any. And then the total of ALL your itemized deductions has to be more than the standard deduction to get any benefit (so you would only be getting the benefit of the amount that puts you over the standard deduction).

And There is a limit on SALT deductions. SALT is State And Local Tax. Which includes property tax, any state tax paid like for last year’s return and includes any state withholding from your W2s and any 1099s you have. And any other taxes like in W2 box 14 & 19. You can only deduct up to 10,000 (5,000 MFS) for SALT State and Local Taxes.

FAQ on changes starting in 2018

https://ttlc.intuit.com/community/tax-reform/help/how-will-tax-reform-affect-my-federal-tax-return/0...

And some Deductions that have been suspended for 2018-2025

https://ttlc.intuit.com/community/tax-reform/help/which-federal-tax-deductions-have-been-suspended-b...

For 2019 the standard deduction amounts are:

Single 12,200 + 1,650 for 65 and over or blind

HOH 18,350 + 1,650for 65 and over or blind

Joint 24,400+ 1,300 for each 65 and over or blind

Married filing Separate 12,200 + 1,300 for 65 and over or blind

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Unless you have enough itemized deductions --including charity donations_-- to exceed your standard deduction, the donations have no effect on your tax due or refund.

STANDARD DEDUCTION

Many taxpayers are surprised because their itemized deductions are not having the same effect as they did on past tax returns. The new higher standard deduction and the elimination of certain deductions, as well as the cap on state and local taxes have had a major impact since the new tax laws went into effect beginning with 2018 returns.

Your itemized deductions have to be more than your standard deduction before you will see a change in your tax owed or tax refund. The deductions you enter do not necessarily count “dollar for dollar;” many of them are subject to meeting tough thresholds—medical expenses, for example, must meet a threshold that is pretty hard to reach. The software program uses all the IRS rules that apply to the expenses you enter, and it tells you if you have enough to use your itemized deductions or if using the standard deduction is more advantageous for you. Under the new tax laws, some deductions have been capped—there is a $10,000 limit to the itemized deductions for state, local, property and sales taxes.

Your standard deduction lowers your taxable income. It is not a refund.

2019 Standard Deduction Amounts

Single $12,200 (+ $1650 65 or older)

Married Filing Separate $12,200 (+ $1300 if 65 or older)

Married Filing Jointly $24,400 (+ $1300 for each spouse 65 or older)

Head of Household $18,350 (+ $1650 for 65 or older)

Look on line 9 of your 2019 Form 1040 to see your itemized/standard deduction amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

I have tax information for 2019 for following, CBN for $720.00 Partner #[social security number removed] and also National Kidney Foundation and expenses put into the vehicle that exceeded over $2500.00. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

If you are trying to determine if you itemize versus taking the standard deduction, you would only itemize if your total deductions exceed the standard deduction for your filing status.

Itemized deductions include medical expenses in excess of 7.5% of AGI, mortgage interest, state and local taxes including real estate taxes (capped at $10,000), and charitable contributions.

You can review the deductions in the Deductions & Credits section of TurboTax and see if anything pertains to your personal situation. TurboTax will assign the deduction that provides the best tax benefit for you.

What are Itemized Tax Deductions?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

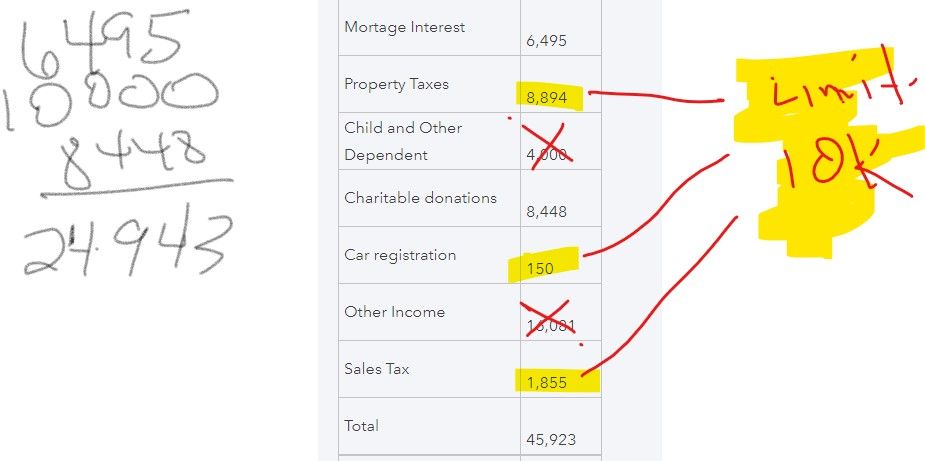

I have more than $24,400 in deductions, but it doesn't appear I am getting the benefit of my deductions. My refund last year was $7k.

I have provided two items, one grouping lists other income and sales tax ($45,923) and the other does not ($27,987). Where is my refund?

Thanks,

Jennifer

| Mortage Interest | 6,495 |

| Property Taxes | 8,894 |

| Child and Other Dependent | 4,000 |

| Charitable donations | 8,448 |

| Car registration | 150 |

| Other Income | 16,081 |

| Sales Tax | 1,855 |

| Total | 45,923 |

| Mortage Interest | 6,495 |

| Property Taxes | 8,894 |

| Child and Other Dependent | 4,000 |

| Charitable donations | 8,448 |

| Car registration | 150 |

| Total | 27,987 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

You will need to print out or view your tax return to determine if you are itemizing or not. You can either take the total of your itemized deductions OR the standard deduction. TurboTax will apply the largest deduction.

You can take the deduction for Children and Other Dependents no matter which option you choose. This is a tax credit, not an itemized deduction.

State and Local taxes are limited.

Mortgage interest may be limited.

How does the Standard Deduction differ from itemizing deductions?

How do I check my e-file status? This link will help you track your refund

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Looking at the summary screen can be confusing ... reviewing the Sch A is the only way to know for sure ... the amounts given in your post add up to 24,943 ... and the standard deduction for a married couple is 24,400 PLUS 1200 per person 65 or older. Were either of you 65 or older ... if so the standard deduction is better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

We are not over 65. So it's better to take the standard deduction instead of itemizing? I'm pretty sure TurboTax told me to itemize.

Thank you so much for all of your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

And how do I know if TurboTax chose the standard deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

@jah72773 wrote:

And how do I know if TurboTax chose the standard deduction?

Look at your federal tax return Form 1040 Line 9

Standard deductions for 2019

- Single - $12,200 add $1,650 if age 65 or older

- Married Filing Separately - $12,200 add $1,300 if age 65 or older

- Married Filing Jointly - $24,400 add $1,300 for each spouse age 65 or older

- Head of Household - $18,350 add $1,650 if age 65 or older

If you have not filed your tax return and are accessing the 2019 online tax return -

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

OK, I went back and changed to the standard deduction and it decreased by refund. I just don't understand why all of my donations didn't help me get a larger refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

No. If you are under 65 it might be better to take the Itemized Deductions. You should take whichever is more, the Standard Deduction or Itemized. Looks like your Itemized Deductions are about 900 more than the Standard Deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Thank you for this excellent response. I was frustrated by the fact that my almost $5,000 of charitable deductions did not move the needle AT ALL. It sounds like the threshold is quite high now, sort of like Medical Expenses. I don't even bother itemizing medical expenses since it requires a significant amount of medical expenses to qualify as an actual deduction. I'm grateful NOT to be able to take the medical expense deduction as one must be in very poor health to achieve these limits.

It would be very helpful to know the % of AGI that must be achieved for things like medical expenses and charitable contributions.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

You can only deduct the amount of unreimbursed Medical Expenses you actually paid OVER 7.5% of your AGI. So it might take a lot to deduct any. And then the total of ALL your itemized deductions has to be more than the standard deduction to get any benefit (so you would only be getting the benefit of the amount that puts you over the standard deduction).

And There is a limit on SALT deductions. SALT is State And Local Tax. Which includes property tax, any state tax paid like for last year’s return and includes any state withholding from your W2s and any 1099s you have. And any other taxes like in W2 box 14 & 19. You can only deduct up to 10,000 (5,000 MFS) for SALT State and Local Taxes.

FAQ on changes starting in 2018

https://ttlc.intuit.com/community/tax-reform/help/how-will-tax-reform-affect-my-federal-tax-return/0...

And some Deductions that have been suspended for 2018-2025

https://ttlc.intuit.com/community/tax-reform/help/which-federal-tax-deductions-have-been-suspended-b...

For 2019 the standard deduction amounts are:

Single 12,200 + 1,650 for 65 and over or blind

HOH 18,350 + 1,650for 65 and over or blind

Joint 24,400+ 1,300 for each 65 and over or blind

Married filing Separate 12,200 + 1,300 for 65 and over or blind

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

snoblack

Level 2

ead307d72a5f

New Member

Davesilb

Level 2

Joann48

New Member

ArielA77

Returning Member