- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Charitable Deduction Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

Using TurboTax Deluxe 2021. I entered my charitable deduction for 2021 and I see that TurboTax gives us a $600 deduction on our joint return on Form 104 Line 12b.

I complete my return and go to Review-Analyze my return and it changes the deduction to $300.

I go to Federal Taxes - Smart Check and it says I have an error. I click Check Errors and it notes that "Charitable contributions has an unacceptable value" of $300. I correct the number to be $600, run Smart Check and it says there is no error.

If I run Review-Analyze again, it will revert back to $300.

A fix needs to be rolled out for this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

I'm running into the same problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

Hey just got this issue fixed by awesome rep - Pamela. So you can deduct up to 600 dollars. The steps that worked for me were:

1 - delete the $$ charitable donations (we are going to add them in later).

2 - select wrap up tax breaks

3 - it will ask you one more time about the charitable donations

4 - here you enter the total amount you donated (up to $600 max)

5 - click continue

This worked for me. hope it helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

I'm using the PC version of TurboTax Deluxe. I don't see where it says: wrap up tax breaks.

@MG47

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

I'm not looking for a workaround since I already have one. For now, I just won't run Review-Analyze after Smart Check has me change the $300 back to $600. The reason I posted this is because this is an error in the software. I worked in IT for over 30 years and this is my QA findings after doing this year's taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

I’m replying to my post to point out that this is not a problem I’m having in completing my taxes through TurboTax.

It is an erro in the TurboTax Deluxe program that I found and ma reporting. I don’t know of any better wat to report this erro than posting in the forum.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

Can you please help me with Charitable deductions on line 12b . the program keeps telling me the amount of 300 is incorrect. I change it to 600 and it tells me its wrong. what do i put in line 12b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Deduction Error

For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

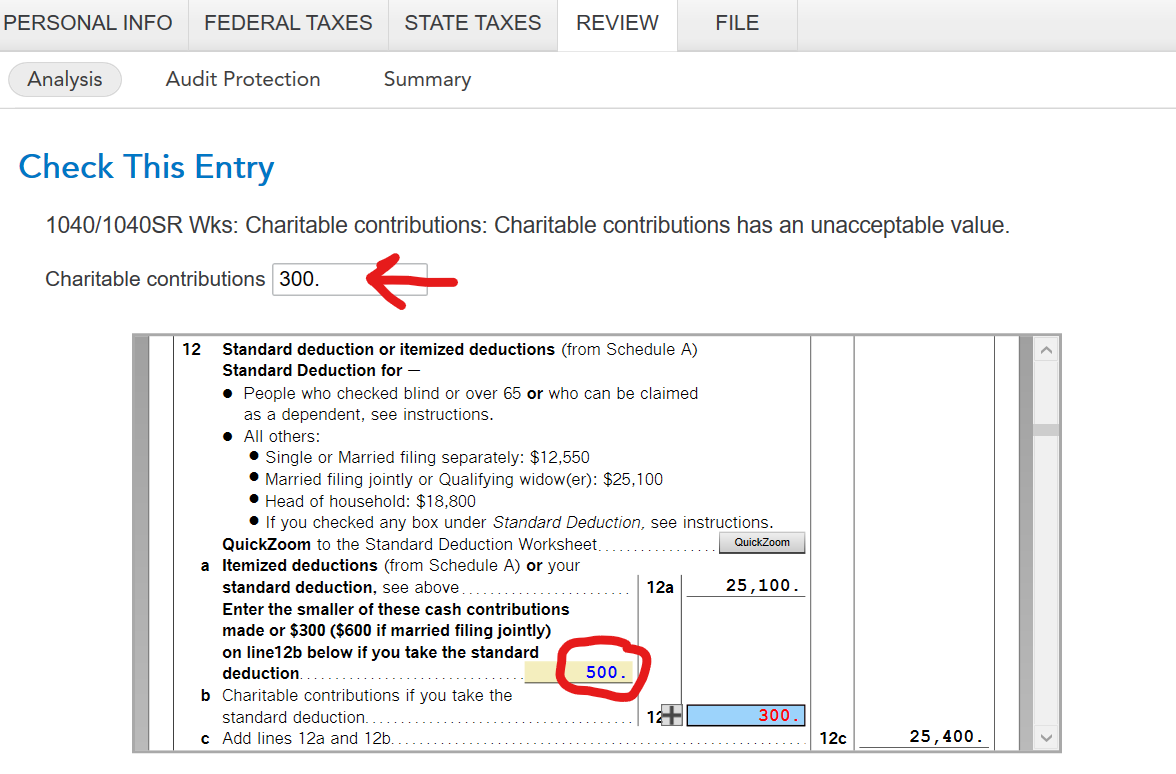

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

paedge

New Member

J_J

New Member

rtregoning

Level 1

KrishnaKSsingh

Level 2

ramatsu

New Member