- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Bug found in Turbotax 2021 for line 12b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

I've read the thread pertaining to the TurboTax Line 12b "error" but the solution requires one to remove the charitable contribution entries. I don't believe a TurboTax customer should have to do that because the reason one enters that info is to enable the TurboTax program to determine whether one should itemize or take the standard deduction. In our case, TurboTax properly determined that we should take the standard deduction. However every time I run the review, the program states there is an error in line 12b and displays $300. In fact because we are married filing joint, and per the 1040 instructions (see below) we are allowed to deduct $600 because we donated more $600 to our church. It's OK for the review to bring this to the customers attention, but there should be nomenclature included that describes the allowable deduction. I copied and pasted from the 1040 Instructions below, (I did remove hyphens from the words that were broken in the 1040 columns).

From the 1040 Instructions document pertaining to Line 12b:

If you don't itemize deductions on Schedule A (Form 1040), you (or you and your spouse if filing jointly) may be able to take a charitable deduction for cash contributions made in 2021.

Enter the total amount of your contributions on line 12b. Don't enter more than $300 ($600 if married filing jointly).

The contributions must be made to organizations that are religious, charitable, educational, scientific, or literary in purpose. See Pub. 526 for more information on the types of organizations that qualify.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

You are correct. For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you follow the instructions below, you will be able to claim your charitable contributions up to $600 in addition to your standard deduction without deleting any charitable contribution entries you have made.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

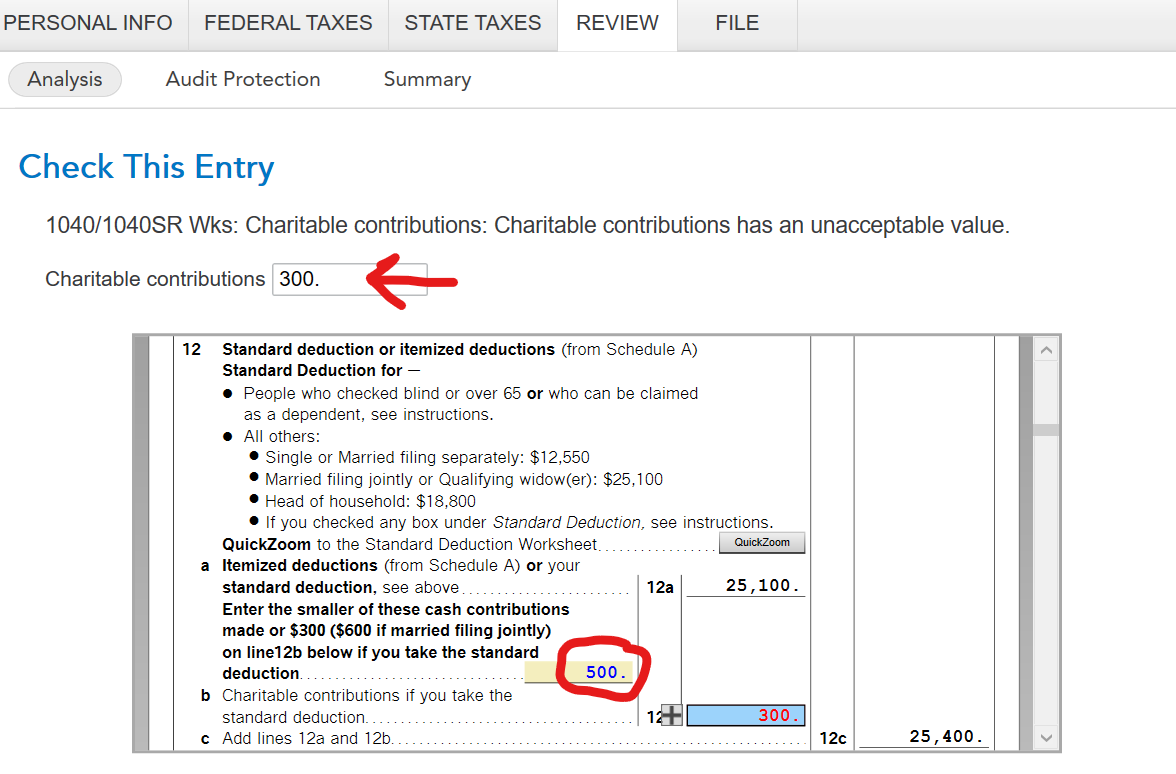

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

Thank you for the reply, and that is what I have been doing every time I run the review. My point was that rather than TurboTax making this look like an unacceptable entry (the error states "Charitable contributions has an unacceptable value") and potentially frightening customers into zeroing out the entry when they are entitled to it, instead the information should be provided to educate the customer. Perhaps the error message could be changed to something like "Charitable Contributions allows an entry under certain conditions, click here for more info" allowing customers to educate themselves about the requirements.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

the error on 12b is there also when you are trying to itemize deductions. it keeps auto-filling 300.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

I have TTAX Basic for 2021 returns. Line 13 of my 1040 shows a $1.00 deduction for "qualified business deduction" though I have no business deductions. Looking at the form 8895 source there appear numbers that I cannot explain. Can you inform TurboTax support of this?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

@NDJCO The qualified business deduction (QBI) can come about from ownership in an investment that is reported on a K-1 schedule. You may have entered that not knowing it was associated with QBI. It can also carry over to other years, so it may have come from an entry in a prior year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

I agree with musicnancy that this error doesn't make sense, which is why I defined it as a bug. (I wasn't sure how to put that person's name in my reply, got an error that the html was invalid when I copied & pasted.)

For an expert, please review below my thoughts regarding a possible solution to how the program logic should deal with this situation:

Determine whether itemizing or standard deduction.

(1) If itemizing, the program should NOT enter anything and therefore no message.

(2) If standard deduction then determine whether single or married

(a) If single, populate 300

(b) If married, populate 600

(c) During review, provide the warning and include this note (from 1040 instructions): "The contributions must be made to organizations that are religious, charitable, educational, scientific, or literary in purpose. See Pub. 526 for more information on the types of organizations that qualify."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

Hello!

The bug I mentioned is on line 13, not 12b.

However, I found the following:

1040 line 13, click leads to 1040 Worksheet. On WS click on line 13 leads to QID summary which shows an REIT divided of $5 on lines 9 and 15, Line 16 show 20% of line 15 or $1.00. Quickzoom to form 8995 show line 6 and 8 contain $5. I am not using any K-1 forms, so the source of the $5 is unknown. Ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

Sure seems like a no-brainer to me. Filled in Sked A, did not meet threshold for itemizing this year, but did have in excess of $600 charitable deductions from ItsDeductible input. When Standard Deduction is selected seems like this should automatically carry over to 1040 Line 12b. But I found if I manually enter 600 in the box at 1040 line 12a, and enter again at 1040 line 12b, it seems to work. Ran verification process and did not throw an error.

This should be an automatic carry over . . .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

I have the same error. I am using the itemized deduction even though the standard deduction is higher because my combined federal and state taxes are lower. My state accepts the itemized deductions from schedule A and it lowers my state taxes. Turbo Tax program keeps adding the $600 on line 12b on the 1040 SR wks and I have to keep deleting it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

You may have an entry posted at the second area of entry. If so, you may have to temporarily reduce one or more itemized deduction entries to invoke the screen Based on what you just told us, the Standard Deduction is best for you.

Federal 1040 line 12b Charitable Cash Contributions under CARES Act can be entered or removed at either:

- Federal Taxes / Deductions & Credits / Your tax breaks / Donations to Charity in 2021 or

- at the screen Charitable Cash Contributions under CARES Act immediately following Based on what you just told us, the Standard Deduction is best for you.

If you temporarily reduce one or more itemized deduction entries,

- Scroll down to Wrap up tax breaks to invoke the screen Based on what you just told us, the Standard Deduction is best for you.

- At the screen titled Charitable Cash Contributions under the CARES Act, make sure that the box contains $0.

- At Other Tax Situations, scroll to the bottom of the page and click on Let’s keep going.

- Continue through Review.

Go to Tax Tools / Tools / View Tax Summary / Preview my 1040 to view line 12b for the charitable deduction.

Under Deductions & Credits, re-instate the deductions that had been temporarily changed and re-qualify for itemized deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

JamesG1 - Your instructions did not work. I want to take the itemized deductions. I don't want the standard deduction.

My state allows me to take the itemized deductions from the federal itemized schedule A. By doing this I will pay higher federal taxes but lower state taxes and my combined taxes are lower than if I take the standard deduction. Turbo Tax is additionally applying the $600 charitable contribution (line 12b) that is associated with the standard deduction. I would get an error, correct the error and Turbo Tax (TT) temporarily indicate that error has been corrected. The problem is proceeding to do state or doing other functions, TT will refill line 12b with the $600.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

I am using Turbo Tax Premier. I’ve been purchasing Turbo Tax (TT) at a store since 2005. That is 17 years. I am taking the itemized deduction even though the standard deduction is at a slightly higher amount. I am doing this because my combined federal and state taxes are lower. My state accepts the itemized deductions from schedule A and it lowers my state taxes and effectively both taxes. So I am itemizing for both the federal and state. The TT program would identify an error on the 1040 SR wks line 12b, I would correct the error by deleting the $600 and TT would indicate that the error has been corrected. However, TT would re-populate the $600 in two occasions.

- When I recheck my state return (the line 12b problem occurs and I would have to fix it again, TT temporarily fixes the problem) and

- When I am wrapping everything up taxes, this is what the following screen shows

- Done with states, ---- this is ok

- Let’s make sure things are correct ----this is ok

- Give us a minute to look things over ---- this is ok

- Tax Summary for 2021 (at this point it has already re-populate the $600 – because my federal taxes are lowered by $200) ---- the error returns

- Let’s check these entries (this is the error screen showing the S600 on 1040 SR wks on line 12b) --- the same darn error occurs

In other words, Turbo Tax program keeps adding the $600 on the 1040 SR wks line 12b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

I am also in a case where, although taking the standard federal deduction raises my federal taxes slightly, that amount is more than offset by the itemized benefit for the state tax which requires itemizing federal.

I am experiencing the exact same problem that is being described by ChrisG2021.

Turbo Tax program keeps adding the $600 on the 1040 SR wks line 12b when it should not.

This also shows a lack of TurboTax actually doing the full impact of its itemized deduction calculation. It appears that TT only looks at federal to state that one should take standard. If it looked at the combined federal plus state tax impact, it should see that, oh my goodness, there is a benefit to itemizing in some situations where the state benefit outweighs the federal increase. This is certainly disappointing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug found in Turbotax 2021 for line 12b

Turbo Tax customer service folks are nice people but they mostly take notes, run through basic computer checks, sends you surveys and then closes the ticket.

Reporting this issue to someone responsible for software issues at Turbo Tax is impossible.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

v8899

Returning Member

Omar80

Level 3

DavidRaz

Returning Member

botin_bo

New Member

RyanK

Level 2