- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: AZ Auto Registration fees

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZ Auto Registration fees

Are AZ auto regiatration fees (based on value of vehicles) deductable on AZ return if you don't itemize?

I know they are not on federal with standartd deduction but I thought they were on state level.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZ Auto Registration fees

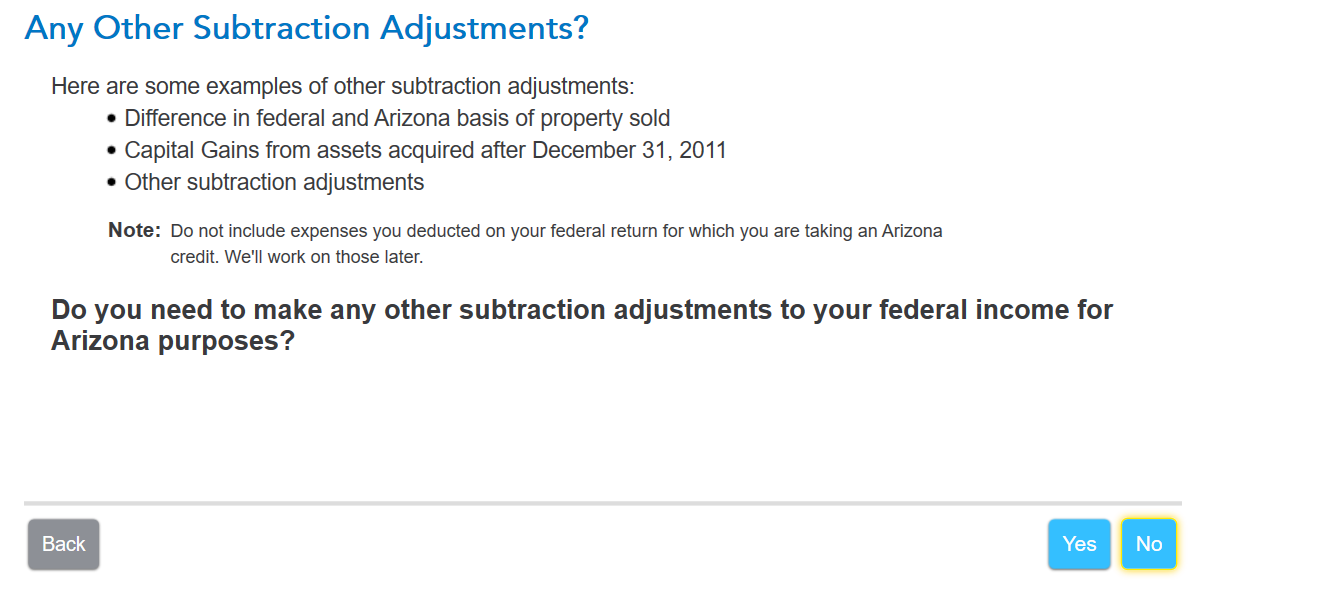

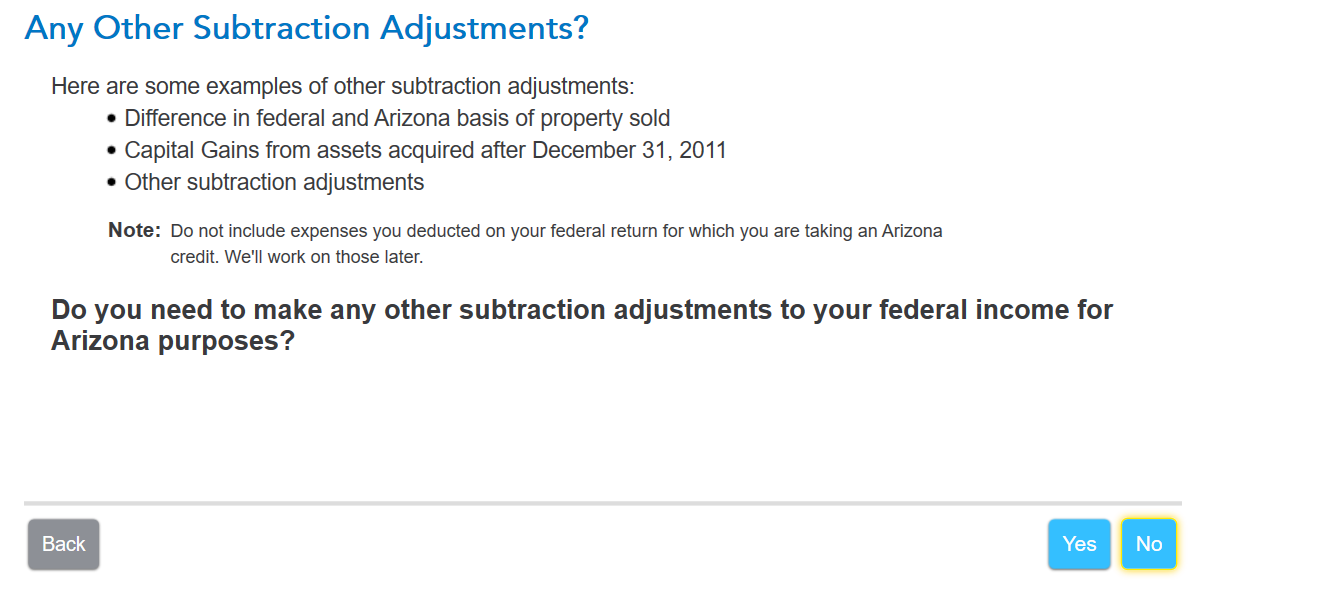

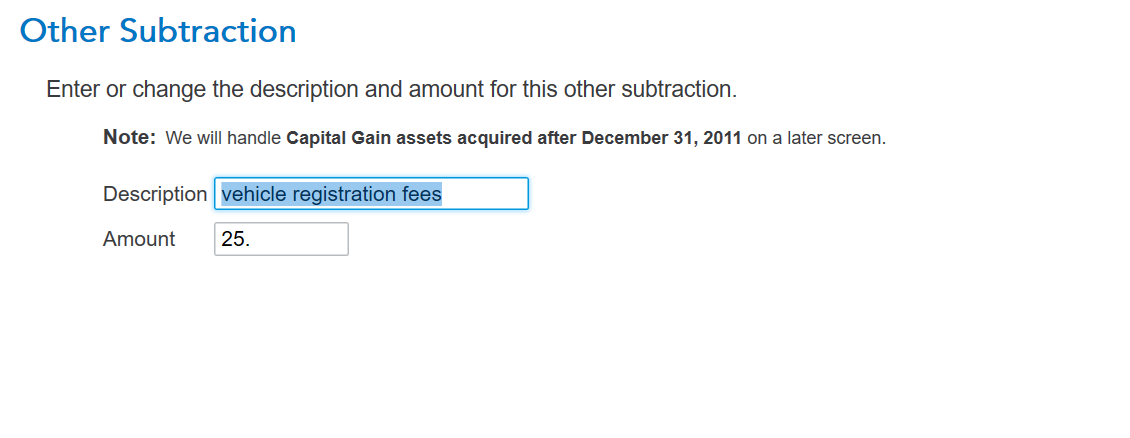

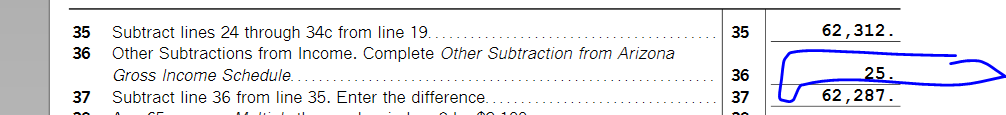

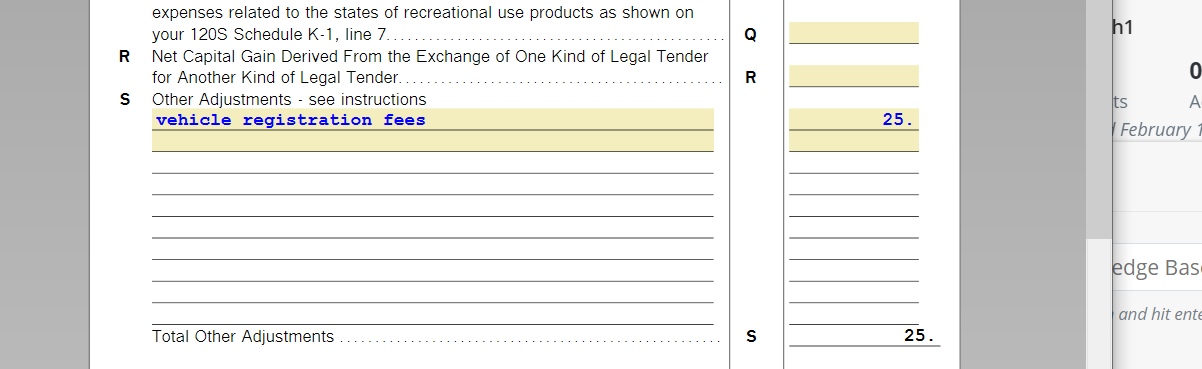

See HERE although you cannot take the vehicle registration fees as a deduction for federal tax purposes if you take the standard deduction, you can nethertheless claim it for the state of Arizona. Arizona does not specifically have a state tax adjustment for deductible registration fees. In that case, I would enter it on the state input as follows,When entering your state input for Arizona, when you get to this screen

hit yes

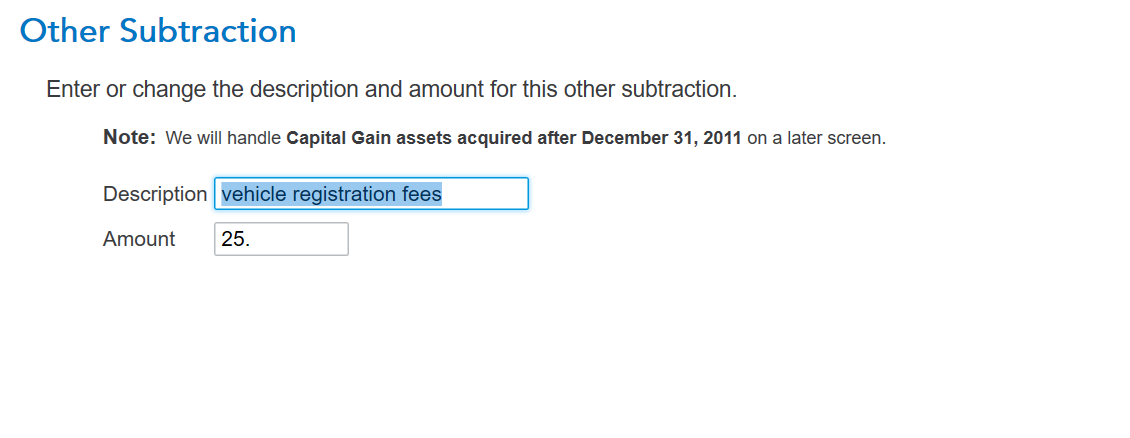

Enter the description and amount

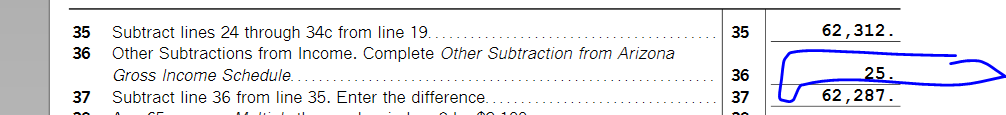

The 25.00 deduction will flow seamlessly to Form 140 line 36 like this

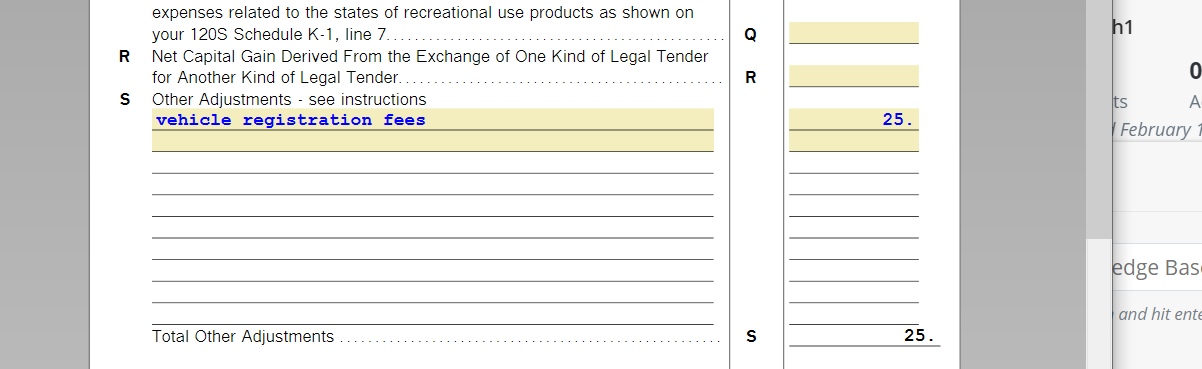

which comes from the Other Subtractions Worksheet (140) from here

This should work well for you. Good luck!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZ Auto Registration fees

After reviewing the Arizona Individual Income Tax Instruction Booklet and the itemized deductions page, there does not seem to be any deduction allowed for auto registration fees even if using itemized deductions on your state return.

If you would like to take a closer look, use the following link to download the instruction booklet and take a look at the itemized deduction form on page 31 of the PDF document.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZ Auto Registration fees

Thanks for providing reference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZ Auto Registration fees

Another question regarding auto registration fees on federal return. I entered the fees in the fields in interview and I took the standard deduction in 2021 and 2022 but on the deductions and credits summary page in TT it shows a deduction of my vehicle registration fees for 2021 but $0 for 2022. I did not itemize last year but shows a $587 deduction on 2021 taxes. Why is it not applied in 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZ Auto Registration fees

See HERE although you cannot take the vehicle registration fees as a deduction for federal tax purposes if you take the standard deduction, you can nethertheless claim it for the state of Arizona. Arizona does not specifically have a state tax adjustment for deductible registration fees. In that case, I would enter it on the state input as follows,When entering your state input for Arizona, when you get to this screen

hit yes

Enter the description and amount

The 25.00 deduction will flow seamlessly to Form 140 line 36 like this

which comes from the Other Subtractions Worksheet (140) from here

This should work well for you. Good luck!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZ Auto Registration fees

That works. Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bruno_Mesquita

New Member

anonymouse1

Level 5

in Education

israelloera00

New Member

mycst85

New Member

mycst85

New Member