- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 401k - 1099-R Total Distribution pushed Roth IRA contribution over the limit, what can I do a...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k - 1099-R Total Distribution pushed Roth IRA contribution over the limit, what can I do about it?

Last year I switched jobs and did a rollover of my 401k with Fidelity, from the previous job to the new job with. When I received my 1099-R from Fidelity, the Total Distribution box was checked in Box 2b.

Last year, I also maxed out my Roth IRA account. Because of the 401k Total Distribution, it push up my 2019 year earnings significantly, to the point I exceeded the contribution limit for my Roth IRA. Now I have to remove the excess contributions and earnings and do a re-characterization from a Roth IRA, to a Traditional IRA, and then move that money into an SEP IRA, because I have single person LLC business.

My question is, if I rolled over the old 401k funds to my new plan, (which I did immediately), why is it considered income / earnings? I didn't use the money or dip into it, all I did was roll it over? Is there any way to avoid this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k - 1099-R Total Distribution pushed Roth IRA contribution over the limit, what can I do about it?

If you did a rollover of your 401(k) plan to another 401(k) plan it is not taxable and it should not included in your income. When you enter your 1099-R, you will be asked

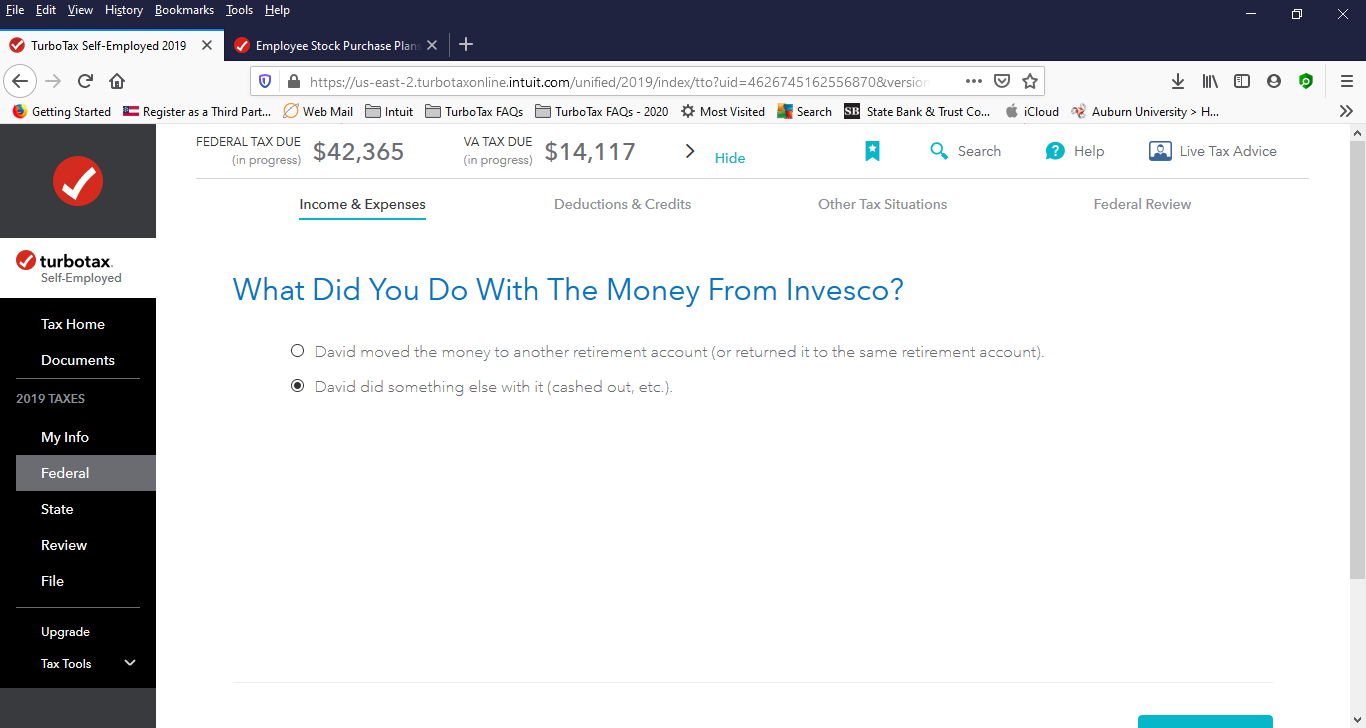

Just make sure that when you are reporting this information into TurboTax that for the question "What Did You Do With The Money From (your retirement fund)?", answer "I moved the money to another retirement account (or returned it to the same retirement account)" See the Screen Shot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k - 1099-R Total Distribution pushed Roth IRA contribution over the limit, what can I do about it?

I am using TurboTax Mac download. The software is not asking me the question you stated. It is asking me the following:

Is this 1099-R reporting a rollover of funds from a 401(k), 403(b), or a governmental 457(b) plan to a designated Roth 401(k) or Roth 403(b) plan?

Yes, this money rolled over to a designated Roth 401(k) or 403(b) account

No, this money didn't roll over to a designated Roth 401(k) or 403(b) account

Was this money rolled over to a Roth IRA?

Yes, this money was rollover to a Roth IRA account?

No, this money wasn't rolled over to a Roth IRA account?

Those are the only two questions is asks me about the 1099-Entries

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k - 1099-R Total Distribution pushed Roth IRA contribution over the limit, what can I do about it?

I assume that the 1099-R box 7 code is a "G".

If it was not rolled to either type of Roth, then the only other choice is a traditional IRA so there are no more questions.

It will show as income on the summary screen which shows gross income, not taxable income.

The IRS requires reporting all income on a *income* tax return - taxable and not-taxable.

The income will be reported on line 4c and 4d on the 1040 form with the word “ROLLOVER” next to it if it was a rollover.

The taxable amount will go on the 1040 line 4c. In the case of a rollover, nothing goes on 4d.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k - 1099-R Total Distribution pushed Roth IRA contribution over the limit, what can I do about it?

Yes, you are correct. 1099-R box 7 is "G"

It was definitely a Rollover. I made sure I did it once I started the new job.

But because it is considered "income", and not "taxable income", can that income increase force me to exceed Roth IRA contributions limits? I was within my limit until I had to enter my 1099-R

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tcondon21

Returning Member

xhxu

New Member

christoft

Returning Member

CRAM5

Level 2