- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 2020 Software not set up properly for 1099-S (Sale of a Second Home)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

Couldn't disagree more. Everything is still the same as it was even after the update. The instructions don't match the screen choices ....and there is no place to select "sale of second home". Despite my having reported this over a month ago, it still remains the same. It's not set up like it used to be (I've sold a second home before and someone earlier in the thread showed the screen shot of how it has been set up previously). TurboTax dropped the ball on this one this year...better know your stuff in this regard to be able to complete their wizard properly which is not the least bit helpful for the purpose of selling a second home. It may help if the help instructions helped but I was able to show how they did not match the procedure. Further, the sale of a second home was moved to the investments section where the programming was catered to this much more than the sale of a second home (and for investments needs the premier version per the help menu). Next year is a new year and the way this has been handled this year despite my repeated calls and reporting the matter they said "would be fixed"...it isn't. Next year I'll make a change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

I download the update and nothing has changed - still no screens or questions about 1099-S or selling of land.

I also previously upgraded to Premier but it also has the same problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

Correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

A sale of a second home or land is considered a sale of an investment. To report this in TurboTax, please follow these steps:

TurboTax Online

- Click on Federal > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, OK, what type of investments did you sell? mark the Other box and click Continue.

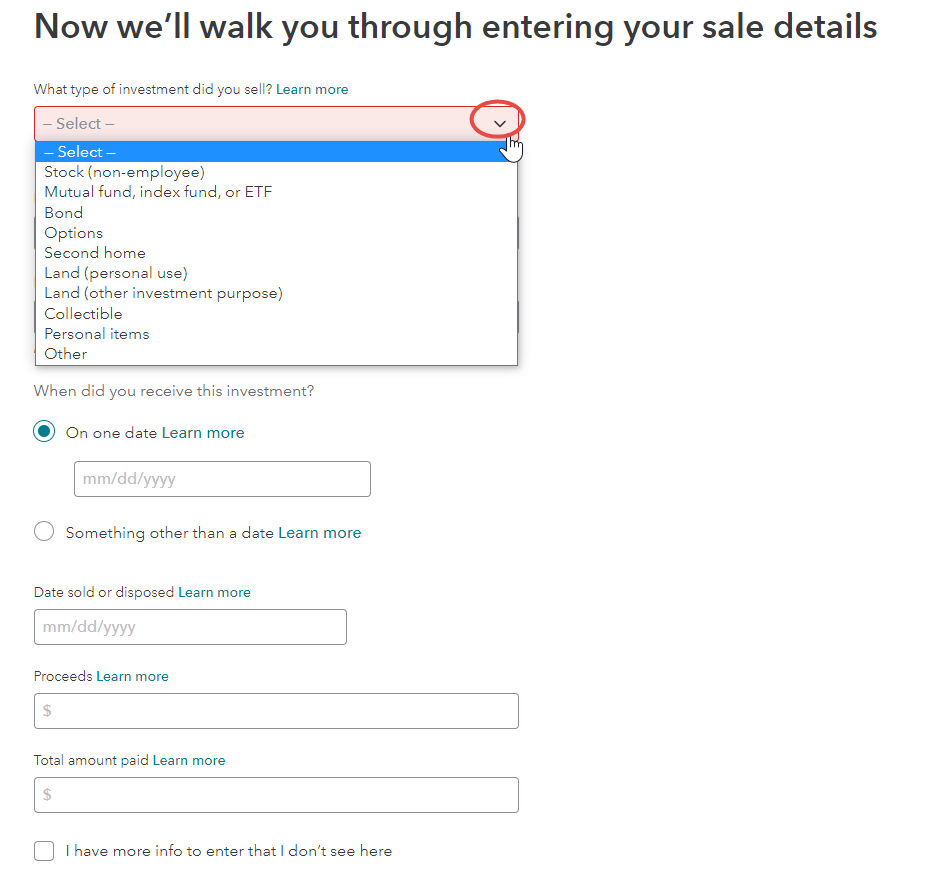

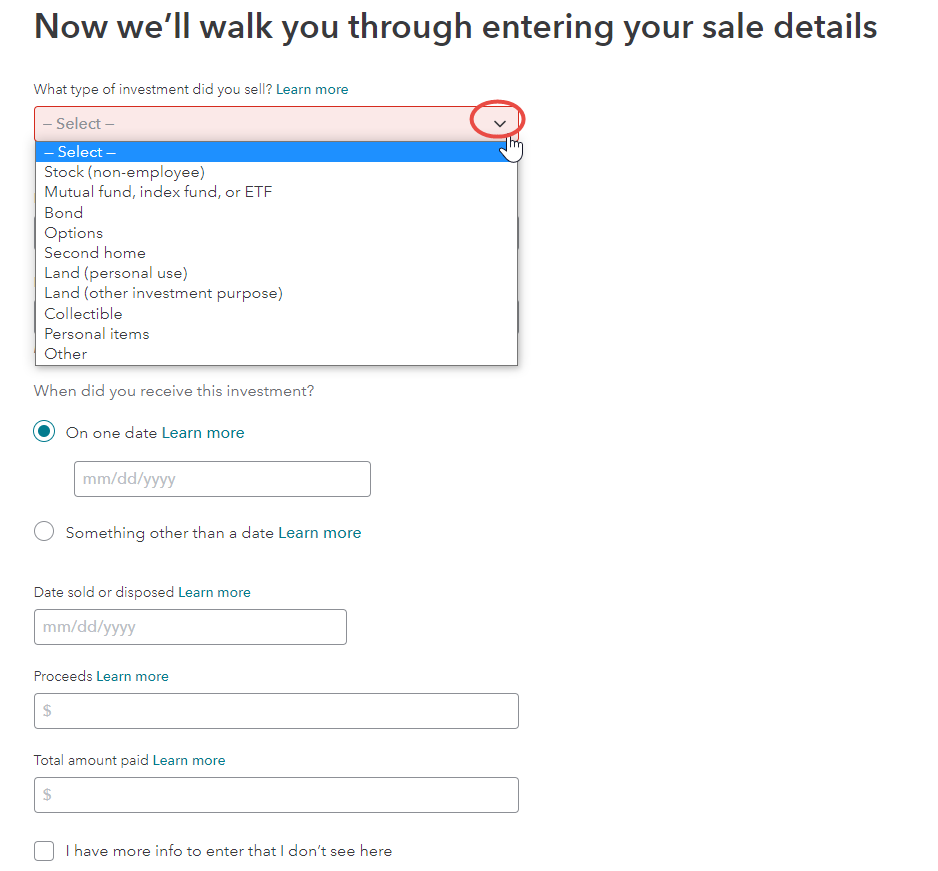

- When you get to the screen, Now we’ll walk you through entering your sale details enter the details of the sale. You will be able to select the type of investment in the first box [second home, land, etc.] [See Screenshot #1 below.]

- Enter the requested information and click Continue when done.

TurboTax CD/Download

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, Did you get a 1099-B or brokerage statement... click the No box.

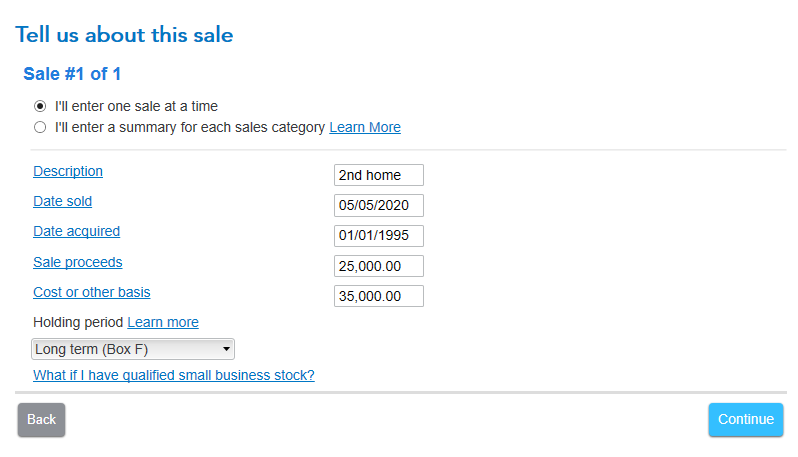

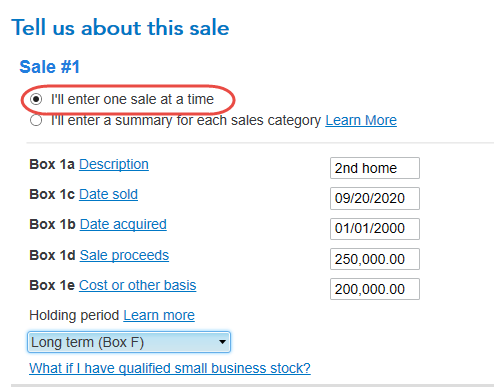

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Second Home or Land in box 1a.

- Enter the total sales proceeds as well as the other information requested. [Screenshot #2]

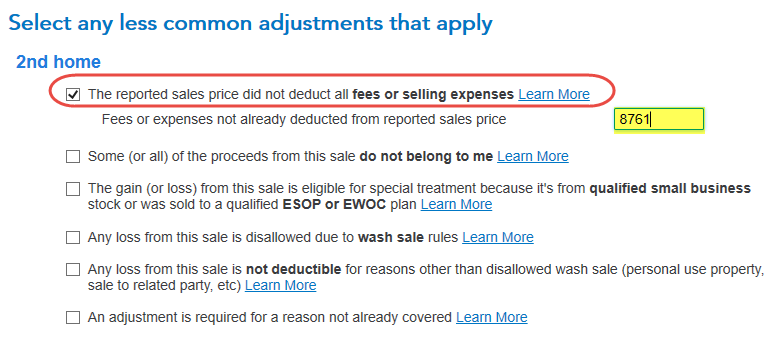

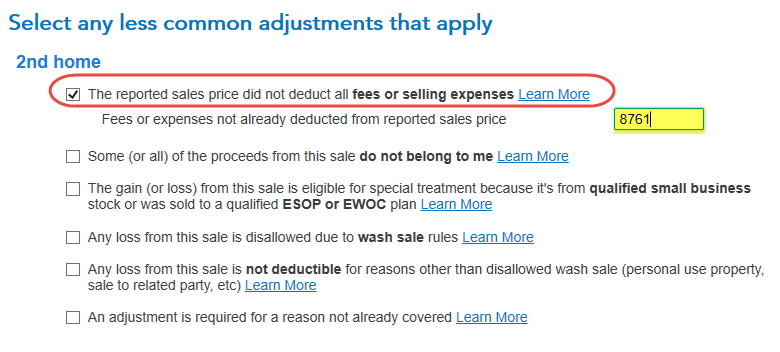

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #3]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

Screenshot #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

I am using the downloaded version of Turbo Tax and I do not get the first screen shot. I am also not being asked to enter information from my 1099-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

Irene, maybe you'll read the full thread. It's not fixed. Versions are different.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

I have the very same issue. I sold some vacant land in 2020, and received a 1099-S from the sales agent, an attorney's office. There is no opportunity for me to enter a 1099-S in the Investment Income area of the Premier version, it keeps asking for a 1099-B. This is already April, and it still hasn't been fixed, even after I applied the latest updates to the software. I have been very happy with Turbo Tax, and have used it every year for 5 or so years. Until now. What gives? Not sure what I should do.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

No I tried that, and I received an error when trying to install the patch, and it didn't complete for some reason. The software has NOT been updated. I tried 2 or 3 different ways of downloading and installing the patch and no luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

My choices do not look exactly like this. I am using the Premier desktop version for 2020. However, I did finally get through it, and I think it worked. Thank you Irene for clarifying these menu options.

However, I must say that this Investment Income menu path certainly was NOT very user-friendly, and TurboTax needs to reprogram it IMHO. It was not clear to me, for example, that they were even going to cover the 1099-S starting into the menu; it seemed that only the 1099-B income was being covered, and it wasn't obvious how to get around the 1099-B options.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

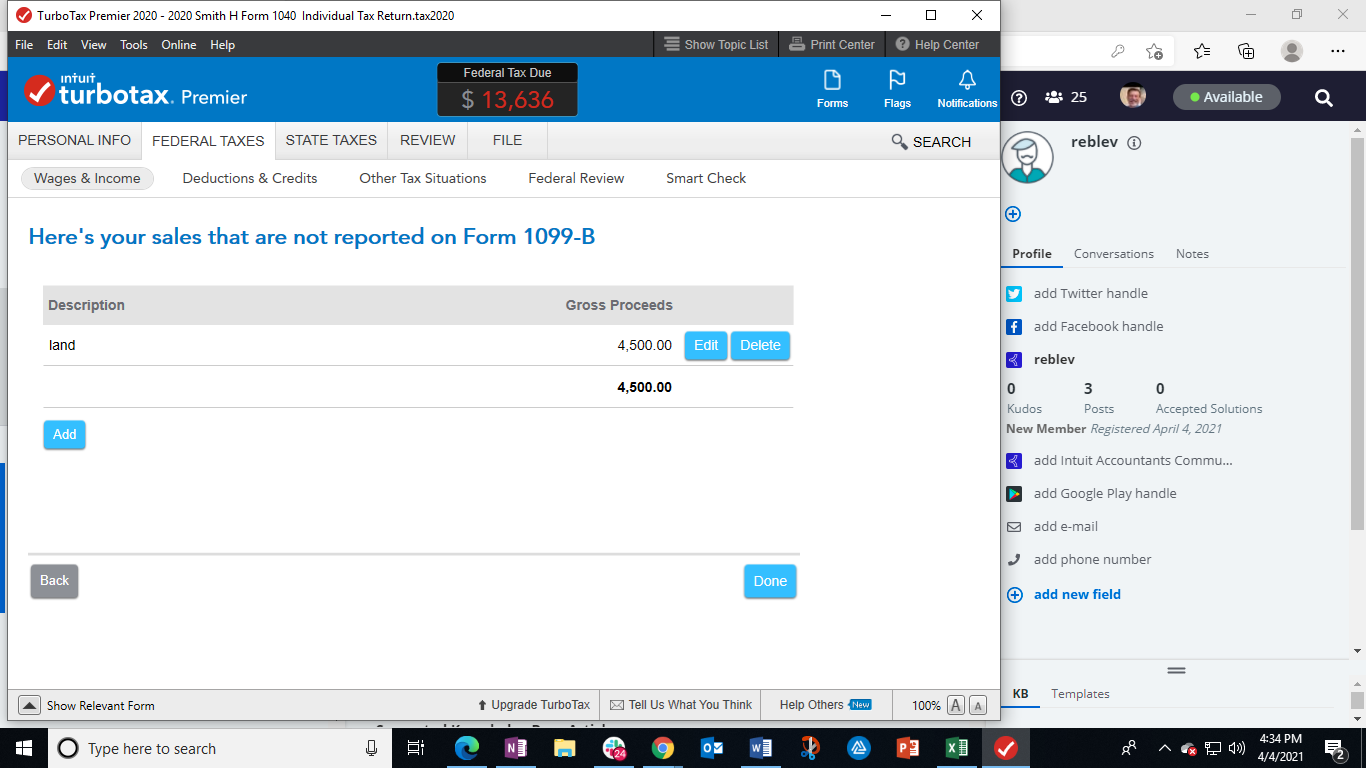

Yes, there is a way to enter land sale but you do need to follow these instructions explicitly.

- Open Turbo Tax

- Federal taxes>wages and income>investment income>stocks, bonds other etc.

- Did you sell any investments in 2020? The answer is yes.

- Did you get a 1099 B or brokerage statements for these sales. Answer NO

- Next screen, you will enter one sale at a time

- Tell us about the sale. You will enter information about cost basis, description, when acquired, when sold etc. For description, you will put land.

- For holding period, if you owned it 1 year or less, it is a short term sale. more than one year, a long term sale.

- Next screen, you will say done unless there were federal or state taxes withheld from the proceeds.

- Just finish out the rest of the section and once complete, you should see a screen that looks like this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

Thanks Dave - so to be clear when you say 'NO' to 'Did you get a 1099-B or brokerage statements for these sales' the following steps you outline are for entering information from a 1099-S, correct?

If this is the case I think the software should be updated to clarify that you have a 1099-S just like it is asking if you have a 1099-B. This would be consistent with how the rest of TurboTax works.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

You skipped an entire step that needs to be completed between 7 and step 8 for reducing the income by claiming things like permanent improvements and costs related to the sale such as commission paid out. This issue has gone on way to long for when I first called it to TurboTax attention and they *said* they are working on a fix...yet, there has been no change for literally months. You've buried the details for receiving a 1099-S and not made it friendly at all for your customers to handle this form for the sale of a second home. Your own "help" didn't match the process identified! Sorry, but done with you guys over this matter. You know you should and could have made this a lot easier for your customers as you have in the past with receiving a 1099-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

There is not a specific entry screen for a 1099-S in TurboTax.

A sale of a second home is considered a sale of an investment. To report this in TurboTax, please follow these steps:

TurboTax Online

- Click on Federal > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, OK, what type of investments did you sell? mark the Other box and click Continue.

- When you get to the screen, Now we’ll walk you through entering your sale details enter the details of the sale. You will be able to select the type of investment in the first box [second home, land, etc.] [See Screenshot #1 below.]

- Enter the requested information and click Continue when done.

TurboTax CD/Download

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, Did you get a 1099-B or brokerage statement... click the No box.

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Second Home in box 1a.

- Enter the total sales proceeds as well as the other information requested. [Screenshot #2]

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #3]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

Screenshot #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

Yes, this is what I did after spending several hours on hold and trying to get help with this. I don't think any of you are hearing something - in the past (I have sold second homes before) there has been a dedicated path for handling a 1099-S for the sale of a second home. This year, it was put under investments with absolutely no reference to a 1099-S beyond the main screen under investments to help support where and how things needed to be entered. Just look at your instructions in your post (well laid out) that you're asking the customer to enter sale of a second home as the description, know that they are still in the correct place to begin without any mention of 1099-S, help instructions that conflicted with the procedure and where to enter, relying on the customer to know what type of deductions can be made from the sale by entering a total (that part is ridiculous. That's what the software is supposed to "guide" you through). You HAVE had a dedicated procedure in the past for 1099-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Software not set up properly for 1099-S (Sale of a Second Home)

Hi, it's now May 14th and I'm doing my taxes with TT Download Deluxe which I thought would walk me through the sale of a second property easily. All updates should have included clarification on this long before now. I've done everything you stated, but there is nowhere for a novice like me to figure out what is a selling expense (ie-moving costs) or what is an upgrade that can be deducting from the Gross Proceeds. I've clicked on all the help buttons with no useful answers. I'll have to go to the IRS site, which is something I thought TT would cover for me. Also, you've stated repeatedly that there is a "radio button" that delivers a drop down box where a person can choose from a list of sold investments. I have no radio button. I must type in what the investment was. What if it was land with a mobile home on it? Is that considered "land" or "2nd home"? I thought TT would be able to walk me through this. I'm glad I'm not alone with this problem.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vgutierrez65

New Member

vgutierrez65

New Member

vgutierrez65

New Member

girishapte

Level 2

william-b-clay

New Member