- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 1040 -ES - Estimated Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

I just realized that I paid estimated federal taxes (additional to what is held in my pay check) in 2019 quarterly (4 times) but forgot to enter it when I did my taxes for 2019. I also paid my additional estimated federal taxes by using 1040-ES for 2020. Can I add the payments of my 2019 to my 2020 additional Estimated Taxes (where can I enter this info) or what should I do to correct the mistake? Thanks for trying to help me...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

No, you can't add payments made toward your 2019 tax return for 2020. Amend your 2019 to include estimates paid for that year.

You can amend and mail your 2019 tax return as long as your original return was accepted in TurboTax Online or TurboTax CD/Download. You can’t amend a return that hasn’t been filed yet.

Select the product you're using to get started.

To track the status of your amended return, use the IRS's Where's My Amended Return? tracking tool. Please note that mailed amended returns will take longer than returns that were e-filed.

Processing times for amended state returns vary from state to state. If it's been more than 12 weeks since you mailed your amended state return, and you haven't heard anything, we suggest you contact your state tax agency.

Note: E-filing 2019 amended returns is not supported at this time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

You use the same year program. So you use 2019 Premier to amend the 2019 return. But didn't the IRS automatically add them on for you and adjust your 2019 return? They usually catch missing estimates and withholding. I would first double check with the IRS and see if you still have a credit for them.

Do you need to enter the 2020 Estimates now?

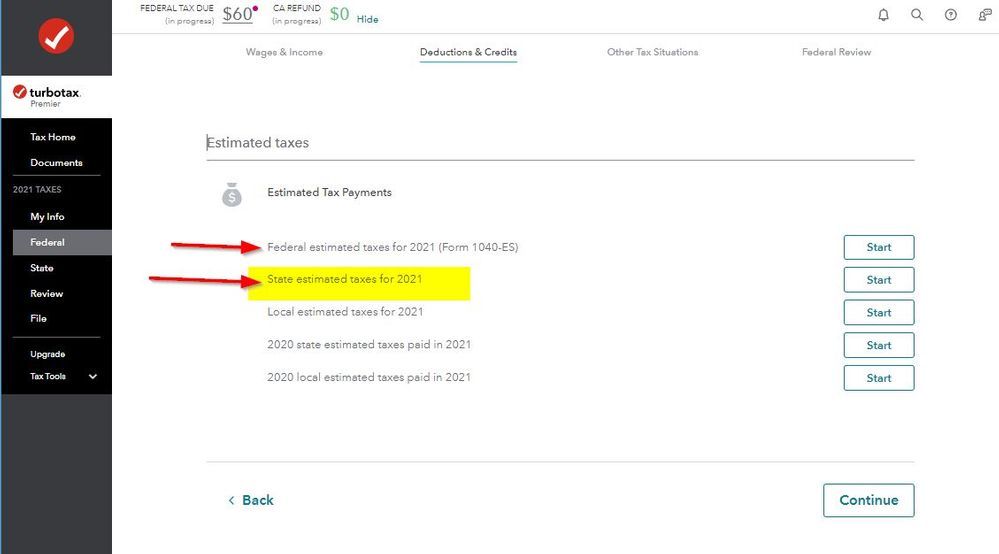

To enter Federal or State Estimated Taxes Paid, including a state estimated payment made in January for the prior year, go to

Federal on left or at top. Personal (Home & Business)

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Estimated Taxes - click the Start or Update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

No, you can't add payments made toward your 2019 tax return for 2020. Amend your 2019 to include estimates paid for that year.

You can amend and mail your 2019 tax return as long as your original return was accepted in TurboTax Online or TurboTax CD/Download. You can’t amend a return that hasn’t been filed yet.

Select the product you're using to get started.

To track the status of your amended return, use the IRS's Where's My Amended Return? tracking tool. Please note that mailed amended returns will take longer than returns that were e-filed.

Processing times for amended state returns vary from state to state. If it's been more than 12 weeks since you mailed your amended state return, and you haven't heard anything, we suggest you contact your state tax agency.

Note: E-filing 2019 amended returns is not supported at this time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

Thanks for your reply. Do I do amended tax using Turbo Tax 2019 Premier (one I used to do the 2019 taxes) or the current Turbo tax 2020 Premier.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

You use the same year program. So you use 2019 Premier to amend the 2019 return. But didn't the IRS automatically add them on for you and adjust your 2019 return? They usually catch missing estimates and withholding. I would first double check with the IRS and see if you still have a credit for them.

Do you need to enter the 2020 Estimates now?

To enter Federal or State Estimated Taxes Paid, including a state estimated payment made in January for the prior year, go to

Federal on left or at top. Personal (Home & Business)

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Estimated Taxes - click the Start or Update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

where do I enter mailed Estimated Taxes amount for 2020 on my 1040SR?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

@Panache You want to enter Estimates you paid during 2020?

You can type estimates paid in the search box at the top of your return and click Find and it will give you a link to Jump To it.

OR

To enter Federal or State Estimated Taxes Paid, including a state estimated payment made in January for the prior year, go to

Federal on left or at top. Personal (Home & Business)

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Estimated Taxes - click the start button

For 2020 Federal Estimated payments should be on 1040 line 26.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

Open your return in the software and go to the search box and enter "Estimated taxes paid" and it will take you to the location needed for those entries.

Estimated taxes paid will reduce your balance due and may be required to avoid an underpayment penalty.

Estimated taxes to be paid for the next year is a different section and will need to be paid to avoid an underpayment penalty next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

I am trying to learn where to enter my 1040

I am trying to learn where to enter my 1040 ES Payments in my Ohio taxes entries

es

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

You can type estimates paid in the search box at the top of your return and click Find and it will give you a link to Jump To it.

OR

To enter Federal or State Estimated Taxes Paid, including a state estimated payment made in January for the prior year, go to

Federal on left or at top. Personal (Home & Business)

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Estimated - click the Start or Update button

You enter state estimated payments under the federal side (because they can be a federal itemized Deduction). THEN after you finish filling out the estimates under Federal you need to click on the State Tab at the top and start the state return over for it to update.

You have to pick the right state from the drop down box and enter the right payment dates.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

Where do i enter the estimated taxes i paid for the tax year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

Didnt you see my answer above?

You can type estimates paid in the search box at the top of your return and click Find and it will give you a link to Jump To it.

OR

To enter Federal or State Estimated Taxes Paid, including a state estimated payment made in January for the prior year, go to

Federal on left or at top (Personal for Home & Business)

Deductions and Credits at top

Then scroll way down to Estimates and Other Taxes Paid

Estimated Taxes - click the start button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

I would like turbo tax to produce estimated taxes and vouchers for federal and state at 100% of 2021 taxes due, not the default that is higher. How can I do this within the software itself?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

To get to the Estimated tax input screen:

- On the menu bar on the left that shows.

- My Info

- Federal

- State

- Review

- File

- Select Tax Tools

- On the drop-down select Tools

- There will be 4 green boxes

- Select Tax Topics

- Select 1040-es Estimated taxes for next year = GO

- Adjust How Much Tax You Pay = No

- Estimated Taxes for 2022 = Prepare Now

- The voucher amounts for 2022 will be there based on the income you received in 2021

- You'll come to the Print Vouchers? screen = Yes and

- We'll include your 2022 1040-ES payment vouchers when you print a copy of your return later

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

I'm sorry but on my 2021 deluxe version I don't see any screens that match what you are saying.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040 -ES - Estimated Taxes

I'm sorry but my screens on turbo 2021 deluxe do not match what you are saying.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

griffinkelly38-g

New Member

TomG6

New Member

jadaadams44

Returning Member

angryandbroke32

New Member

NeUnhappy

New Member