- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Personal property tax paid not taking entry

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal property tax paid not taking entry

Does not let me make an entry

Federal Taxes - Deductions and Credits

How much did you pay in personal property taxes during 2022?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal property tax paid not taking entry

1) IF this is the Desktop Software

and

2) If the field shows a $0 that won't allow an entry.

THEN

You have a Supporting Details (SD) sheet attached to that field.

Double-click on the box and the SD sheet should pop up for you to make the entry.

or...click on the "X" at the top of the SD sheet to get rid of it and then the regular entry field in the interview is freed up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal property tax paid not taking entry

The software will not allow you to make an entry

Or

You have entered personal property taxes as a deduction on Schedule A Itemized Deductions and your refund has not changed?

Please clarify.

If you are itemizing and your refund has not changed, your State and Local Tax (SALT) deduction may be capped. This TurboTax Help states:

Even if you itemize, the State and Local Tax (SALT) deduction, which includes property tax, is capped at $10,000 ($5,000 for couples filing separately).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal property tax paid not taking entry

The software does not let me entery numbers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal property tax paid not taking entry

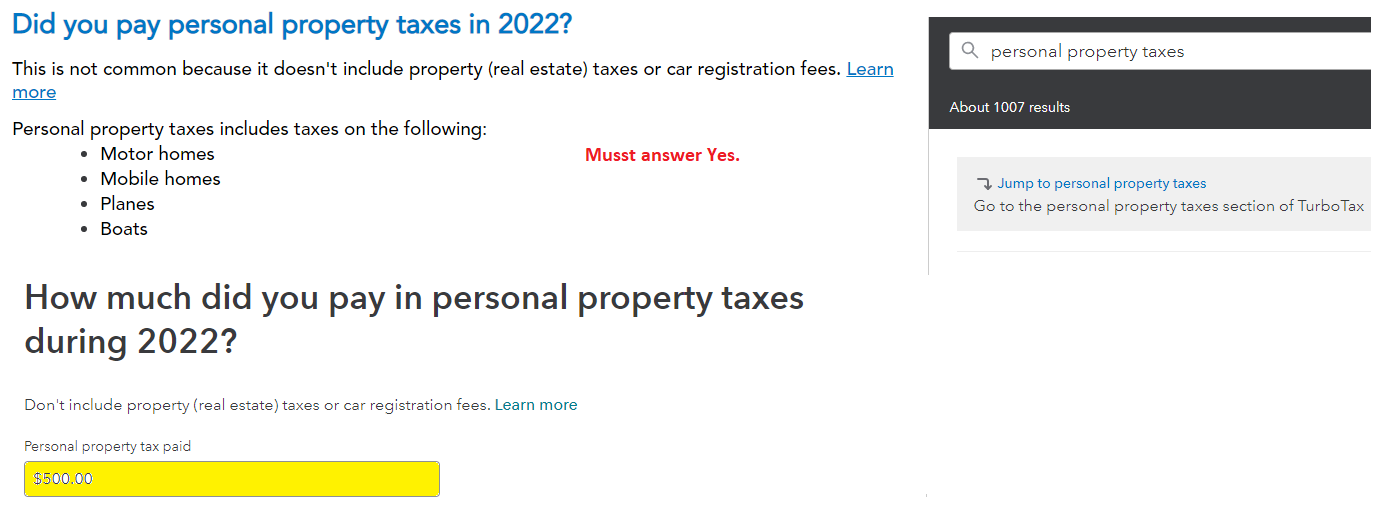

To be clear, I believe you want to enter personal property taxes under Deductions and Credits. These can be used as an itemized deduction on your federal return and in some states you can also use this expense. If you are referring to your state taxes please clarify.

In your situation, you should first clear your cache and cookies. It handles many issues that seem nonsensical on a regular basis.

- Close your TurboTax return first.

Watch to be sure you are selecting 'all time' as example. Do not use selections like 'last hour' for those browsers that give you options.

Once this is complete open your return and select to enter your income.

- Search (upper right) type personal property taxes > Jump to... link

- Begin your entry

- See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal property tax paid not taking entry

1) IF this is the Desktop Software

and

2) If the field shows a $0 that won't allow an entry.

THEN

You have a Supporting Details (SD) sheet attached to that field.

Double-click on the box and the SD sheet should pop up for you to make the entry.

or...click on the "X" at the top of the SD sheet to get rid of it and then the regular entry field in the interview is freed up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal property tax paid not taking entry

Thank you - yes I had supporting documents that carried forward from last year double clicking let me update

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chiroman11

New Member

jlfarley13

New Member

jackkgan

Level 5

SB2013

Level 2

Idealsol

New Member