- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- On my HSA contributions form under deductions, it has my employer contributions (box 12) as $0 and won't let me change it, but my W2 shows they did contribute?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my HSA contributions form under deductions, it has my employer contributions (box 12) as $0 and won't let me change it, but my W2 shows they did contribute?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my HSA contributions form under deductions, it has my employer contributions (box 12) as $0 and won't let me change it, but my W2 shows they did contribute?

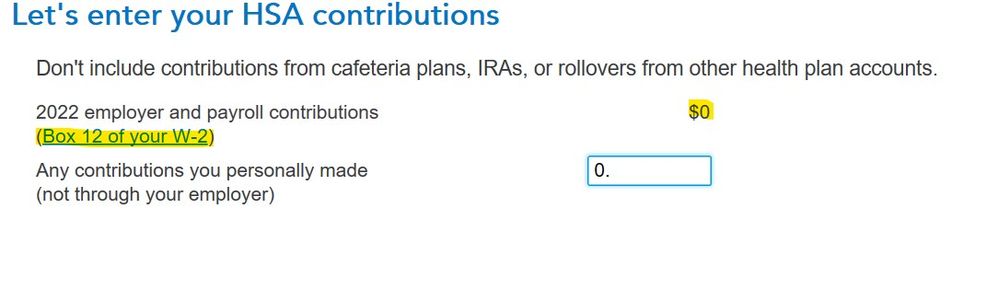

If you are referring to the screen below that is under the Deductions section which shows $0 as your employer contribution, then you did not enter your employer contribution from your W2 from box 12. Check your W2 and if your employer made contributions to your HSA it should have code W in box 12 with the amount of your employer contribution. Return to the Wages and Income section and review your entries for your W2 to update what you see on your W2 in box 12. Once you update the information, it will show your employer contribution on this screen.

If you have a form 5498-SA that is incorrect, contact your HSA provider if you feel there is an error and request a corrected copy of your form 5498-SA. The form is sent to you for informational purposes and is not entered into TurboTax. Make sure that you go through the HSA interview under Less Common income if you received a 1099-SA to input your HSA distributions.

For more information, please review the TurboTax help article Where do I enter form 5498-SA?

If this is not your issue, please provide us with more information.

[Edit 01/30/23| 10:02AM]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my HSA contributions form under deductions, it has my employer contributions (box 12) as $0 and won't let me change it, but my W2 shows they did contribute?

What exactly do you mean by your "HSA contributions form under deductions"? Are you looking at an actual tax form, such as Form 8889? Or are you looking at a screen in TurboTax, such as the screen that says "Let's enter your HSA contributions" or "Your HSA Summary"?

And what do you mean by your "employer contributions (box 12)"? What is the exact description of the line that shows $0?

If you can, post a screen shot showing the incorrect employer contributions.

Does the W-2 that you got from your employer have the HSA contributions amount in box 12 with code W? Go back to where you entered your W-2 in TurboTax and make sure that the amount is entered in box 12 with code W. Try deleting the code and amount and re-entering them.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vicente

Level 3

user17538294352

New Member

xiaochong2dai

Level 2

tcondon21

Returning Member

march142005

New Member