- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

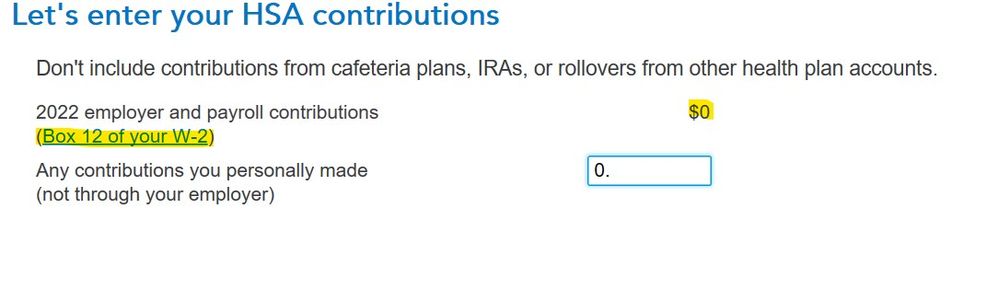

If you are referring to the screen below that is under the Deductions section which shows $0 as your employer contribution, then you did not enter your employer contribution from your W2 from box 12. Check your W2 and if your employer made contributions to your HSA it should have code W in box 12 with the amount of your employer contribution. Return to the Wages and Income section and review your entries for your W2 to update what you see on your W2 in box 12. Once you update the information, it will show your employer contribution on this screen.

If you have a form 5498-SA that is incorrect, contact your HSA provider if you feel there is an error and request a corrected copy of your form 5498-SA. The form is sent to you for informational purposes and is not entered into TurboTax. Make sure that you go through the HSA interview under Less Common income if you received a 1099-SA to input your HSA distributions.

For more information, please review the TurboTax help article Where do I enter form 5498-SA?

If this is not your issue, please provide us with more information.

[Edit 01/30/23| 10:02AM]

**Mark the post that answers your question by clicking on "Mark as Best Answer"