- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- OK resident sold land in KS. Paid capital gains tax to KS. TurboTax verifies AGI & tax paid in KS, but states, "You do not have a credit for tax paid to Kansas." Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OK resident sold land in KS. Paid capital gains tax to KS. TurboTax verifies AGI & tax paid in KS, but states, "You do not have a credit for tax paid to Kansas." Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OK resident sold land in KS. Paid capital gains tax to KS. TurboTax verifies AGI & tax paid in KS, but states, "You do not have a credit for tax paid to Kansas." Why?

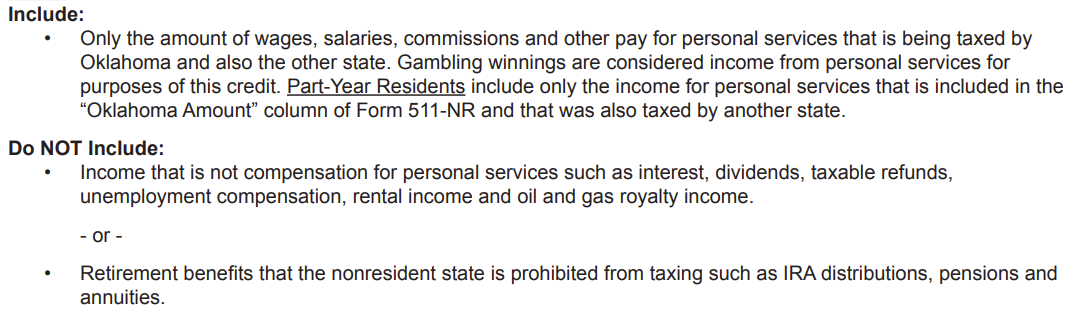

Oklahoma's credit for taxes paid to other states is eligible for taxes paid on income from personal services, such as wages. Tax on capital gains, dividends, interest, unemployment, rental income, etc is not eligible for the credit.

See: Oklahoma Credit for Taxes Paid to Other State

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OK resident sold land in KS. Paid capital gains tax to KS. TurboTax verifies AGI & tax paid in KS, but states, "You do not have a credit for tax paid to Kansas." Why?

According to Oklahoma.gov, "An Oklahoma resident individual is taxed on all income reported on the federal return, except income from real and tangible personal property located in another state, income from business activities in another state, or the gains/losses from the sales or exchange of real property in another state.

Note: Residents are taxed on all income from non-business interest and dividends, salaries, commissions and other pay for personal services regardless of where earned. Wages earned outside of Oklahoma must be included in your Oklahoma return, and credit for taxes paid to/in other states claimed on Oklahoma Form 511-TX. (See Form 511, line 16.)" (https://oklahoma.gov/content/dam/ok/en/tax/documents/forms/individuals/current/511-Pkt.pdf)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OK resident sold land in KS. Paid capital gains tax to KS. TurboTax verifies AGI & tax paid in KS, but states, "You do not have a credit for tax paid to Kansas." Why?

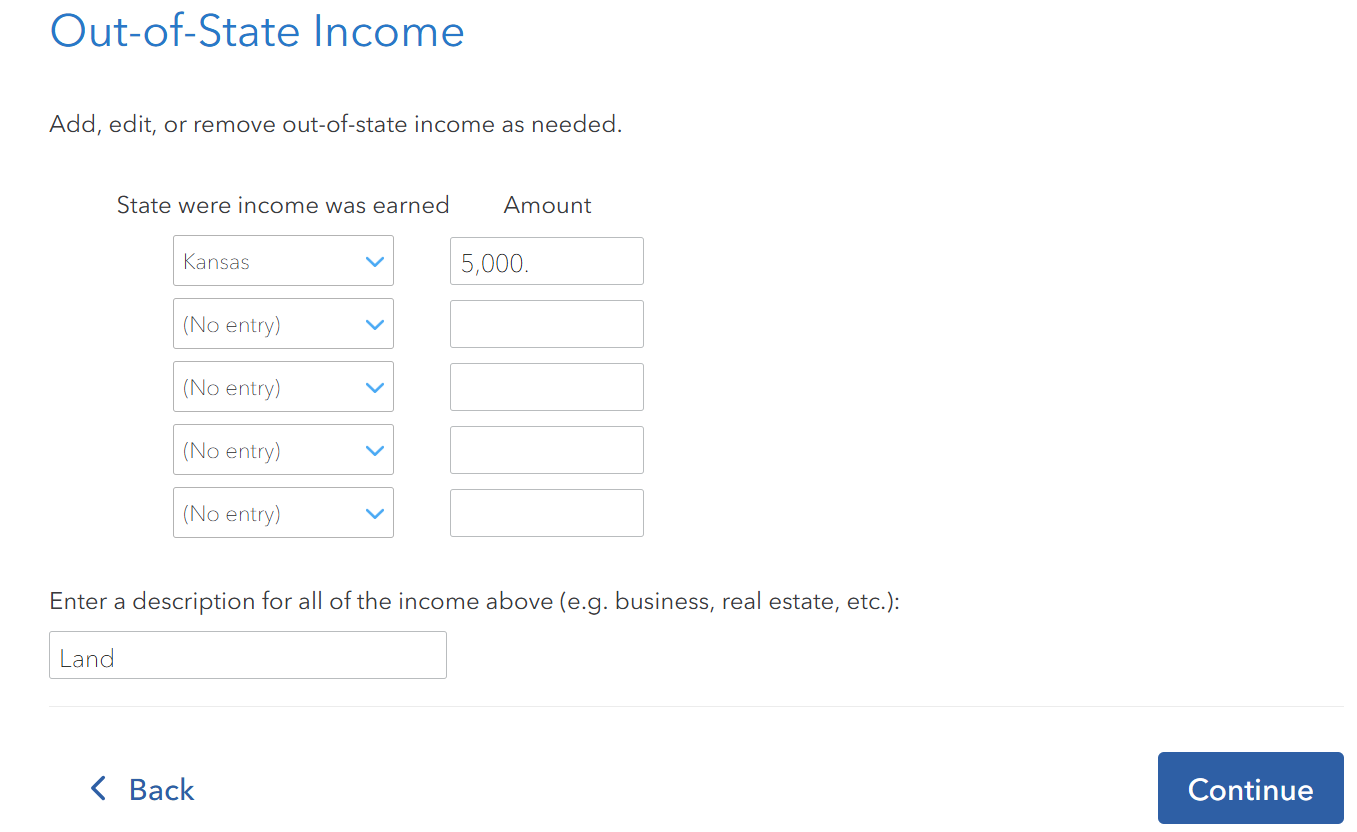

Income that is excluded from Oklahoma tax would not be eligible for the other state tax credit since it wouldn't be included in Oklahoma income and not double taxed.

To exclude this income from tax, you would report other state income in the Out-of-State Income or Losses section, if you haven't already.

If the gain has already been reported here, it should already be removed from your Oklahoma income and tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

OK resident sold land in KS. Paid capital gains tax to KS. TurboTax verifies AGI & tax paid in KS, but states, "You do not have a credit for tax paid to Kansas." Why?

Thank you. I was not including capital gains in the total KS Income total. When I changed that, it corrected the OK state tax owed. I appreciate your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

csully

Level 3

tkenbo

Level 2

juleyh

Level 3

jtout1124

Returning Member

ernieralls

New Member