- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- My 2023 tax return shows $2555 Foreign Tax Paid Carryover. How should I report it on my 2024 return?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2023 tax return shows $2555 Foreign Tax Paid Carryover. How should I report it on my 2024 return?

posted

March 13, 2025

9:23 AM

last updated

March 13, 2025

9:23 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2023 tax return shows $2555 Foreign Tax Paid Carryover. How should I report it on my 2024 return?

The $2,555 Foreign Tax Paid Carryover from your 2023 tax return can be applied to your 2024 return to offset U.S. taxes on foreign income. If you have no foreign income to offset this year, the carryover will be carried forward for ten years to be applied to offset future foreign income. To report as if you didn't have income this year.

- Go to Federal

- Deductions and credits

- Estimate and other taxes paid

- Foreign Tax Credit>start or revisit

- Answer yes to this question if you have foreign tax to report or if you have credits to report from a prior year.

- Answer yes to the next question asking if you reported your income.

- Continue until it asks if you wish to take the deduction or credit. Say you wish to take credit.

- Say yes to the question, asking if there is no other income or expenses.

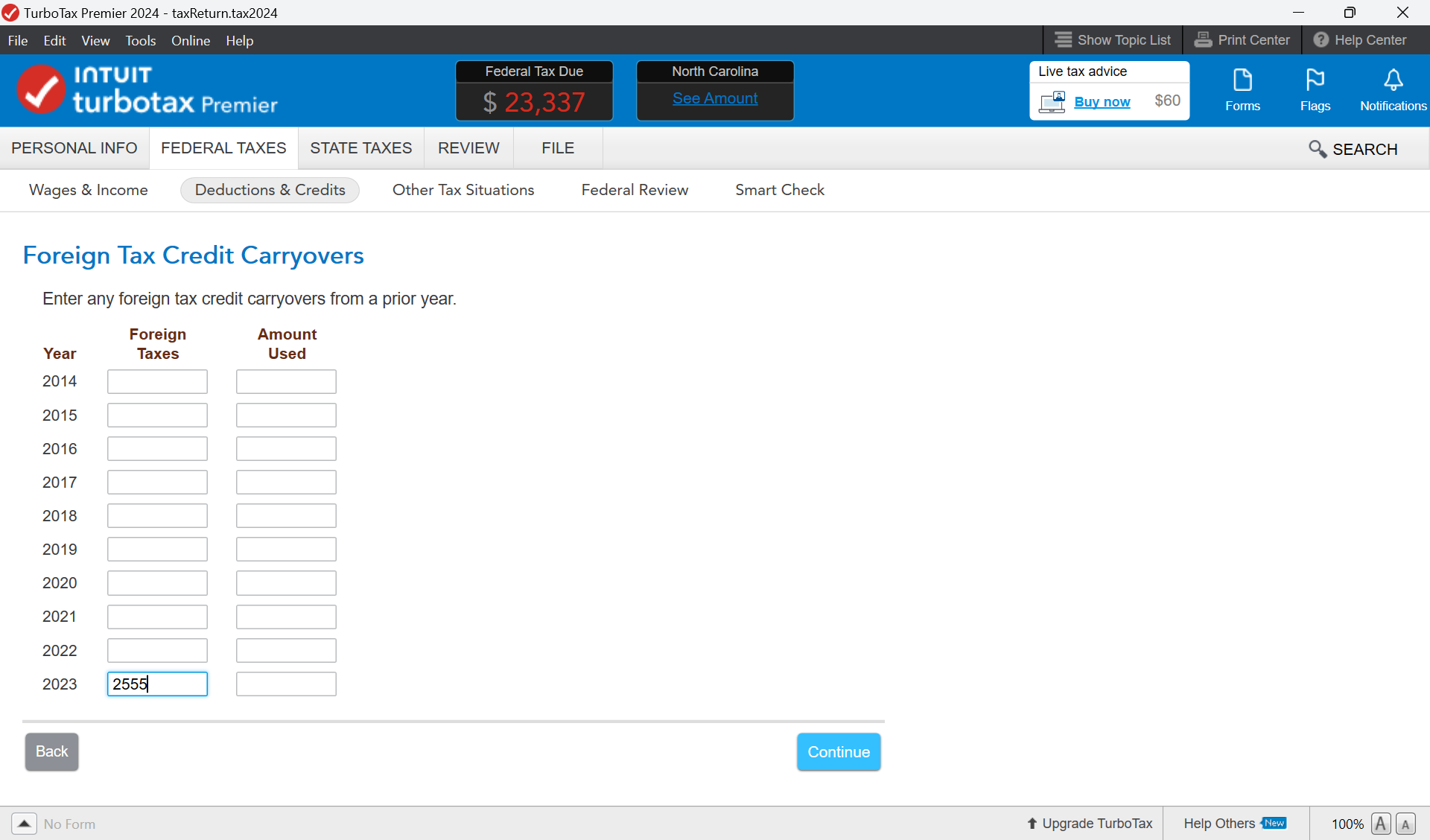

- Continue through the screens until it asks if you have carryovers or carrybacks. Here is where you report your 2023 carryover amount. This is what the screen looks like.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 13, 2025

10:12 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

black1761

Level 1

joegrillope

New Member

IndependentContractor

New Member

Idealsol

New Member

HNKDZ

Returning Member