- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Mortgage Interest Deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

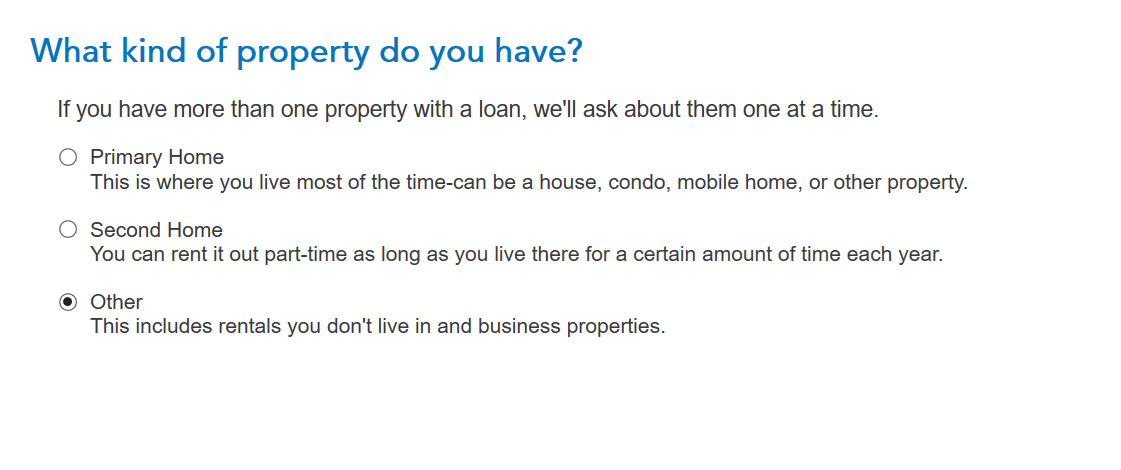

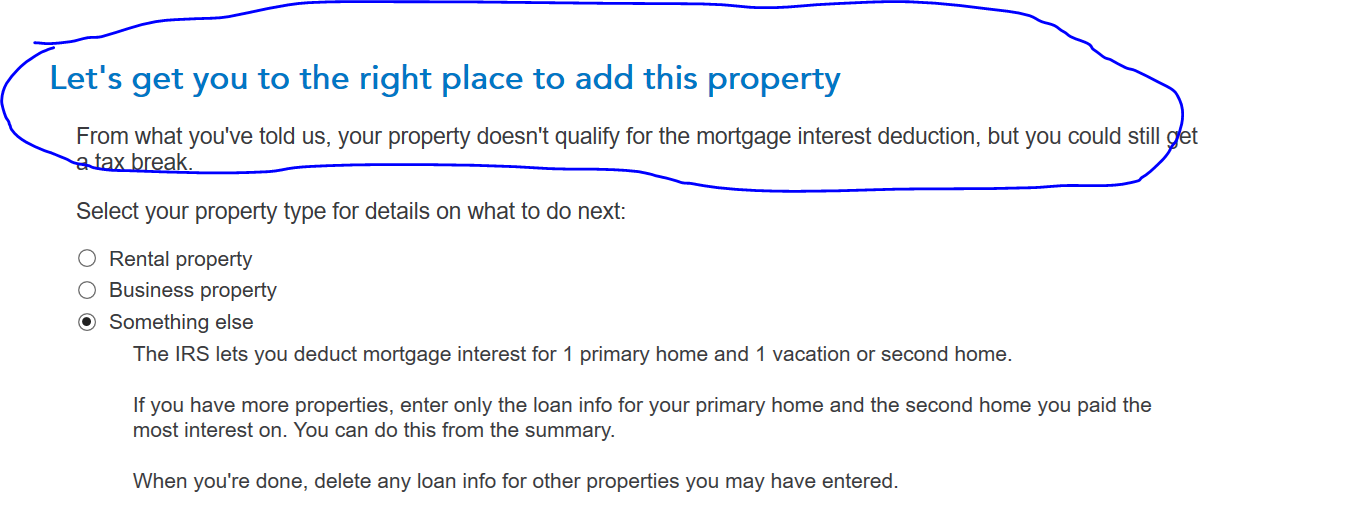

Owned a NYC coop in 2022 and entered my mortgage interest for personal mortgage I took out to buy unit as well as mortgage interest paid by coop on several building loans. Turbo Tax shows both entries.

Itemized federal deductions only show interest deduction for my personal loan and not building loan. When I open a home Mortgage Interest Worksheet, it talks about expiration of Mortgage Insurance Premium Reduction. I do not have this.

Not sure what I am missing to get both mortgages shown on federal itemized deduction sheet.

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

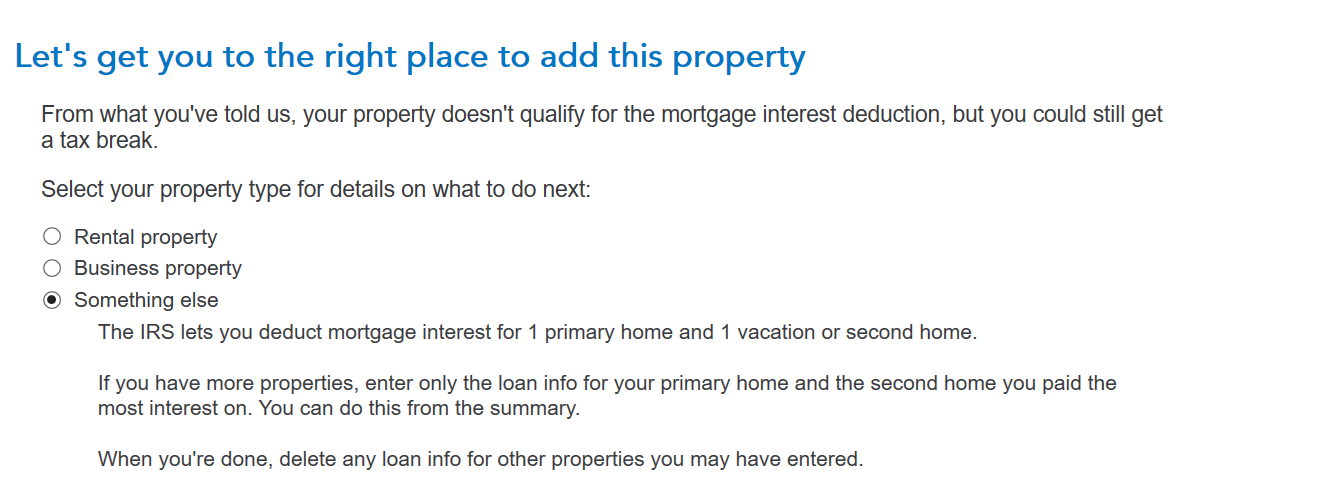

Based on this information , you will not be entitled for the deduction for the mortgage interest paid by the coop for these building loans as your situation doesn't seem to fit in the other two categories.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

Yes, problem solved.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

baltimore_nick

New Member

dave-eggleston

New Member

WilliamBrawner1

New Member

ldb39841

New Member

nlschwarz40

New Member