- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Mortgage Interest Deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

Hello,

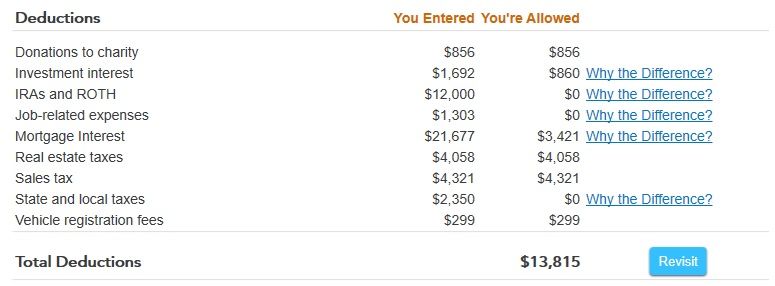

I am in process of completing my 2019 taxes and have a question on mortgage interest deduction. I have paid total interest of $21,677, however, only $3,421 is actually being applied towards my itemized deduction. I have attached a screenshot. Does anyone know why?

Thanks,

Hitesh

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

Please click on the link Why the Difference? to get an explanation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

I did, but the explanation does not apply to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Deduction

If you mortgage interest is not being limited due to having a mortgage that exceeds the limits of $1,000,000 if taken out before December 2017 or $750,000 if the home was purchased after that date, your best option is to have a live agent look at what it going on in your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ahmad-hashem-net

New Member

karlameyer

Level 1

jb_atl

New Member

clarineted

Level 2

lnk-fr

Level 2