If we is you and your spouse, you will just split the amounts and enter them. Your social security number is on their return and theirs is on your return. Everything can be cross referenced that way.

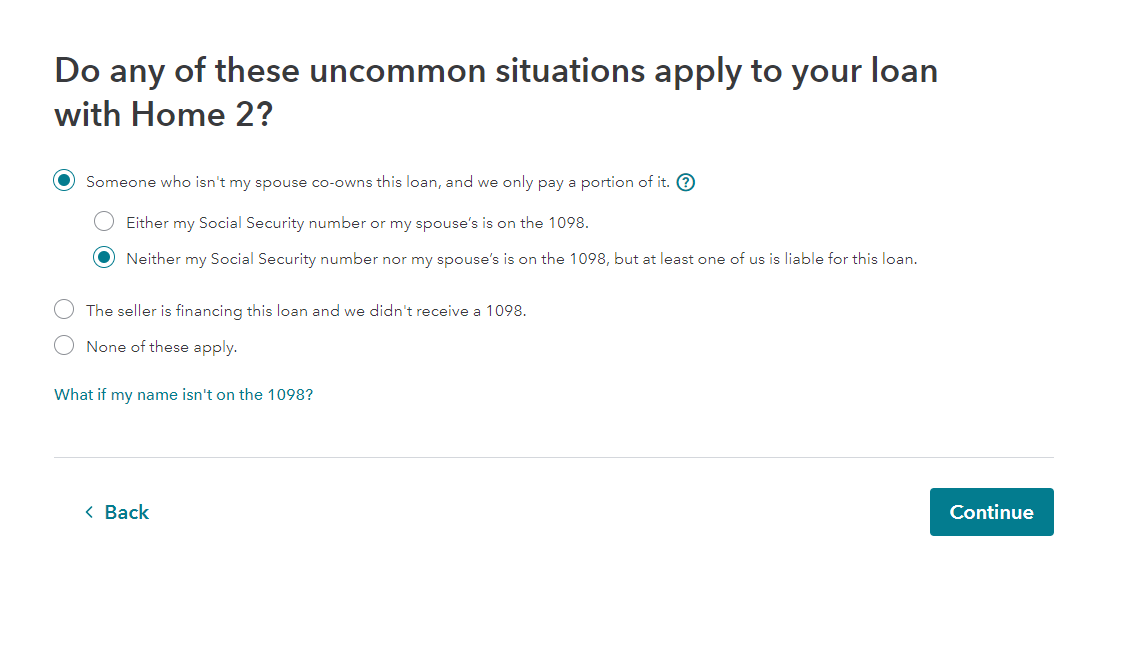

If the person you are splitting the mortgage with is not your spouse, After you enter your mortgage lenders name you will come to a screen that says "Do any of these uncommon situations apply to your loan with xx" Select Someone who isn't my spouse co-owns this loan and we only pay a portion of it, then continue to walk through to enter their information and enter your portion of the 1098 information.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"