- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Maryland state subtraction modification

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland state subtraction modification

Tax question…I have a client who receives a 1099R from the state of Maryland. The designation code is 3 because she is totally disabled. She is 62 years of age. Shouldn’t she be able report this amount as a subtraction modification on line 10A, Form 502? Turbo Tax is not rolling that forward from the Federal return.

The Maryland instructions say 65 or totally disabled…the key word being or.

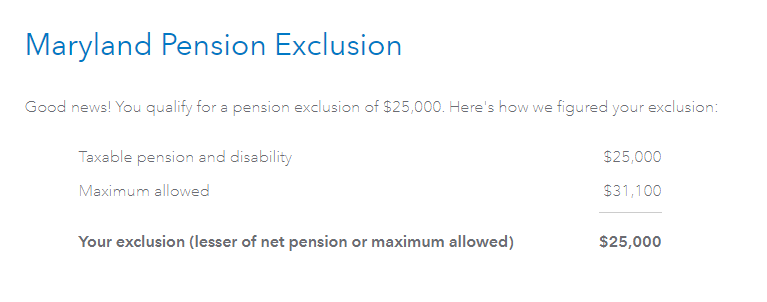

Line 10a. PENSION EXCLUSION. You may be able to subtract some of your taxable pension and retirement annuity income. This subtraction applies only if:

- You were 65 or over or totally disabled, or your spouse was totally disabled, on the last day of the tax year, AND

- You included on your federal return taxable income received as a pension, annuity or endowment from an “employee retirement system” qualified under Sections 401(a), 403 or 457(b) of the Internal Revenue Code. [A traditional IRA, a Roth IRA, a simplified employee plan (SEP), a Keogh plan, an ineligible deferred compensation plan or foreign retirement income does not qualify.]

Each spouse who receives taxable pension or annuity income and is 65 or over or totally disabled may be entitled to this exclusion. In addition, if you receive taxable pension or annuity income but you are not 65 or totally disabled, you may be entitled to this exclusion if your spouse is totally disabled.

Thx, Dave

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maryland state subtraction modification

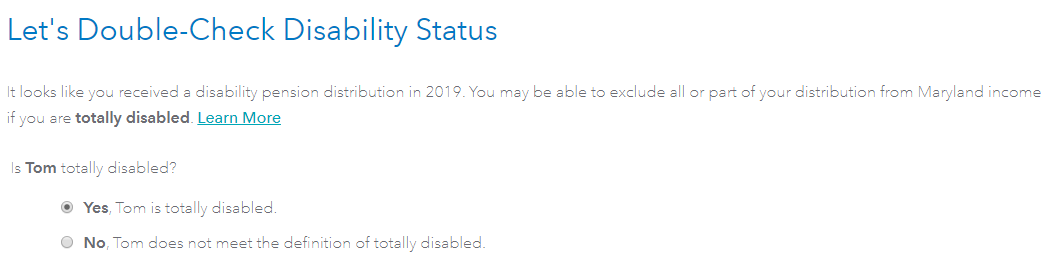

I put an entry in like you described and I was allowed the deduction. Did you see these screens when you went through the Maryland program?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mjeffrey1066

Level 1

gottifire

Level 2

Hockeykid092

Returning Member

nancymychel

New Member

judyslocum

New Member