- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Line 20 on Calif Schedule CA not computing correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 20 on Calif Schedule CA not computing correctly

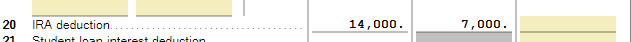

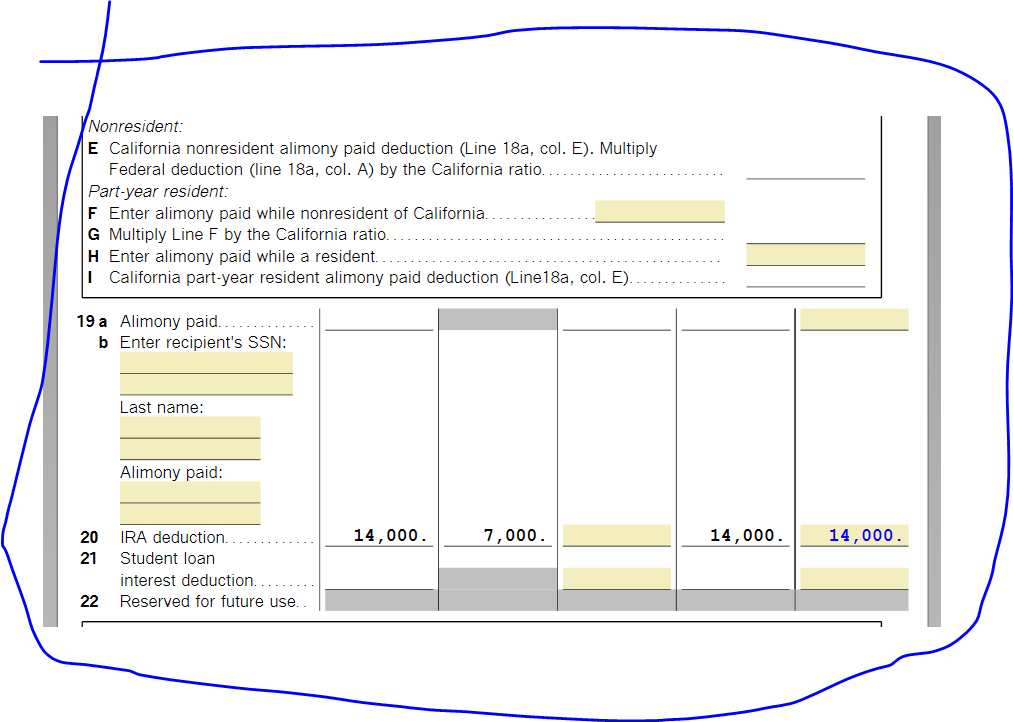

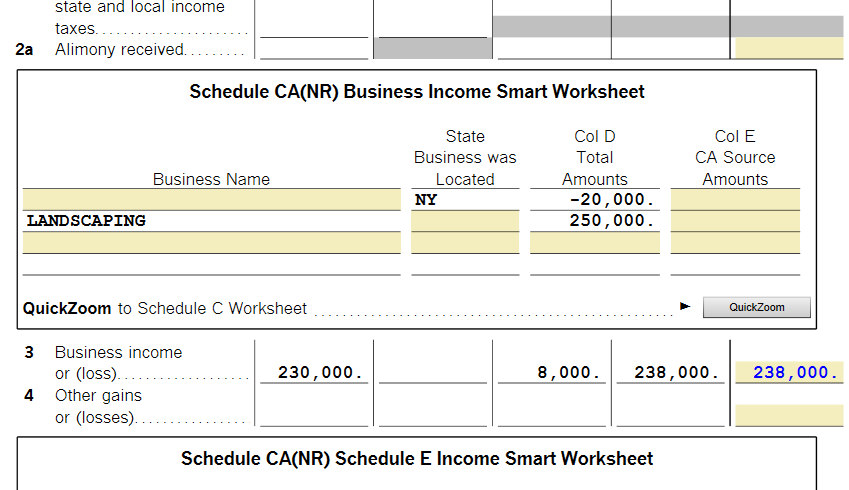

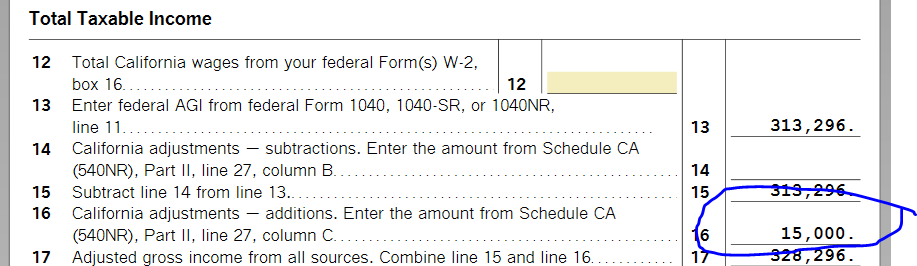

My spouse and I are both over 70.5 years old (at end of 2022 spouse was 71 and I was 75), but only my spouse had 2022 wages (greater than $14,000). We are both taking a $7000 IRA contribution deduction on our Federal taxes. And I noticed that TurboTax is not computing the California adjustment to this deduction correctly. Line 20 of Schedule CA shows this:

The adjustment in column B should be $14,000 (not $7000) since Calif tax law does not allow this deduction for people over 70.5. I can only conclude this is a bug in TurboTax. I played around with the amount of IRA contributions and determined that the $7000 adjustment showing above is actually for my spouse who has wages. The missing $7000 adjustment is actually associated with me (who has no wages). This suggests to me that there is a bug in the code. Obviously I can override this adjustment and correct it myself, but it would be nice to have TT compute it correctly.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 20 on Calif Schedule CA not computing correctly

TurboTax looked into the issue, and it was corrected as of 02/23/2023. Please reach back out to us if you have any additional problems.

TurboTax looked into the issue, and it was corrected as of 02/23/2023. Please reach back out to us if you have any additional problems.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jebalim

Level 1

user17691337843

Returning Member

Mr-TSchimschal

New Member

negoziatore

Level 2

FuzzyDice

New Member