- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- K1 on parnership shows no earned income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

I am working for a company using my business of consulting

I also have SS and retirement income

I made 120K last year in consulting and filed my business partnership using my business FED ID

I then transferred my K1 for both partners (husband and wife filing joint) to our personal

It indicated I had no earned income

An I doing this wrong. because the business should have shown earned income

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

What do you mean by "....I then transferred my K1.....to our personal..."?

There is really no available method to transfer a K-1 created in TurboTax Business to any personal version of TurboTax. Rather, you need to enter the information from your K-1s into the personal version of TurboTax manually.

Also, how did you prepare your 1065 in TurboTax Business?

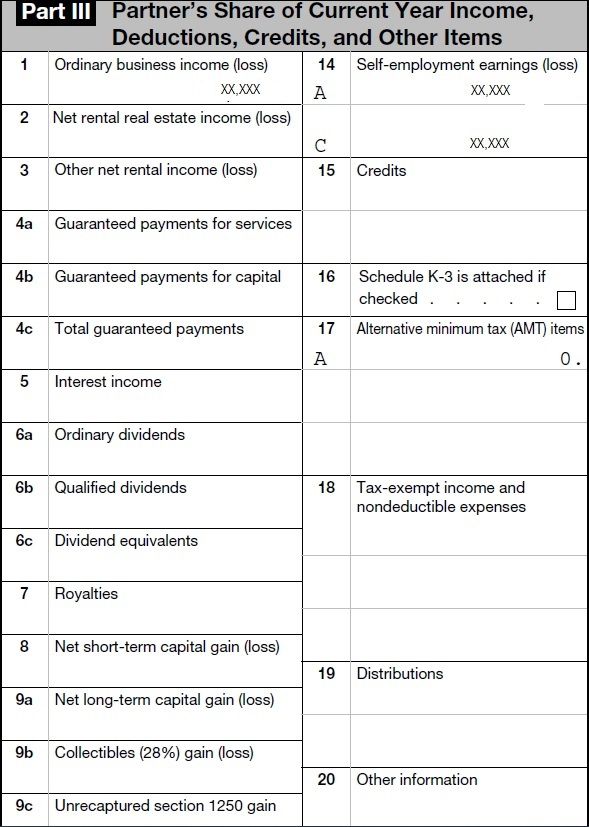

Do you have figures on Line 14 of your K-1s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

For the income on the Schedule K-1 to be compensation from self-employment, it must be present on the Schedule K-1 in box 14 with code A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

Rather, you need to enter the information from your K-1s into the personal version of TurboTax manually.

I did enter it Manually

Line 14 was A and C

Also, how did you prepare your 1065 in TurboTax Business?

Do you have figures on Line 14 of your K-1s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

What, exactly, is the problem? You should see the figure you posted on your K-1 propagate to Line 5 of your Schedule 1 and you should also have a Schedule SE in your forms package.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

problem was when I went to enter the contribution to my IRA it indicated I could not deduct it because of I had no Earned Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

Where in the program are you entering this information?

It should be under Deductions & Credits>>Traditional and Roth IRA Contributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

Make sure you are entering each K-1 under the right person. Maybe you assigned both K-1 to only 1 spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

Did you contribute any deductible amount to a self-employed retirement plan? Such amounts and the deductible portion of self-employment taxes reduce the amount available to contribute to an IRA. If the sum of the amount of an self-employment deduction and the deductible portion of self-employment taxes for the individual equals the amount reported with code A in box 14 of that individual's Schedule K-1, nothing is available to contribute to a Roth IRA unless, perhaps, the individual qualifies for a spousal IRA contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

No I only have an IRA

I figure we wont find an answer on what went wrong

I filed the business, enetered the correct information into the personals

and it told me it was not deductible because I had no earned income

I figure this is a program bug

Because the business income is earned income

Next year I will show the business income as personal income using my SS number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

@asterof wrote:I figure this is a program bug

It's not a program bug; it's an input error.

I did a test return using your K-1 figures and an IRA contribution and the deduction was allowed in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 on parnership shows no earned income

Yes we should be able to figure it out. If you have a partnership you can't file business income as personal under your ssn. You need to enter each K-1 on your personal return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MomThatCusses

New Member

snowy_al

New Member

chris-davidebel1979

New Member

ithiam2016

Level 2

Tax_right

New Member