- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

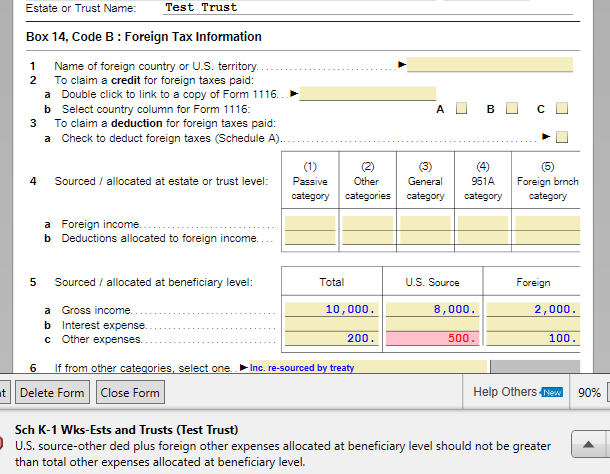

- K-1error"U.S. source-other ded plus foreign other expenses allocated at beneficiary level should not be greater than total other expenses allocated at beneficiary level."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1error"U.S. source-other ded plus foreign other expenses allocated at beneficiary level should not be greater than total other expenses allocated at beneficiary level."

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1error"U.S. source-other ded plus foreign other expenses allocated at beneficiary level should not be greater than total other expenses allocated at beneficiary level."

You may need info in supplemental attachments to the K1. Sometimes trustees do not give you enough information, and you have to go to them and ask.

The basic idea is that for the trust income that is allocated to you as a beneficiary (and not kept at the trust's level and reported on the trusts 1041), some expenses are related to that income.

I.R.C. 904(a) limits the amount of the foreign-tax credit (FTC) as follows: https://www.law.cornell.edu/uscode/text/26/904

FTC max = US tax times [foreign income / worldwide income]

So, to calculate that amount, TT needs to know the beneficiary's foreign and US income and deductions related to that income.

The Foreign deductions + US deductions must equal the worldwide deductions. It sounds like that is not the case in what you entered. Here's an example of that. In this case, the $200 either needs to be $600, or the US/Foreign source deductions need to be less (and add up to $200).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

flyday2022

Level 2

tbduvall

Level 4

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

trust812

Level 4

pchicke

Returning Member

heueh9456

New Member