- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

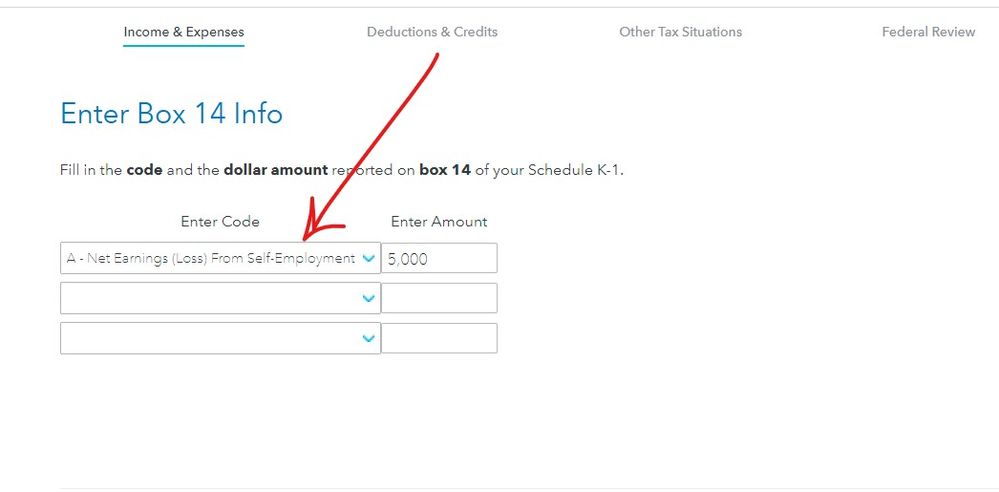

I am a General Partner with material participation in an oil & gas LP with IDC (Intangible Drilling Costs) losses. I entered this info in the K-1 section in TT, but TT does not ask if I materially participate. It classifies the IDC loss as a Passive Income loss. I believe this is incorrect and it should an Active Income loss - and therefore should reduce this years tax due on other Active Income (such as W2 income). Any idea how to make this IDC loss Active Income? It's reported on the K-1 in Box 14 as a Self-Employment loss, so I think it should appear as such in TT.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

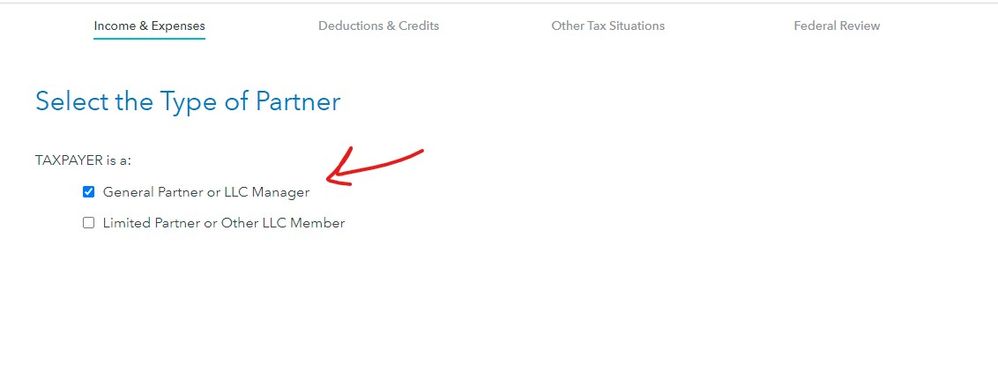

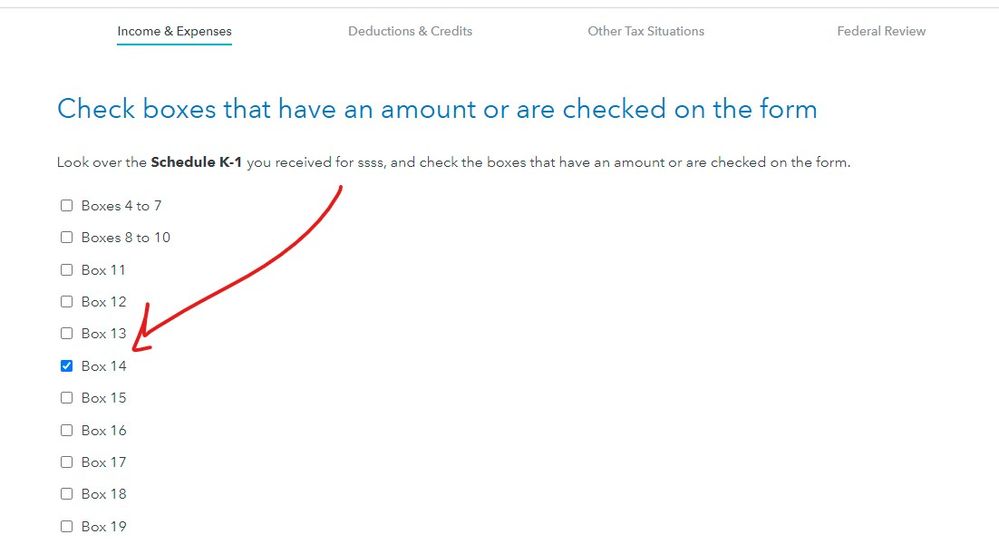

Make sure you choose the correct K-1 form and entered in the correct info and the return will be filled in properly ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

Thanks for your reply. Yes that's exactly how I filled it in. The Box 14 Self Employment is a large loss, so I entered a negative number. I think it should reduce my AGI, but it doesn't.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

I’m in the same boat. Is there any update on this one?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

Well I understand it now. In my case, the K-1 Box 1 was blank, but I had to select it anyway in TT and then just leave it blank - then you can say No to materially participate and TT then asks if it's an O&G company, to which you reply Yes. That makes it NonPassive income/Loss. You then enter the IDC loss when prompted and any other expenses/losses. Those losses reduce your ordinary taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

Thank you for this update! Could you please also confirm that you still qualify for this NonPassive income/Loss whether you are a general partner or limited partner in the K1, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

No, only General Partner. Limited Partner is Passive, even for O&G companies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

Thank you! That is a huge help! Now I just need to find a reputable oil and gas investment to fund as a GP within the next few weeks! Let me know if you have any recommendations/referrals!

Currently, I only know of King Operating in Dallas Texas that I just found from their youtube webinars that I thought was nicely done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

Reach out to Prudent Resources LLC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 IDC (Intangible Drilling Costs) should be Active Income, not Passive

You can contact my advisor. Their firm offers a few really great oil and gas drilling fund, reputable, good solid ones, not the ones u cannot even find info online. [email address removed].

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kashyapvijay

Level 3

kashyapvijay

Level 3

turner121

Level 2

Nhanda

Level 3

hlb0103

Level 1