- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- K-1 does not reflect correct gain

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 does not reflect correct gain

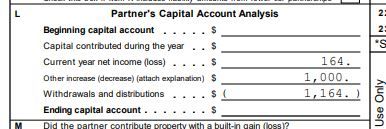

Hi - I received a Final K-1 for an investment. Please see the snip below showing the capital account. The K-1 also shows income of $164, which you would expect. However, I did not buy the investment at $1000 but I bought it from an original investor in a secondary market. at a price of $1050. As such, my profit was $114 and not $164. The investment company only ever received $1000 for the investment at issuance and just transferred ownership to my name when I bought the investment in the secondary market for $1050 (and paid $1050 to the original investor).

My question then is how to I go about reporting the additional $50 in basis and $50 less in income that is not reflected on the Final K-1? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 does not reflect correct gain

this is a situation of inside and outside tax basis. the k-1 (inside tax basis) is correct and should be reported exactly as shown, your outsise tax basis is likely as follows

1050 +164 -1164 = 50 which you report as a $50 capital loss on disposal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 does not reflect correct gain

this is a situation of inside and outside tax basis. the k-1 (inside tax basis) is correct and should be reported exactly as shown, your outsise tax basis is likely as follows

1050 +164 -1164 = 50 which you report as a $50 capital loss on disposal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 does not reflect correct gain

"you report as a $50 capital loss on disposal" Does this happen on Schedule D?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PhilGoelz

New Member

blesna1

Level 2

smky

Level 1

Themushj

Level 3

mmkhan

New Member