- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

If you did not sell any business property, then you do not need a Sch. D form (unless you had other "Capital Gains and Losses;" e.g., you sold stock). You can delete that form.

Here's the general procedure for viewing the forms list and deleting unwanted forms, schedules, and worksheets in TurboTax Online:

- Open or continue your return in TurboTax.

- In the left menu, select Tax Tools and then Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Select Delete next to the form/schedule/worksheet in the list and follow the instructions.

Please see this Help article for other Tips and tricks concerning deleting other forms that may have transferred from last year's return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

This does not fix anything. Deleting the form does nothing as it is auto-generating it for some reason. I have not sold anything, I don't have a business, and yet I can't file my CA state taxes without it! What's going on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

When you delete a form and it comes back again, that means that something in the interview has been entered in error. You need to go through the interview section on the return and correct what is causing the error.

Here are the steps to follow to locate the error.

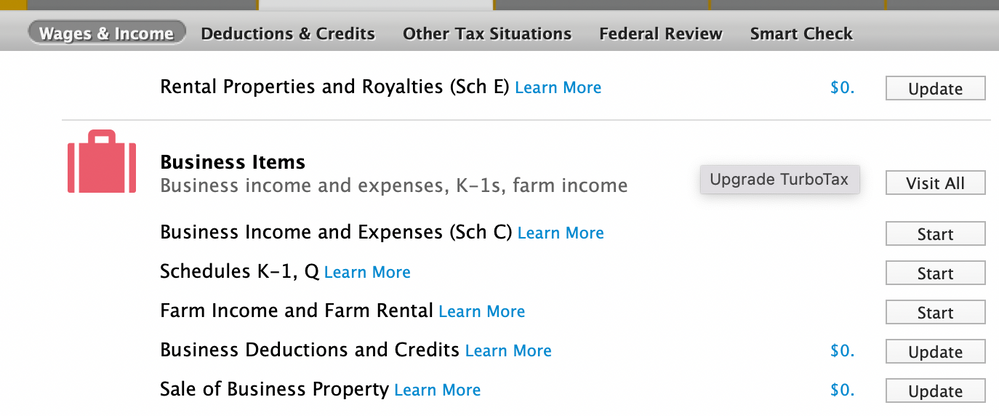

In TurboTax search for Sale of Business Property, then click the Jump to link.

On the screen that comes up uncheck any entry to is checked.

If nothing was selected on the above screen, the other place where this could have reported is under rental property. Search for rental property and Jump to the link.

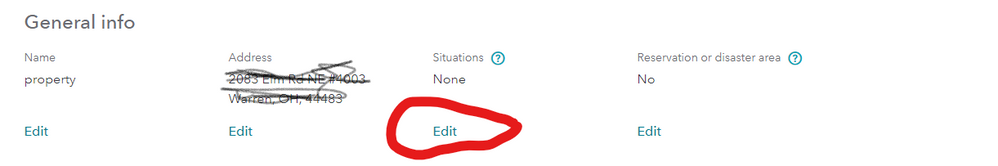

If you have a rental property listed, click on Situations

The next screen will bring up the question about selling a rental property and make sure that a sale is not entered there.

[edited 2/13/2021 | 2:27 pm PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

I tried to delete this form several times and although I get a message stating it was deleted, i get the same message that the form isn't ready when I try to file. I went through all the questions and can't find why this form is being required. Any advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

If you deleted Form 4797 for Sale Of Business Property from your return, then an entry in TurboTax may be re-generating the form.

Did you dispose of or sell any property that may have been previously used in a business (or rental)?

If you can give more info, we will try to help you.

Click this link for instructions on How to Delete Sale of Business Property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

Hi, I met the same issue when using Turbotax Mac, where I received a warning saying that Sch D-1 p1 is not ready, and when I deleted the form it is regenerated again. I don't own any business property and cannot find any entry on the California tab to delete such info.

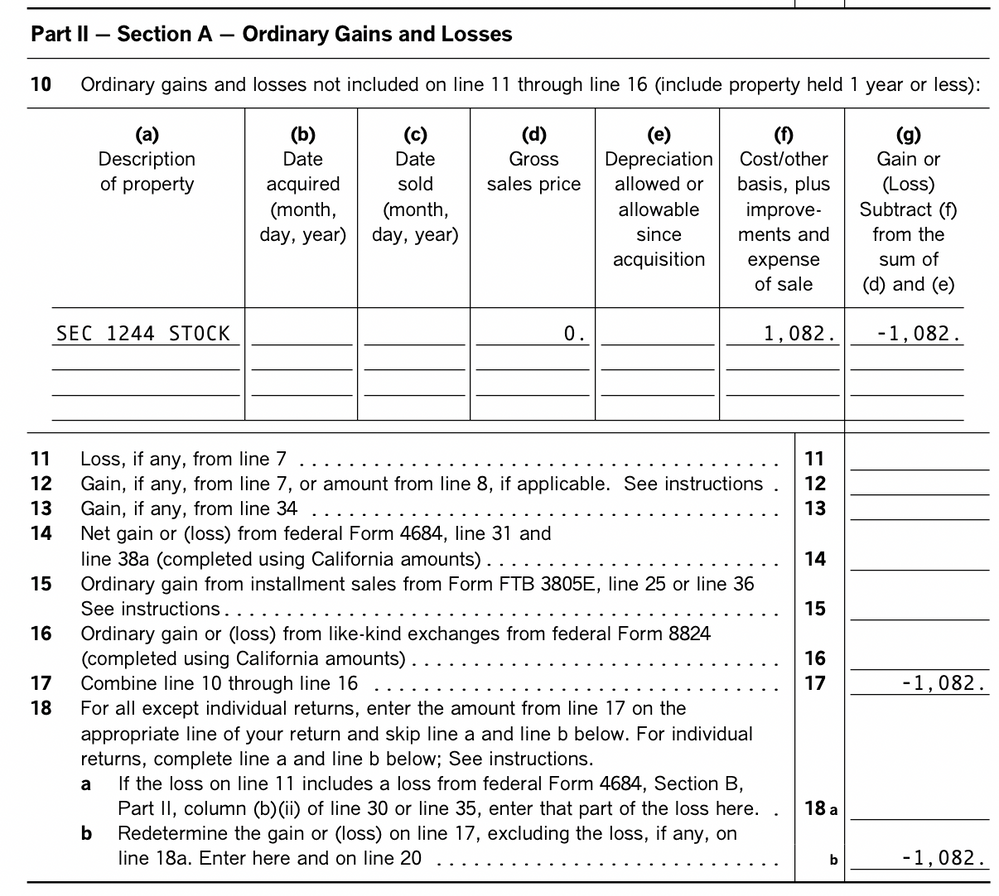

From the screenshot below you can see there's an "SEC 1244 STOCK" where the gross sales price is 0 and there's a cost/gain of $1082. I don't know where it comes from, could you inform me where is the $1082 generated?

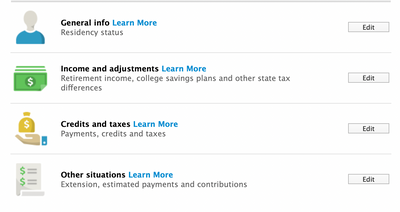

The UI for the California tax return is shown below, cannot find any info to remove the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

post the screenshot again:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

Yes, the entry for Sec 1244 stock is generated from the Sale of Business Property.

Try these steps for How to Edit or Delete Sale of Business Property in your Federal return.

Then, if you're using TurboTax Online, close the program, clear your Cache and Cookies, and step through your state interview again to see if your issue is corrected.

Since we can't see your return in this forum, you may want to Contact TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

I am using Turbotax Desktop version, where the sale of the business property has been updated to 0. But the sch D-1 p1 is still there after deleting the form. Anything else I can check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It's stating that I have form Sch D-1 p1 for Sale of Business Property, But I did not sell any business property. Is that just a form I have to fill out ?

Please sure there is not a partially completed Schedule D in TurboTax, please check in Forms mode to delete the form from your return. In TurboTax for Desktop:

- Please go to the upper right-hand corner and click on Forms; it will show you a list of all the forms in the return along the left column.

- If you see a Schedule D, click on it and it will open in the pane on the right. You can click Delete Form, at the bottom.

- Go to the upper right-hand corner and click on Step-by-Step (or Easy Step) to switch back to Interview mode.

This should resolve the flag in Review.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17550205713

New Member

SB2013

Level 2

Kenn

Level 3

pv3677

Level 2

lou-chapko

New Member