- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- IRA Deduction Worksheet LIne 2 earned income for self employment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction Worksheet LIne 2 earned income for self employment

The IRA Deduction Worksheet, Line 2 earned income for self employment.

Turbotax does not reduce this by the self employed insurance deduction which is on Schedule 1 Line 17.

Qualified Business Income for form 8995 is reduced by the self employed insurance deduction.

Can anyone confirm that the IRA Deduction Worksheet is correct, and cite the source of the information?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction Worksheet LIne 2 earned income for self employment

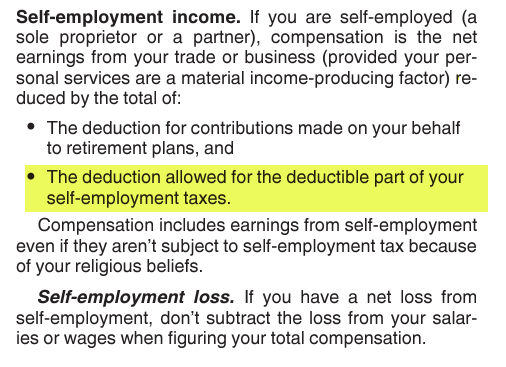

I cannot confirm the worksheet is correct as the current IRS publication does state that you must reduce self-employment income by the deduction allowed for the deductible part of your self-employment taxes (screenshot below).

The above was taken from Page 6 of Publication 590-A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Deduction Worksheet LIne 2 earned income for self employment

@jenfeldmann wrote:The IRA Deduction Worksheet, Line 2 earned income for self employment.

Turbotax does not reduce this by the self employed insurance deduction which is on Schedule 1 Line 17.

That's correct. It's not supposed to. The deduction for self-employed health insurance is a personal deduction, not a business deduction. See What Is Compensation in IRS Pub 590-A:

https://www.irs.gov/publications/p590a#en_US_2021_publink1000230359

QBI is calculated differently.

@JosephS1 , there is no bug.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TEAMBERA

New Member

ericbeauchesne

New Member

in Education

CTinHI

Level 1

candeaves

New Member

dgjensen

New Member