- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- If our capital gains from sale of home are excluded, why does TurboTax say I need to report on Schedule D because "you owe taxes on the sale"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If our capital gains from sale of home are excluded, why does TurboTax say I need to report on Schedule D because "you owe taxes on the sale"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If our capital gains from sale of home are excluded, why does TurboTax say I need to report on Schedule D because "you owe taxes on the sale"?

As long as you meet the requirements of use and timeframe you will not pay any tax on the sale of your home. Review the article and then double check your entries on the sale of your home to be sure you have answered all the questions correctly.

- Is the gain on the sale of my main home taxable? Not if you meet the following requirements:

- You owned the home

- It was your main home for two years or more within the five years leading up to the sale

- You waited at least two years between selling your primary home and excluding your prior gain

TurboTax will show you if your home sale is taxable.

- Open or continue your return in TurboTax

- Search for home sale

- Select the Jump to link in the search results

- Answer Yes to Did you sell or have your home foreclosed in 2021? on the Sale of Your Main Home screen

- Follow the instructions to enter your info - Watch each screen to be make sure you answered correctly to the question

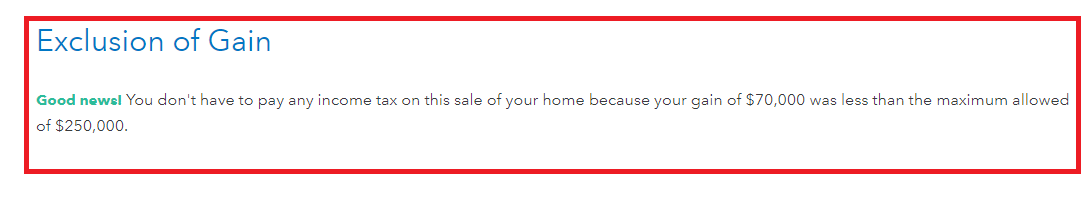

Once you complete the sale you should see the following screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If our capital gains from sale of home are excluded, why does TurboTax say I need to report on Schedule D because "you owe taxes on the sale"?

Thank you for the reply. I did get that message, but once I finish out this section, it tells me I need to upgrade my TurboTax (to include Schedule D) because I owe taxes on the sale of my home. I don't owe taxes though as the gains are excluded. I just don't want to upgrade if I don't have to, especially since I don't owe taxes on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If our capital gains from sale of home are excluded, why does TurboTax say I need to report on Schedule D because "you owe taxes on the sale"?

The sale of your home is not taxable but does require schedule D in order to report the fact that it isn't taxable to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

glmfedtax

Level 2

priestleydave

New Member

g-r-land

New Member

margomustang

New Member

troyponton

New Member