- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

As long as you meet the requirements of use and timeframe you will not pay any tax on the sale of your home. Review the article and then double check your entries on the sale of your home to be sure you have answered all the questions correctly.

- Is the gain on the sale of my main home taxable? Not if you meet the following requirements:

- You owned the home

- It was your main home for two years or more within the five years leading up to the sale

- You waited at least two years between selling your primary home and excluding your prior gain

TurboTax will show you if your home sale is taxable.

- Open or continue your return in TurboTax

- Search for home sale

- Select the Jump to link in the search results

- Answer Yes to Did you sell or have your home foreclosed in 2021? on the Sale of Your Main Home screen

- Follow the instructions to enter your info - Watch each screen to be make sure you answered correctly to the question

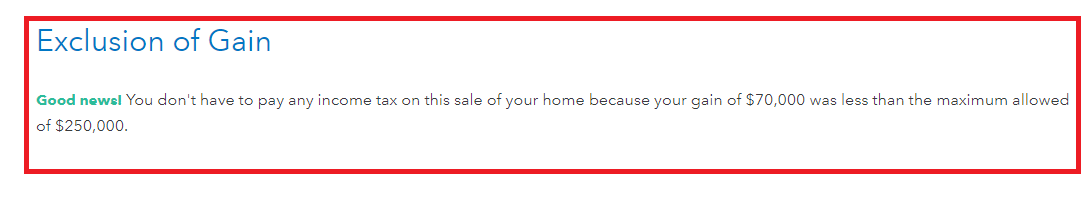

Once you complete the sale you should see the following screen.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 17, 2022

7:47 AM