- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I sold vacant land that I owned since 2016 at a loss in 2020. TurboTax taxes this at my top tax bracket of 37% instead of the 20% L/T capital G/L rate. Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land that I owned since 2016 at a loss in 2020. TurboTax taxes this at my top tax bracket of 37% instead of the 20% L/T capital G/L rate. Is that correct?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land that I owned since 2016 at a loss in 2020. TurboTax taxes this at my top tax bracket of 37% instead of the 20% L/T capital G/L rate. Is that correct?

You should not be taxed at all if it were a loss. Did you enter this in the Investment section? Go back over your entries and see how you entered your amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land that I owned since 2016 at a loss in 2020. TurboTax taxes this at my top tax bracket of 37% instead of the 20% L/T capital G/L rate. Is that correct?

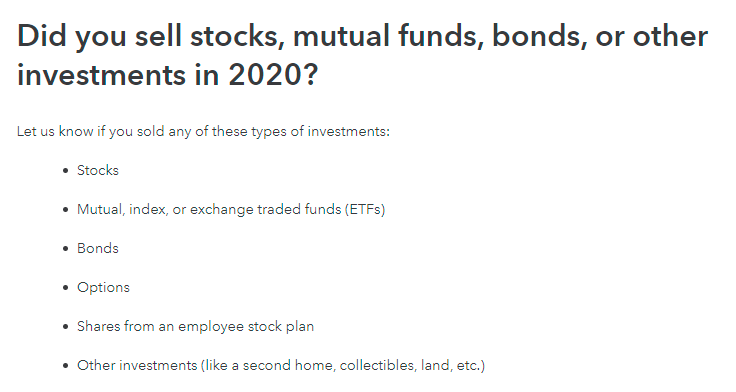

Thx Coleen. I was unclear. The capital loss was over $3K and TT correctly applied only $3K of the loss to 2020. On that $3K, I expected a lower tax amount of $600 (20%) but TT calculated it at $1,110 (37%). I also simulated what TT would calculate had it been a gain. That returned a tax increase in amount of 20% of the gain, which I expected. Why would TT use 37% when it's a capital loss and 20% when it's a capital gain? And yes, I reported this in the Investment section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land that I owned since 2016 at a loss in 2020. TurboTax taxes this at my top tax bracket of 37% instead of the 20% L/T capital G/L rate. Is that correct?

It may be the way you created your scenario. A capital loss or gain is 20% but an ordinary gain or loss is 37%. Turbo Tax may have interpreted your data as being an ordinary loss but this is just pure speculation on my part.

You may wish to contact tax support at 1-800-446-8848 as they have the ability to look at your screen to see how your calculations were applied.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abcxyz13

New Member

dpa500

Level 2

mmoul1

New Member

RicN

Level 2

derrickbarth

Level 2