- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

You should see this screen if you are using TurboTax Online. You can select Land as an investment from the pulldown menu.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

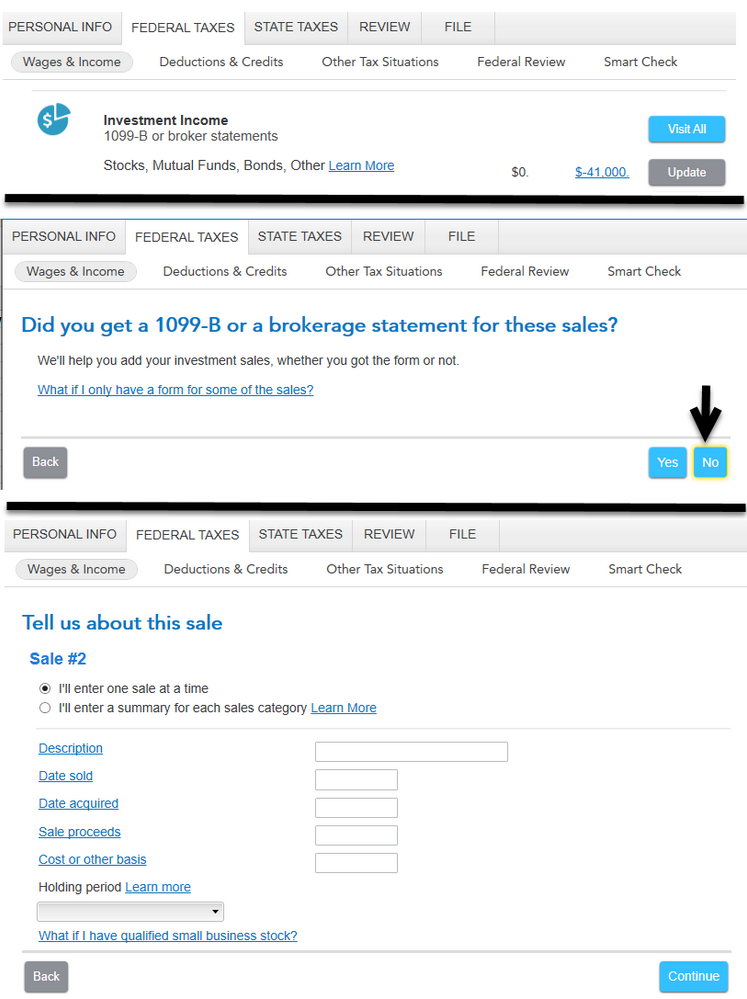

Thank you - it turns out that I'm using the desktop version, which is different. Below are the screens that I see:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

Correct, in TurboTax Desktop, you need to type Land in the description box.

There is no drop-down listing Land as an option in TurboTax Online.

Hopefully that is your only issue entering the land sale.

If there is another issue, please continue in the thread or start a new question.

The thread we are in started in June 2019 and things can get confusing when a conversation continues so long.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

Thank you.

I changed the description to have only "Land". That was easy. But the write-off is still only $3000. I understand that if the land was never for personal use, then I can write off the full loss, per earlier in this thread. Is this still true? The person in the thread followed the instructions for the online version and got it to work. What do I need to do in TurboTax to convey that information, so I get the full write-off?

I agree about starting a new thread if we veer off the main topic.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

@uscholdm wrote:

But the write-off is still only $3000. I understand that if the land was never for personal use, then I can write off the full loss, per earlier in this thread.

@uscholdm I'm not sure what you mean by "the write-off." The full amount of the loss should be in column (h) on Form 8949. But you don't necessarily get to deduct it all in one year. Capital losses are first used to offset any capital gains. If your losses are more than your gains, up to $3,000 of the remaining loss will be used to offset ordinary income. If you have a $3,000 loss on Form 1040 line 7, that's the amount that is being used offset other income. Any additional loss is carried over to future years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

Your total capital gains for the year minus your total capital losses result in a net gain or a net loss. You can deduct a net loss of up to $3000. Any capital loss you cannot deduct this year will be carried forward and used in the next year that you will be able to claim the loss. The amount of the write-off is only $3000 with no work around to change that amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

@njurkovi another thing to consider is whether the zero-percent capital gains rate applies to you.

If so and you sell stock you could be wasting the $3 loss carryforward because the gain would be taxed at 0%. (e.g. sell no stock, you get $3k off any income for the loss carry over. but sell, say $20k of stock gain (not proceeds, but proceeds - cost basis) then you have $20k gain - $3k loss carryover = $17k gain. If in the 0% bracket no tax on the $17k. But the $3k for that year doesn't offset other income.

Also a possible tax strategy might be to sell stock to use up some (all?) of the zero percent bracket (if that applies to you) each year while you still have gains. But as soon as you sell the stock, but buy it back the next minute. (Assuming you want to continue to hold that as an investment). That way you pay zero tax but increase your basis. Otherwise if you need the stock at some point and have to sell a lot in one year you might get above the 0% bracket.

For more info see

https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

https://www.thebalancemoney.com/how-to-use-the-zero-percent-tax-rate-on-capital-gains-2388995

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

OK. I think I misunderstood the earlier post in the thread.

Thank you for clarifying this for me, and for the speedy replies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

Yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

I bought a lot in a highly-promoted new, planned coastal community. Held unused for "appreciation" for 20 years. I paid $2k annually in POA fees (property owners assoc) and $300.00 annually in property taxes. Just sold for only $20K. Can I add the POA fees (which funded neighborhood amenities buildout and property values) and taxes to my $100k basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold vacant land (at a loss) that I owned for 18 years. I don't get any "loss credit"? Thought I would get $3,000.00

No, neither the annual property taxes nor the poa fees will be deductible nor adjusted to the cost basis for property held for investment purposes that was subsequently sold.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Solar Eclipse

Level 3

christybarcelo83

New Member

Wisco920

New Member

lindseym320

New Member

Omar80

Level 3