- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I received refunds in 2023 for the Nebraska Property Tax Incentive Act Credit from 2020, 2021 and 2022. Do I need to report those funds on my 2023 return and where?

Announcements

Attend our Ask the Experts event about Tax Law Changes - One Big Beautiful Bill on Aug 6! >> RSVP NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received refunds in 2023 for the Nebraska Property Tax Incentive Act Credit from 2020, 2021 and 2022. Do I need to report those funds on my 2023 return and where?

I had missed the portion in Turbo Tax regarding those credits in the past

Topics:

posted

February 18, 2024

1:05 PM

last updated

February 18, 2024

1:05 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received refunds in 2023 for the Nebraska Property Tax Incentive Act Credit from 2020, 2021 and 2022. Do I need to report those funds on my 2023 return and where?

No, if you received these funds in a prior year, you would need to report the credit on Form PTCX for the applicable year.

Please see these links for the form for each applicable year:

- 2020 Form PTCX - Amended Nebraska Property Tax Incentive Act Credit Computation

- 2021 Form PTCX - Amended Nebraska Property Tax Incentive Act Credit Computation

- 2022 Form PTCX - Amended Nebraska Property Tax Incentive Act Credit Computation

If you have the credit in 2023, you can enter the applicable information to generate the credit in the state interview section. TurboTax will generate Form PTC.

- Log into TurboTax and select state taxes.

- Select start/edit to start your Nebraska return.

- Proceed through the screens and answer the information as prompted.

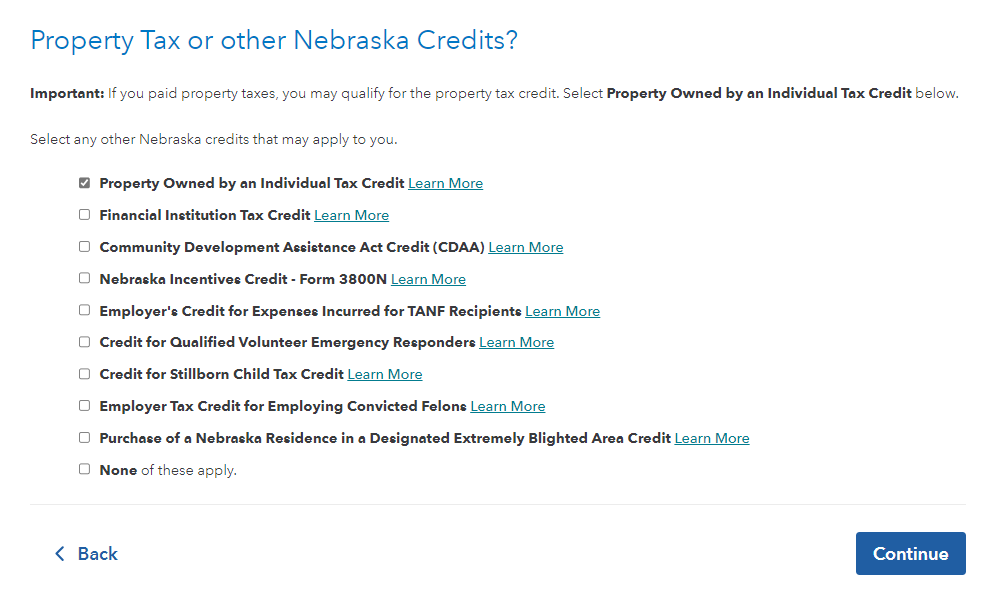

- You will see a screen titled "Property Tax or other Nebraska Credits," be sure to select the box to the left of Property Owned by an Individual Tax Credit.

- Enter the applicable information under the screen titled "Report Property Tax Information." This will generate Form PTC for 2023.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 24, 2024

7:52 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KM-NE

New Member

mlmavis

New Member

f4p1A2v

New Member

f4p1A2v

New Member

skdukelaw123

Returning Member