- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

No, if you received these funds in a prior year, you would need to report the credit on Form PTCX for the applicable year.

Please see these links for the form for each applicable year:

- 2020 Form PTCX - Amended Nebraska Property Tax Incentive Act Credit Computation

- 2021 Form PTCX - Amended Nebraska Property Tax Incentive Act Credit Computation

- 2022 Form PTCX - Amended Nebraska Property Tax Incentive Act Credit Computation

If you have the credit in 2023, you can enter the applicable information to generate the credit in the state interview section. TurboTax will generate Form PTC.

- Log into TurboTax and select state taxes.

- Select start/edit to start your Nebraska return.

- Proceed through the screens and answer the information as prompted.

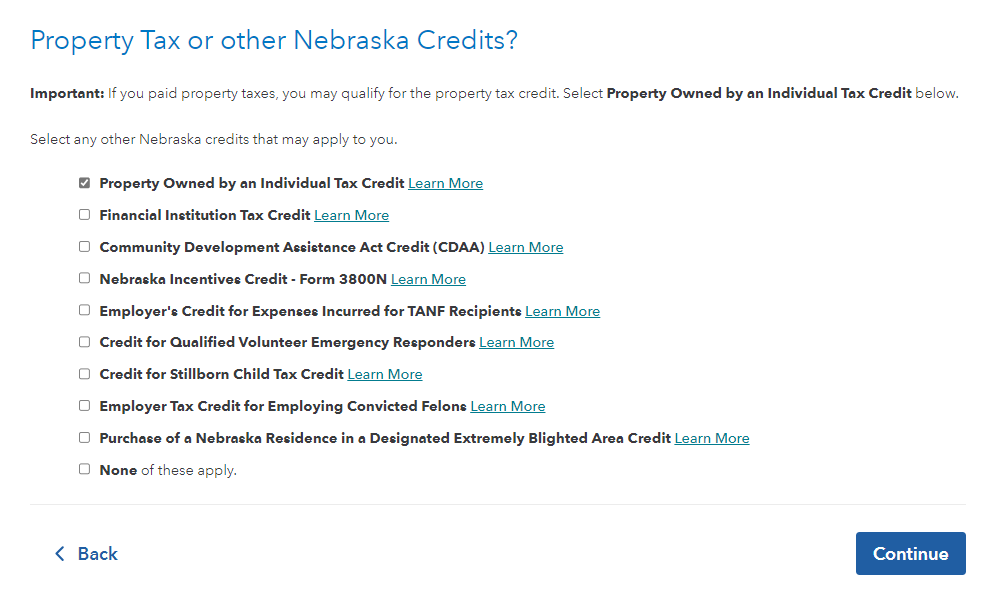

- You will see a screen titled "Property Tax or other Nebraska Credits," be sure to select the box to the left of Property Owned by an Individual Tax Credit.

- Enter the applicable information under the screen titled "Report Property Tax Information." This will generate Form PTC for 2023.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 24, 2024

7:52 PM