- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I received a disaster loan thru the US SBA due to Hurricane Harvey: 1. Is the interest paid on the loan deductible? 2. if yes, where do I enter in turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a disaster loan thru the US SBA due to Hurricane Harvey: 1. Is the interest paid on the loan deductible? 2. if yes, where do I enter in turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a disaster loan thru the US SBA due to Hurricane Harvey: 1. Is the interest paid on the loan deductible? 2. if yes, where do I enter in turbotax?

Yes, generally you can deduct all of the interest you pay during the tax year on debts related to your business.

Here is how you enter interest payments in TurboTax Home and Business Online.

- Open TurboTax.

- "Pick up where you left off."

- Wages & Income > Self-employed income and expenses > Expenses > Edit.

4. "Add expenses for this work."

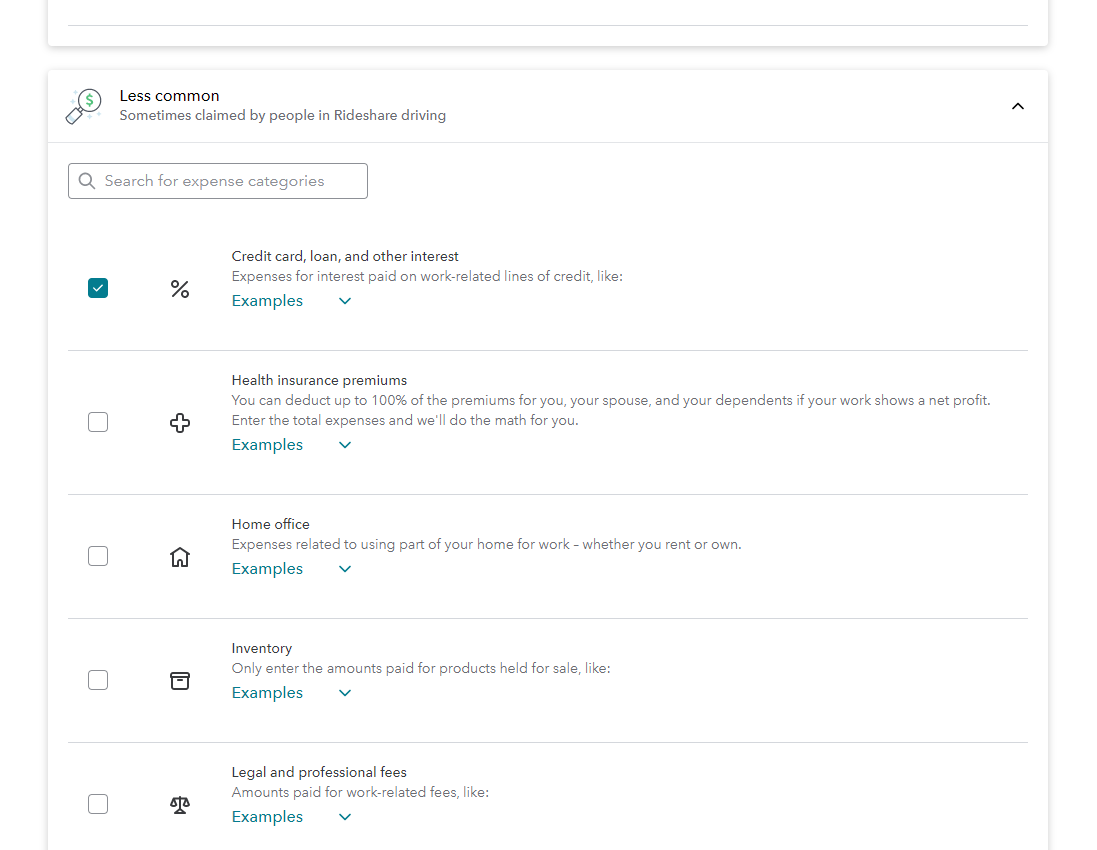

5. Less common.

6. Credit card, loan, and other interest. > Continue.

7. Credit card, loan and other interest > Start.

8. Enter a description and the amount of interest paid.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a disaster loan thru the US SBA due to Hurricane Harvey: 1. Is the interest paid on the loan deductible? 2. if yes, where do I enter in turbotax?

thank you ShirlynW- the loan was for the rebuild of my home so while it says SBA it was really the agency that provided the funding due to the disaster. They did not send me a 1098 but I have the exact amount of interest paid on the loan. Given this, it's not a business loan I am not sure where to deduct the interest? While my wife is self employed I am not sure this would be the location to deduct. Any other thoughts? I appreciate your help and expertise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a disaster loan thru the US SBA due to Hurricane Harvey: 1. Is the interest paid on the loan deductible? 2. if yes, where do I enter in turbotax?

You would enter this in the mortgage interest section of TurboTax. If the loan was to rebuild your home after Hurricane Harvey, this meets the definition of mortgage interest as long as the loan is secured by your home

This definition from a TurboTax Tip article matches your situation:

What counts as mortgage interest?

Deductible mortgage interest is interest you pay on a loan, secured by a main home or second home, that was used to buy, build, or substantially improve the home. For tax years prior to 2018, the maximum amount of debt eligible for the deduction was $1 million. Beginning in 2018, the maximum amount of debt is limited to $750,000. Mortgages that existed as of December 15, 2017 will continue to receive the same tax treatment as under the old rules. Additionally, for tax years prior to 2018, the interest paid on up to $100,000 of home equity debt was also deductible raising the previous total to $1,100,000. Loans with deductible interest typically include:

- A mortgage to buy or build your home

- A second mortgage

- A line of credit

- A home equity loan

If the loan is not a secured debt on your home, it is considered a personal loan, and the interest you pay usually isn't deductible. Your home mortgage must be secured by your main home or a second home. You can't deduct interest on a mortgage for a third home, a fourth home, etc.

From @AmyC:

You can deduct the mortgage on your main home or one second home if the debt is secured by the home. Follow these steps:

- Go to federal deductions and credits

- Select Mortgage Interest

- Enter the name of the lender

- Select Property type

- Do any of these situations apply? Select none of the above

- Enter USD for mortgage information, continue

- Secured by property? select,

- continue answering questions.

At no point do you need SSN or federal ID. When you return to the summary screen, it will show the interest.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a disaster loan thru the US SBA due to Hurricane Harvey: 1. Is the interest paid on the loan deductible? 2. if yes, where do I enter in turbotax?

Thank you all for the responses!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

1dragonlady1

New Member

l-e

Level 1

afernandezcmu

New Member

TomDx

Level 2

helloerinamanda

Level 1