- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I purchased a vehicle for my company that is over the weight limit and cannot find in turbo tax where to put it in my expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a vehicle for my company that is over the weight limit and cannot find in turbo tax where to put it in my expenses

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased a vehicle for my company that is over the weight limit and cannot find in turbo tax where to put it in my expenses

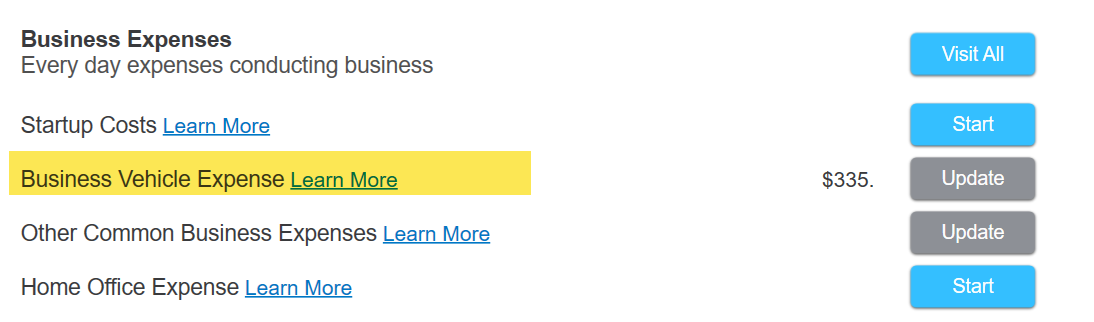

You need to navigate to the business section where you enter your business income and expenses. This will vary depending on which version of TurboTax you are using. Edit your business entries and on the screen that says Your (Name of Business) Business, choose the Business Vehicle Expense option:

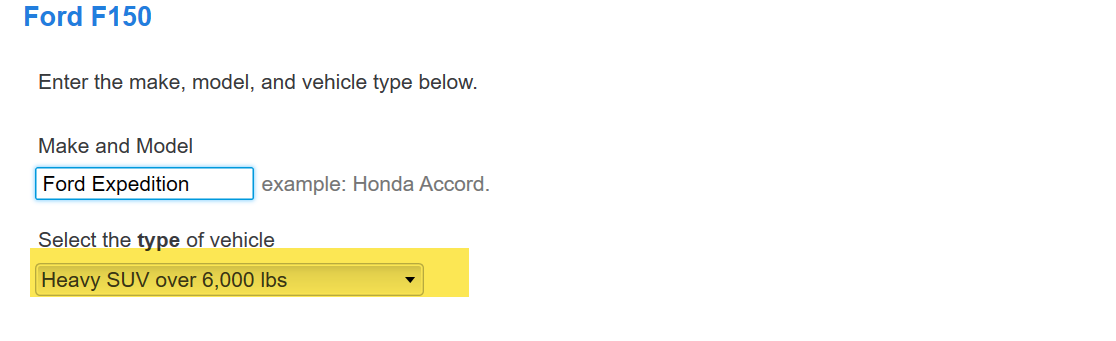

On the asset entry screen, make sure you indicate that it is a Heavy SUV over 6,000 lbs:

Work through that section where you will be asked to enter your vehicle expenses and if you want to use the expensing option for the cost of the vehicle. You must answer "yes" when asked if you want to deduct actual expenses or use the mileage allowance.

There are limits to how much you can deduct in the year that you purchase a vehicle in 2024, so it is unlikely that you will get a deduction for the full purchase price of your vehicle.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

RE-Semi-pro

New Member

justine626

Level 1

ericatsimerman

New Member