- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I no longer have a mortgage. So how do I pay my property tax? The escrow thing took care of it before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I no longer have a mortgage. So how do I pay my property tax? The escrow thing took care of it before.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I no longer have a mortgage. So how do I pay my property tax? The escrow thing took care of it before.

You should get a bill in the mail. Ask your county tax collector. You can probably find out online. I can look up my house in California.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I no longer have a mortgage. So how do I pay my property tax? The escrow thing took care of it before.

Contact your county's property appraiser or tax assessor's office (or visit their website).

You should be receiving an invoice or tax bill in the mail and there is likely a method whereby you can pay online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I no longer have a mortgage. So how do I pay my property tax? The escrow thing took care of it before.

I will just add to the above that your assessor may already know that you paid off your mortgage, because the lender should have contacted them. But you should also do it yourself. You want to make sure the assessor has the right mailing address for you, and that you know what dates to expect your bill to be mailed to you and payments to be due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I no longer have a mortgage. So how do I pay my property tax? The escrow thing took care of it before.

I even get an email when the tax bills are going out. See if you can sign up on the county website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I no longer have a mortgage. So how do I pay my property tax? The escrow thing took care of it before.

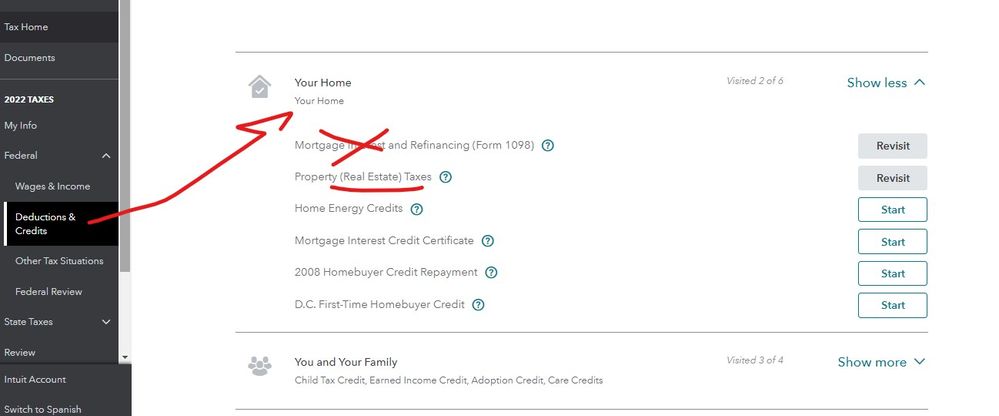

Next year, in the TT program you will skip the mortgage section and just enter the RE taxes in the next section :

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

misschristian0711

New Member

josephmarcieadam

Level 2

jlfarley13

New Member

scatkins

Level 2

djpmarconi

Level 1