- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I need to remove HSA info off my return. How do I do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to remove HSA info off my return. How do I do this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to remove HSA info off my return. How do I do this?

You can remove your HSA information as follows:

Your HSA information is entered in two places in TurboTax.

It is first entered into TurboTax when you enter your Form W-2 in the "Wages and Income" section of TurboTax, by entering Code W in Box 12.

This will also flow to the "Deductions and Credits" section of TurboTax.

If you have entered your Form W-2 and it has HSA information on it, you will need to edit your Form W-2 to delete that entry.

If you are using TurboTax Desktop, you can delete your W-2 information as follows:

- 1. Open your return

- In the Search bar, enter "Form W-2" and select the "Jump to" link. This will take you to your W-2 entries (See screenshot below for additional guidance)

- Select the (down) caret next to your "W-2" and then select "Edit"

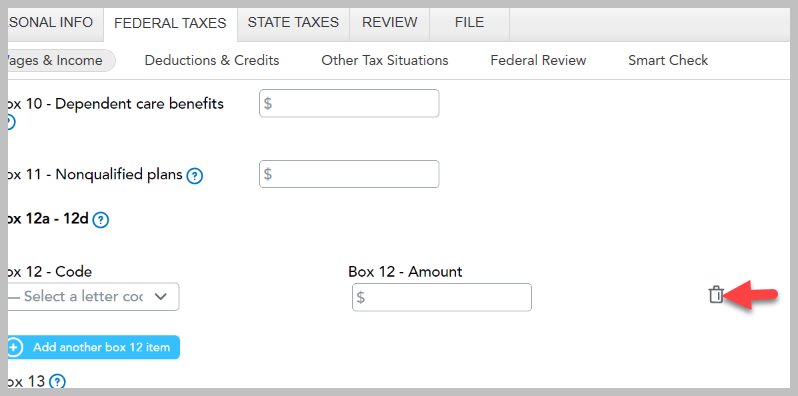

- Continue through the screens until you get to your Box 12 entry and select the "trash can" icon and that will delete the entry. (See Screenshot below for additional guidance)

If you are using TurboTax Online/Mobile: you can use this link W-2, or you can:

- Open your return.

- Go to "Wages and Income"

- Under W-2's select "Add/Edit" next to your W-2 that you need to edit. (See the screenshots below for additional guidance)

- If you have multiple W-2's entered, select the W-2 you are editing and the hit the (down) caret next to it. This will bring up the edit feature for that W-2.

- Select "Delete"

You will then have to go to the HSA section of "Deductions and Credits" in TurboTax and select "None of the above" to complete removing your HSA information.

You can do this by:

- Typing "hsa" in the search bar and

- Selecting "Jump to hsa".

- Then select "None of the above".

- Continue on through your screens.

This should eliminate your HSA information.

For TurboTax Desktop and TurboTax Online to search for your W-2 it will look like this:

In TurboTax Desktop, you will select the "trash can" icon to delete the entry.

In TurboTax Online you will need to select the W-2 you need to edit. If there are multiple W-2's, you will hit the (down) caret to get to the edit feature.

It will look like this:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to remove HSA info off my return. How do I do this?

You didn't say why you want to remove the HSA information. If you took any money out of your HSA in 2024 you cannot remove the information. You have to report it. You will receive a Form 1099-SA and you have to enter it in your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to remove HSA info off my return. How do I do this?

I don't have a W in section 12 of my W2 and in the HSA section of "Deductions and Credits" I select "None of the above" to complete removing HSA information, but it still shows up.

It's very frustrating and i don't know how to fix it. Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to remove HSA info off my return. How do I do this?

***Reset***

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen)

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form(s) - 1099-SA (if one), 8889-T, and 8889-S (if one). Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, and 8889-S (if one)

5. go back and re-add your W-2(s), preferably adding them manually

6. continue with your return.

There is one other thing that can cause your return to resist deleting HSA information but it is so unlikely I haven't written it here.

Come back to us this doesn't do it for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kelsey-peoples

New Member

taxhard47

Level 3

kristinfarrell9999

New Member

trooperdave46

New Member

Ayesha_1027

Level 1