- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in Tu...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

You need to file a WI nonresident return. Here are the instructions. TurboTax will transfer the information to your state returns. All income is transferred to your resident state of IL and the home sale will just be on the WI return. When you do your state taxes, prepare the nonresident WI return first. If you owe any tax to WI, TurboTax will allow you to take a credit for that on your IL resident return. Your resident state taxes all of your income, but they will give you credit for taxes you have to pay to another state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

You need to file a WI nonresident return. Here are the instructions. TurboTax will transfer the information to your state returns. All income is transferred to your resident state of IL and the home sale will just be on the WI return. When you do your state taxes, prepare the nonresident WI return first. If you owe any tax to WI, TurboTax will allow you to take a credit for that on your IL resident return. Your resident state taxes all of your income, but they will give you credit for taxes you have to pay to another state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

I'm working on Wisconsin non-resident now and I'm having a problem with not being able to exclude Taxable Interest and Ordinary Dividends from the non-resident return. It appears TT is auto-feeding all interest and dividends from the Federal return to the non-resident return. If I understand your guidance correctly, the only income that should be on the non-resident return should be the home sale capital gain. How does this get adjusted? There appear to be no prompts in TT to allow me to zero out the interest and dividends.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

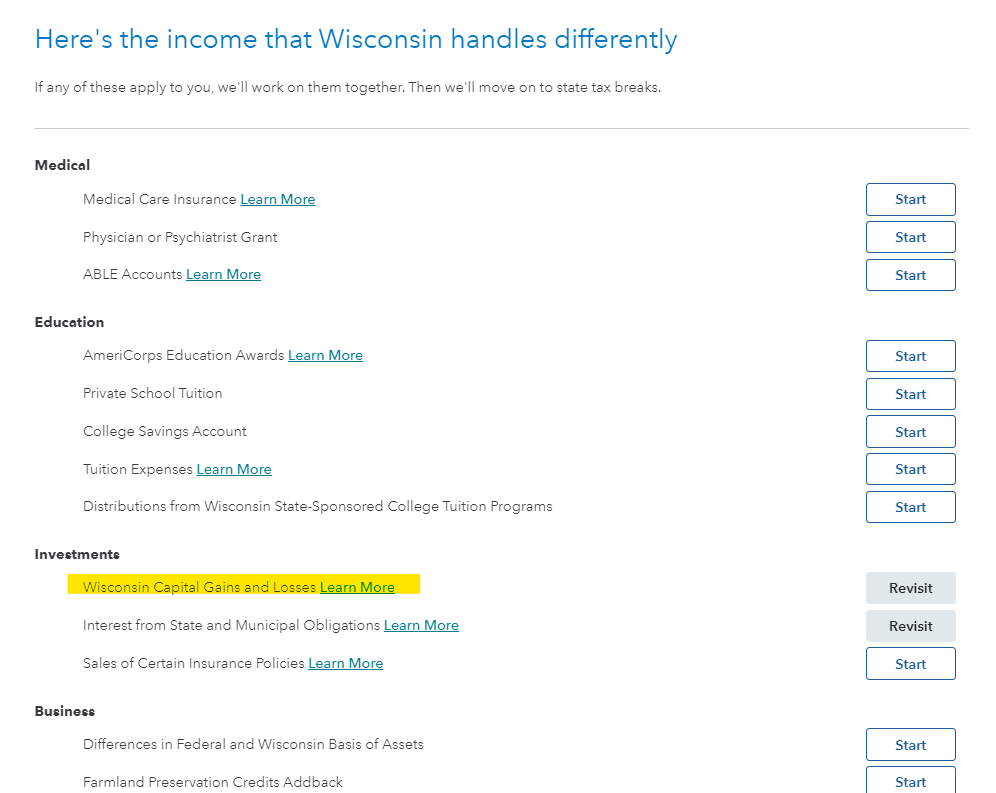

There should be a screen that lists all of your federal income - and TurboTax will allow you to enter the amounts from each line that are WI-sourced. Slowly click through the WI nonresident return until you come to that screen. It will look similar to the one below, but will reference WI. @unzema

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

The template you are showing looks familiar but the Wisconsin TT form does not present a screen for me to enter WI-sourced amounts for dividends and interest. I've clicked through the non-resident return many times and it doesn't appear to exist. I even went into the forms and tried to delete the amounts and it won't let me edit those lines.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

OK, so I just went into the forms and right-clicked and it allowed me to "override" the amounts so I did so entering zero for those two lines. It seems like it is working OK. Did I do anything wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

You may have an issue with e-filing. Overriding the entries will void the accuracy guarantee. In the Wisconsin return, on the screen that says Here's the Income that Wisconsin handles differently, scroll down and click on Edit next to Capital Gains.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois and sold a home in Wisconsin. I will be paying capital gains tax on my federal return. Which state(s) would I owe capital gains tax on this transaction? How would that work in TurboTax?

Yes, I did that and was able to adjust my capital gains. But it never prompts me to adjust dividends and interest.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

johnnywlowe

New Member

OPICIAKMIRIAK

New Member

TomG1

Returning Member

Mary7820

Returning Member

weshakeourbones

New Member