- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I don't understand where I'd get form 8889-T from

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

You would need to file Form 8889 if one or more of the following were true:

- You, or someone on your behalf (such as an employer) made contributions to a Health Savings Account (HSA) for you during the tax year. Both your and your employers contributions will be reported on Form W-2, Box 12 as Code W.

- You received a distribution from an HSA during the tax year. This is reported on Form 1099-SA.

- You must include certain amounts in income because you failed the eligibility text.

- You acquired an interest in an HSA because of the death of an account beneficiary.

Health Savings Accounts are often forms when a taxpayer has a high deductible health plan (HDHP). That is the only time they are allowed, but of course, not every person with an HDHP has an HSA. HSA's allow you (or your employer) to make tax-free contributions. These amounts grow tax free and can be withdrawn for qualified medical expenses with no tax due; however, if you withdraw for non-medical expenses, you will be subject to tax and a penalty.

Please refer to the link below for more information.

https://www.irs.gov/instructions/i8889/ch01.html#d0e48

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

You can get the form from you HSA Bank. In my case the Bank is "Optum". Log in and search for documents.

Typically, they are published late in January, and can go into February. Its intended to document what your employer contributed to your HSA, and MAY have impact on your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

You don't receive form 8889 in the mail or online; it is created by TurboTax as part of your tax return process.

TurboTax creates one or two forms: 8889-T for the primary taxpayer and 8889-S for the spouse (if necessary).

The forms that you may receive are the 1099-SA on which your HSA distributions are printed (money you paid for qualified medical expenses) and the 5498-SA on which various informational fields are entered. If you receive one or more 1099-SAs, you must enter them into TurboTax in the HSA interview (under Deductions & Credits->Medical). You do not have to enter anything from the 5498-SA, as the form is just for your records.

Your should receive the 1099-SA by the end of January, although as noted above you may be able to get it online. The 5498-SA will be sent as early as February or as late as the end of May - since you don;t have to use it on your tax return, the delivery date really doesn't matter.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

When looking at the actual forms, you will not see the suffix -T (or -S). The T or S is TurboTax designation on the list of forms to indicate which taxpayer's name appears in the name box/line on the form.

8889-T for the primary taxpayer and 8889-S for the spouse (if necessary).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

Turbotax is prompting me with a message that the 8889-T and 8889-S aren't ready yet (my wife and I have separate HSAs), any reason why I would get that message if this is filled out with info from the 1099-SA (both 1099-SAs have been received and entered)?

I can see the 8889-T and 8889-S (partially?) filled out in turbotax but they both say "do not file" at the top.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

Those forms should be available. If you are using the desktop version of TurboTax, you may need to do the updates. Find the "Online" menu option and click on "Check for Updates."

I suggest you go through this section in TurboTax and answer the questions

1. Find the "Deductions and Credits" section in TurboTax

2. Find "Medical" in the list of categories

3. Start or update the "1099-SA, HSA, MSA" section

4. Go through that entire section and make sure you answer all of the questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

Same here. My error message said the IRS still hasn't finalized this form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

Essentially, you have to wait until at least Jan 28 to transmit/file your taxes. (at least that's the Date what showed up when I finished my taxes) .

"File Form 8889 to: Report health savings account (HSA) contributions (including those made on your behalf and employer contributions). Figure your HSA deduction. Report distributions from HSAs. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual."

My HSA Provider is Fidelity. They have not completed the 8889T for me yet.

I too have to wait. They have to have it sent to you by Jan 31, more likely they will deliver it or have it ready to download before the 31st.

ALSO

The IRS has Published that they wont begin processing returns until 2/12/21.

You can - submit your taxes , but it wont process until then.

When you get the 8889 form, that will enable you to then Submit/Transmit/aka "File" your taxes.

(This year is not not like any other, due to COVID-19, stimulus, etc...)

Once you File electronically, your return will be queued until 2/12/21 processing begins.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

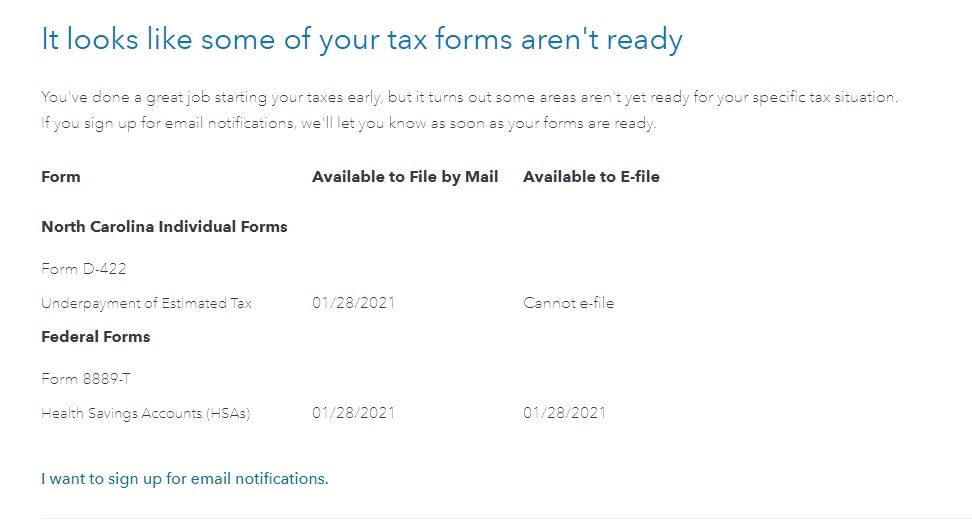

Look for this text in Turbo Tax, Click on the STATE on the left in Black

Federal Forms

Health Savings Accounts (HSA's) Available to E-File 01/28/2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

Please note that you do not receive form 8889 from your HSA administrator. Instead, form 8889 is generated by TurboTax in the process of creating your 1040 tax return, using data from your W-2, form(s) 1099-SA, and entries you make in the HSA interview in TurboTax.

There can be one or two forms 8889 in your return: if you have an HSA, then there is what TurboTax calls 8889-T (for taxpayer), and if your spouse has his/her own HSA, then that form is called 8889-S (spouse).

But the actual forms are 8889 in both cases.

You are correct that form 8889 is not yet available in TurboTax. Please check Federal Forms Availability for estimated date of availability.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

Why does mine say Available to file but my date change to 2/4/2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

As BillM223 clarified : Turbo Tax will provide the form, when they can.

Last date I heard was 01/28/2021. (Which is just a few more days).

I am grateful to BillM223 (Turbo Tax Advisor) For clearing up the fact that the 8889 form is created

by Turbo Tax.

GENTLE Suggestion - make some kind of change to the statement that makes clear the Turbo Tax has to create the form.

The lead me to go to 100 places to find that form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don't understand where I'd get form 8889-T from

The timing for TurboTax forms availability is at this TurboTax Help. IRS Form 8889 is listed as available February 4.

IRS form 8889 is generated by the TurboTax software. Follow these directions to report HSA deductions.

- Down the left side of the screen, click Federal.

- Across the top of the screen, click Deductions & credits.

- Scroll down to Medical.

- Click on Start/Revisit.

- Click on HSA, MSA contributions.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

arihadne19

New Member

stephaniebperez

New Member