- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

Hi

Why HSA Distributions are added to taxable income

I see my HSA Distributions are added to

| 7a Other income from Schedule 1, line 9 |

This should be not taxable right?

- HS71

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

You have to tell TurboTax that you used the money on qualified medical expenses. There is a question in the HSA distributions interview where you can indicate that so that it is not taxable.

Type HSA into the search bar, use the Jump to HSA link to go back through the interview and change your answer to that question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

Hello, I still find that when I add the distribution amount from the 1099-SA it adds that amount to my taxable income. I have carefully followed each question in the interview, I keep coming up with the same result. I don't see where in the interview I can indicate that this distribution is not taxable. Can you please show me how I can indicate that this is not taxable income?

Thanks

Jon

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

When entering the form 1099-SA information, the follow on page asks if the distribution was for medical expenses. You would answer "Yes".

I suggest deleting your Form1099-SA and re-entering to get to the applicable question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

@DMarkM1, thanks for your help, deleting the 1099-SA and entering again fixed the problem.

Kind regards,

Jon

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

@DMarkM1 ,

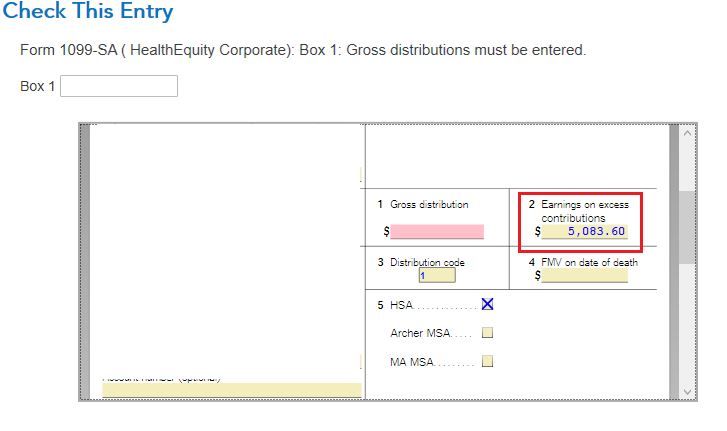

I spoke too soon. After deleting the 1099-SA and re-entering that seemed to fix the issue. However, after running the smart check it flagged an issue in the 1099-SA. As you seen in the attached, the amount of my distribution was entered in Box 2 instead of Box 1. If I delete the amount in Box 2 and and put in Box 1 it adds to the taxable income...my taxed owed goes up over $2000.

Any ideas what is happening here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA distributions are counting toward income? I checked the box stating that distributions were only used for medical expenses. Still appears in main income table

Try deleting and re-entering the 1099-SA again. If the error pops again. Enter the correct amount in "Box 1" just below where it says "Check this entry". Do not make any entries on the form box below in that error screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Smurfect

New Member

tbduvall

Level 4

currib

New Member

trust812

Level 4

afoote

New Member