- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do you report on mineral rights income on property that you do not own?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report on mineral rights income on property that you do not own?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you report on mineral rights income on property that you do not own?

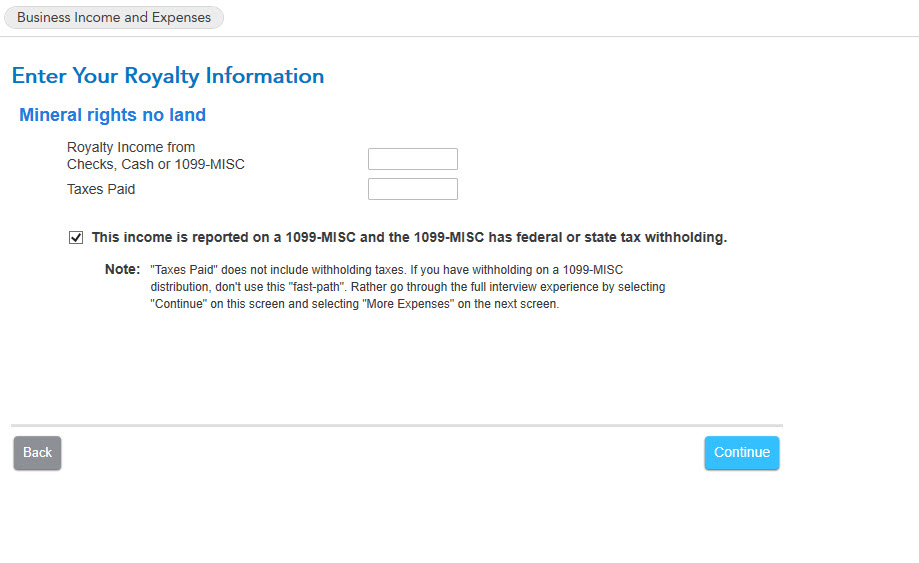

You can enter under

- Rental Property and Royalties START or UPDATE

- Yes, Income from Rentals or Royalty Property you own

- Select YES to review if necessary otherwise "No" not real estate professional

- Select "Royalty property or payment"

- Type "Royalty rights, no land" as the description

- Use your address if needed

- Does all the income belong to you? YES

- What type? Mineral Property

- Enter the income reported on the 1099-MISC

(See the Note concerning additional boxes on your 1099-MISC)

If not needed, do not check the box and finish the interview

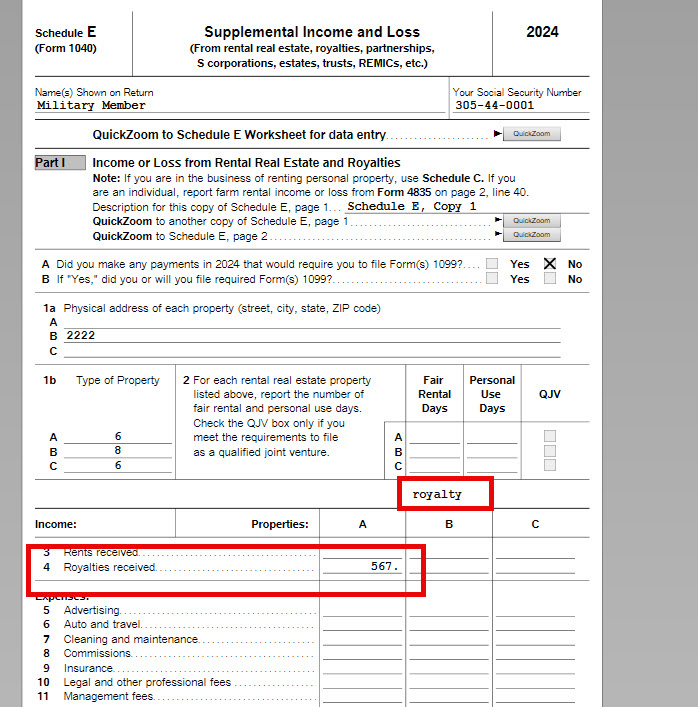

This will generate Schedule E and report the royalty income

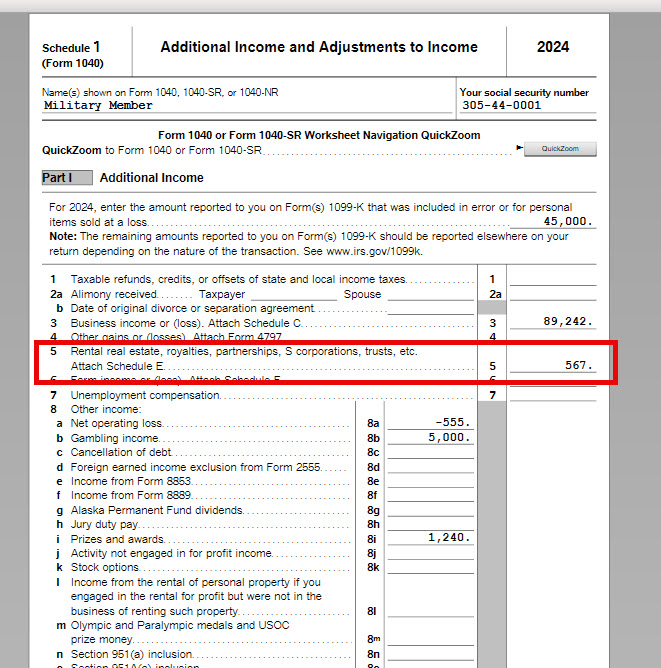

The income will be on Schedule 1 line 5

If you enter as "Other Common Income" "Income on Form 1099-MISC and the income is in Box 1 RENTS, you will need to setup the rental for Schedule E.

If you decide you want to enter the first way, you need to delete all entries for this 1099-MISC you may have already entered and start at the beginning

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chiroman11

New Member

jlfarley13

New Member

scatkins

Level 2

ilenearg

Level 2

realestatedude

Returning Member