- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

You can enter under

- Rental Property and Royalties START or UPDATE

- Yes, Income from Rentals or Royalty Property you own

- Select YES to review if necessary otherwise "No" not real estate professional

- Select "Royalty property or payment"

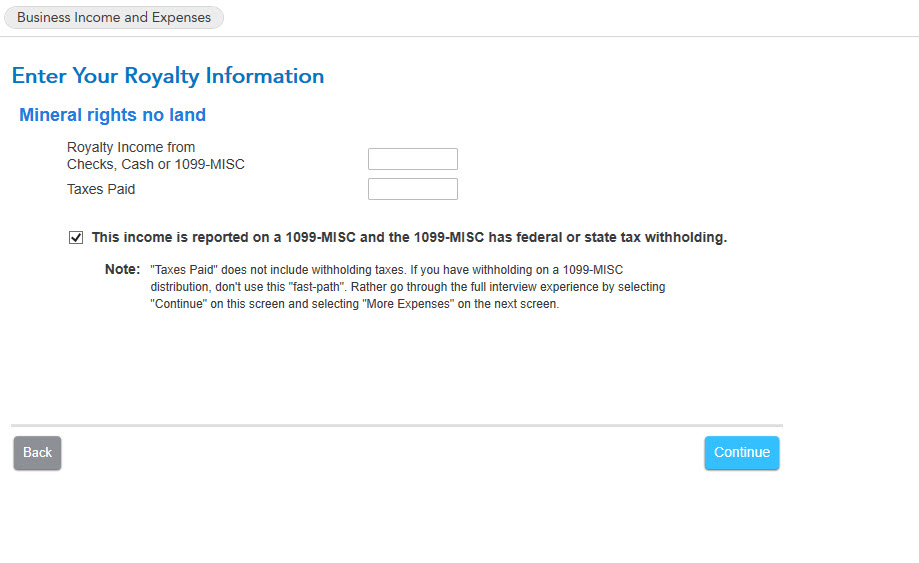

- Type "Royalty rights, no land" as the description

- Use your address if needed

- Does all the income belong to you? YES

- What type? Mineral Property

- Enter the income reported on the 1099-MISC

(See the Note concerning additional boxes on your 1099-MISC)

If not needed, do not check the box and finish the interview

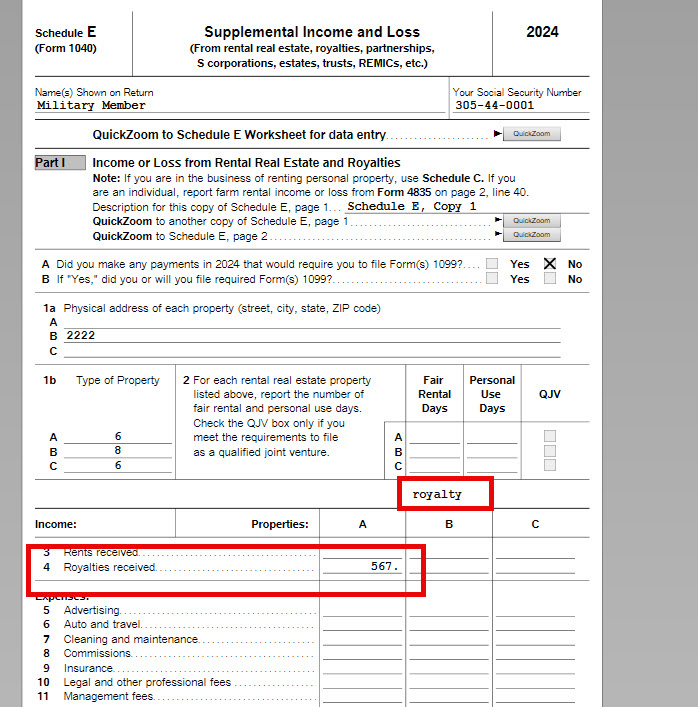

This will generate Schedule E and report the royalty income

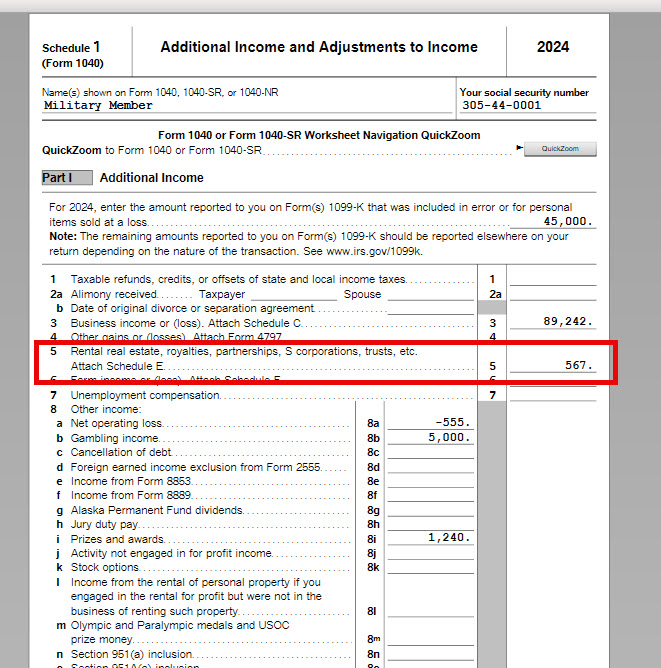

The income will be on Schedule 1 line 5

If you enter as "Other Common Income" "Income on Form 1099-MISC and the income is in Box 1 RENTS, you will need to setup the rental for Schedule E.

If you decide you want to enter the first way, you need to delete all entries for this 1099-MISC you may have already entered and start at the beginning

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 24, 2025

10:52 AM